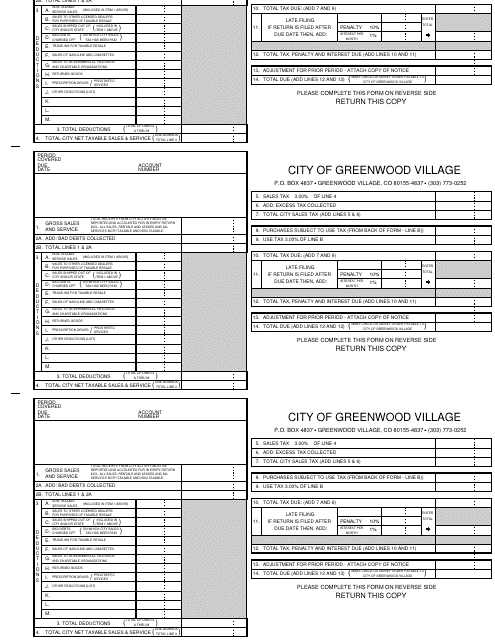

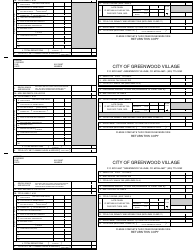

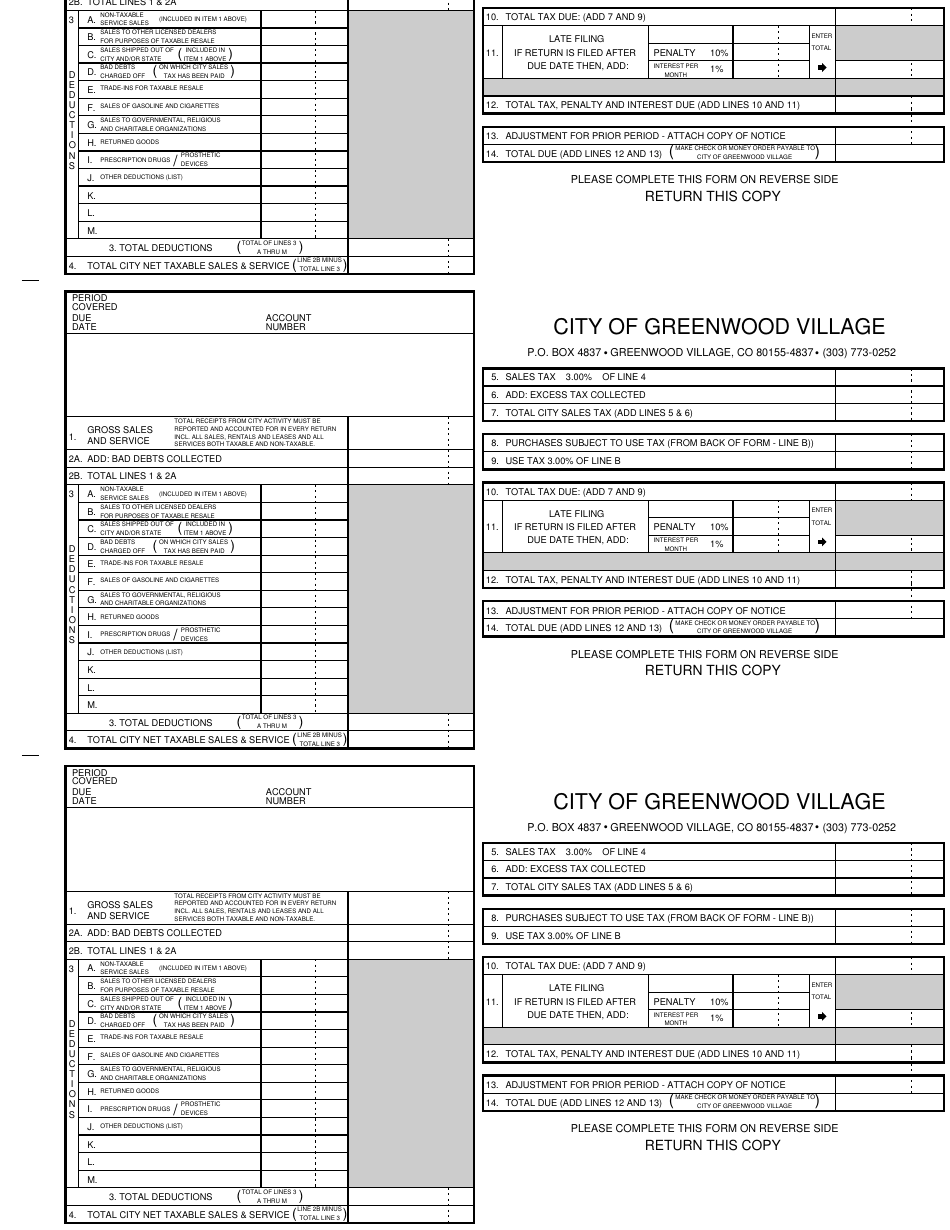

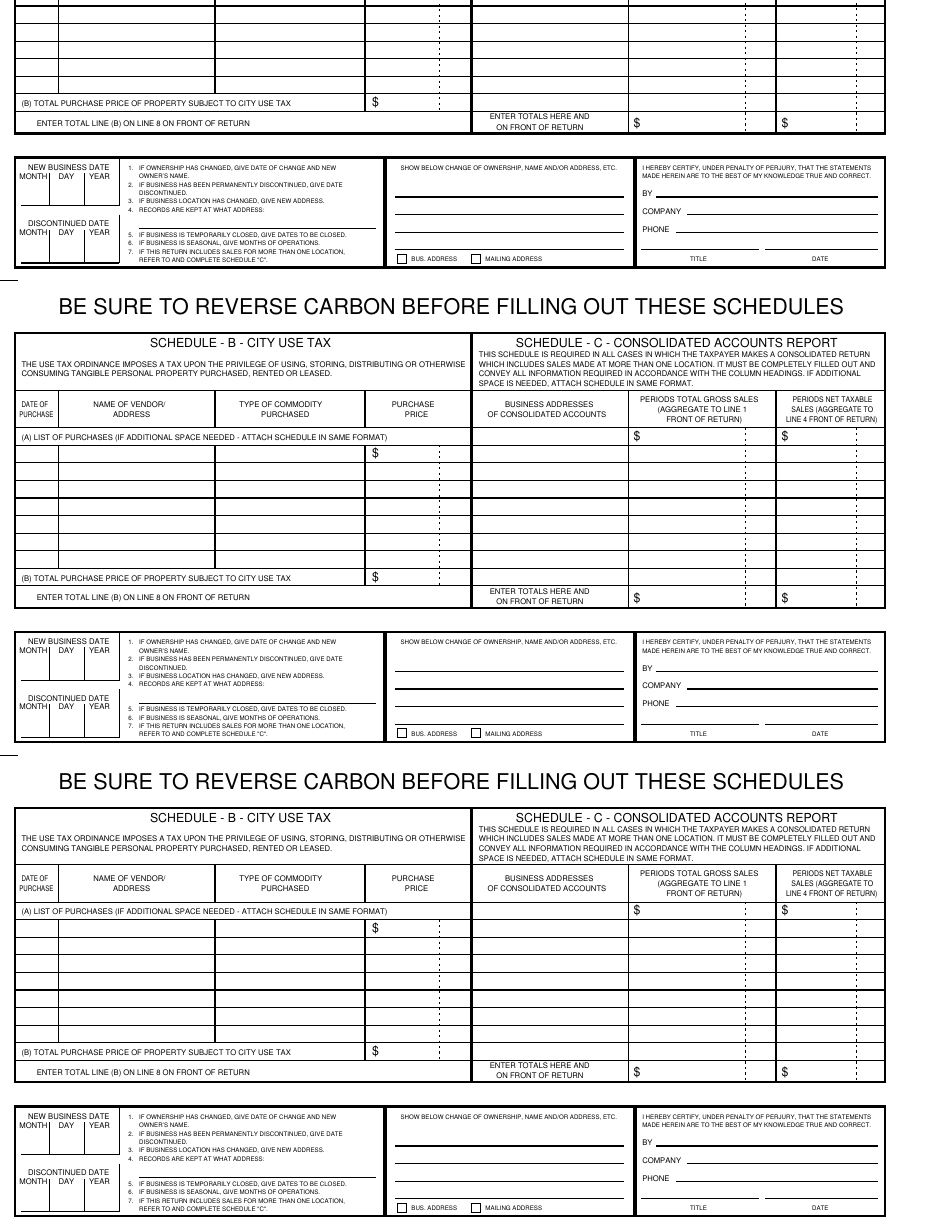

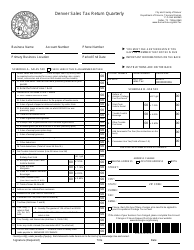

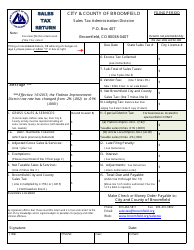

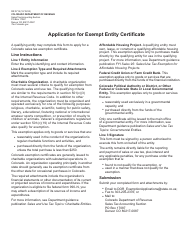

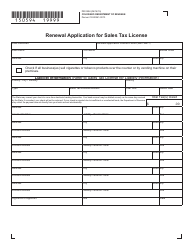

Sales Tax Form - City of Greenwood Village, Colorado

Sales Tax Form is a legal document that was released by the Finance Department - City of Greenwood Village, Colorado - a government authority operating within Colorado. The form may be used strictly within City of Greenwood Village.

FAQ

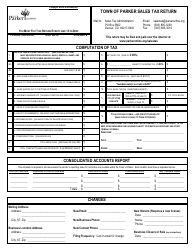

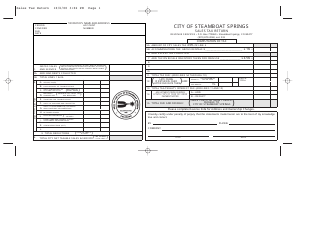

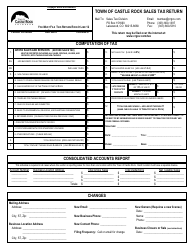

Q: What is the sales tax rate in Greenwood Village, Colorado?

A: The sales tax rate in Greenwood Village, Colorado is 3.75%.

Q: Is there a deadline to submit the sales tax form in Greenwood Village, Colorado?

A: Yes, the sales tax form must be submitted by the 20th of each month.

Q: What items are subject to sales tax in Greenwood Village, Colorado?

A: Most tangible personal property and some services are subject to sales tax in Greenwood Village, Colorado.

Q: How do I calculate the sales tax amount in Greenwood Village, Colorado?

A: To calculate the sales tax amount, multiply the total purchase price by the sales tax rate of 3.75%.

Form Details:

- The latest edition currently provided by the Finance Department - City of Greenwood Village, Colorado;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Finance Department - City of Greenwood Village, Colorado.