This version of the form is not currently in use and is provided for reference only. Download this version of

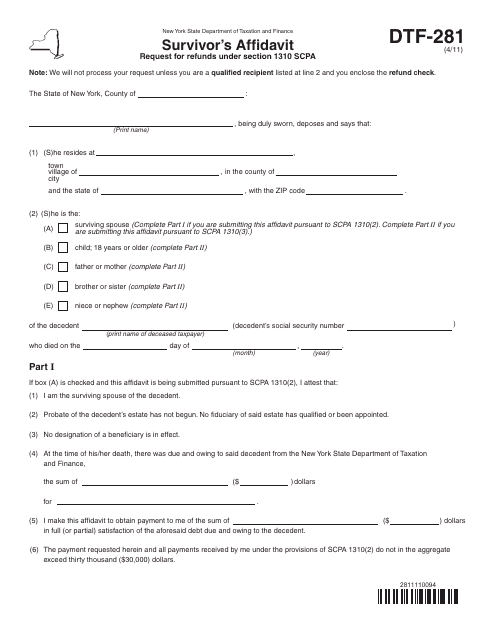

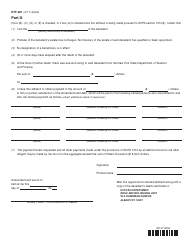

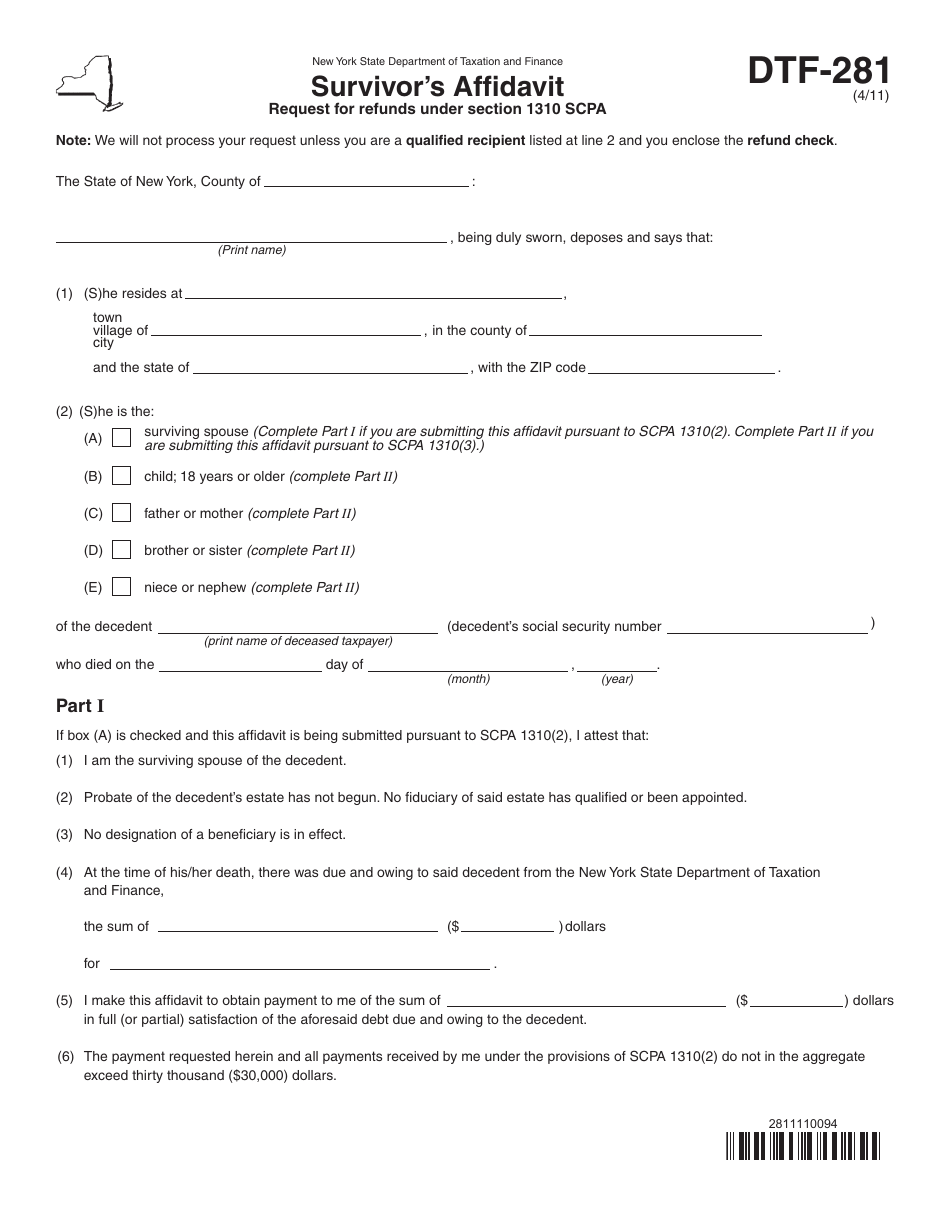

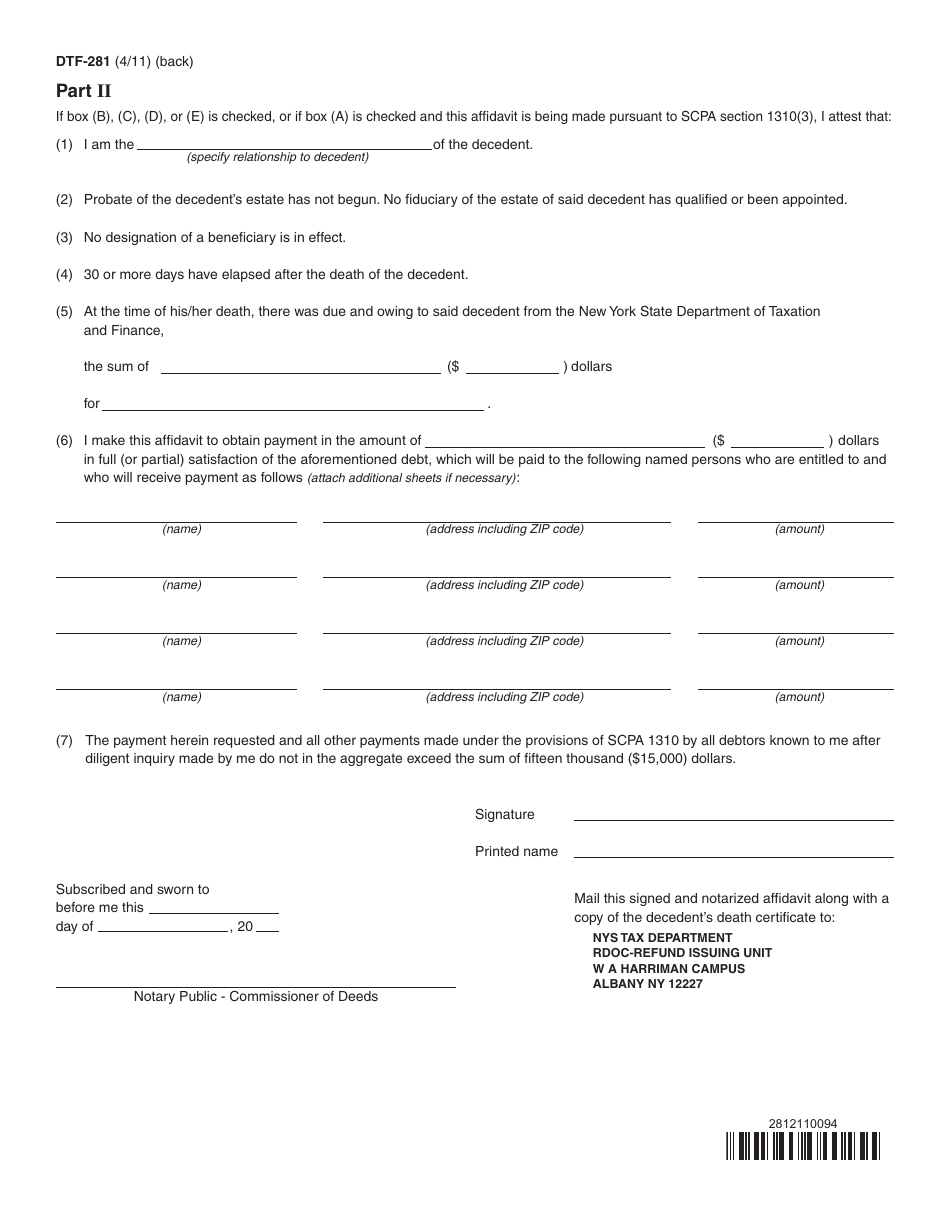

Form DTF-281

for the current year.

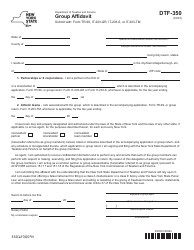

Form DTF-281 Survivor's Affidavit (Request for Refunds Under Section 1310 Scpa) - New York

What Is Form DTF-281?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTF-281 Survivor's Affidavit?

A: Form DTF-281 Survivor's Affidavit is a document used in New York to request refunds under Section 1310 Scpa.

Q: Who can use Form DTF-281 Survivor's Affidavit?

A: This form can be used by individuals who are claiming a refund as a surviving spouse or domestic partner after the death of a taxpayer.

Q: What is Section 1310 Scpa?

A: Section 1310 Scpa refers to a provision in the New York State Consolidated Laws that allows for refunds of certain taxes to be claimed by surviving spouses or domestic partners.

Q: What information is required on Form DTF-281 Survivor's Affidavit?

A: The form requires information about the deceased taxpayer, the surviving spouse or domestic partner, and details about the taxes being claimed for refund.

Q: Are there any supporting documents required with Form DTF-281 Survivor's Affidavit?

A: Yes, you may need to include a copy of the taxpayer's death certificate and other relevant documentation as specified in the instructions for the form.

Q: How should I submit Form DTF-281 Survivor's Affidavit?

A: The form can be submitted by mail to the New York State Tax Department at the address provided on the form.

Q: What happens after I submit Form DTF-281 Survivor's Affidavit?

A: Once the form is received, the Tax Department will process your claim and notify you of the refund or any additional documentation needed.

Q: Is there a deadline to submit Form DTF-281 Survivor's Affidavit?

A: Yes, the form should be submitted within three years from the date of the deceased taxpayer's death, or within one year from the final determination of any tax proceeding.

Q: Can I get assistance with filling out Form DTF-281 Survivor's Affidavit?

A: Yes, you can contact the New York State Tax Department for assistance with any questions or concerns regarding the form.

Form Details:

- Released on April 1, 2011;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DTF-281 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.