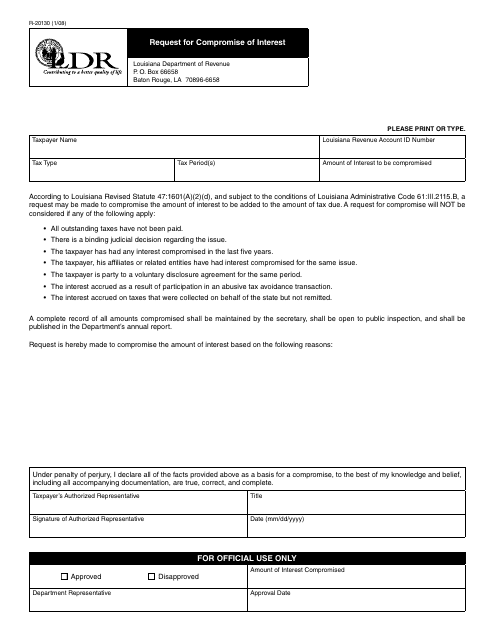

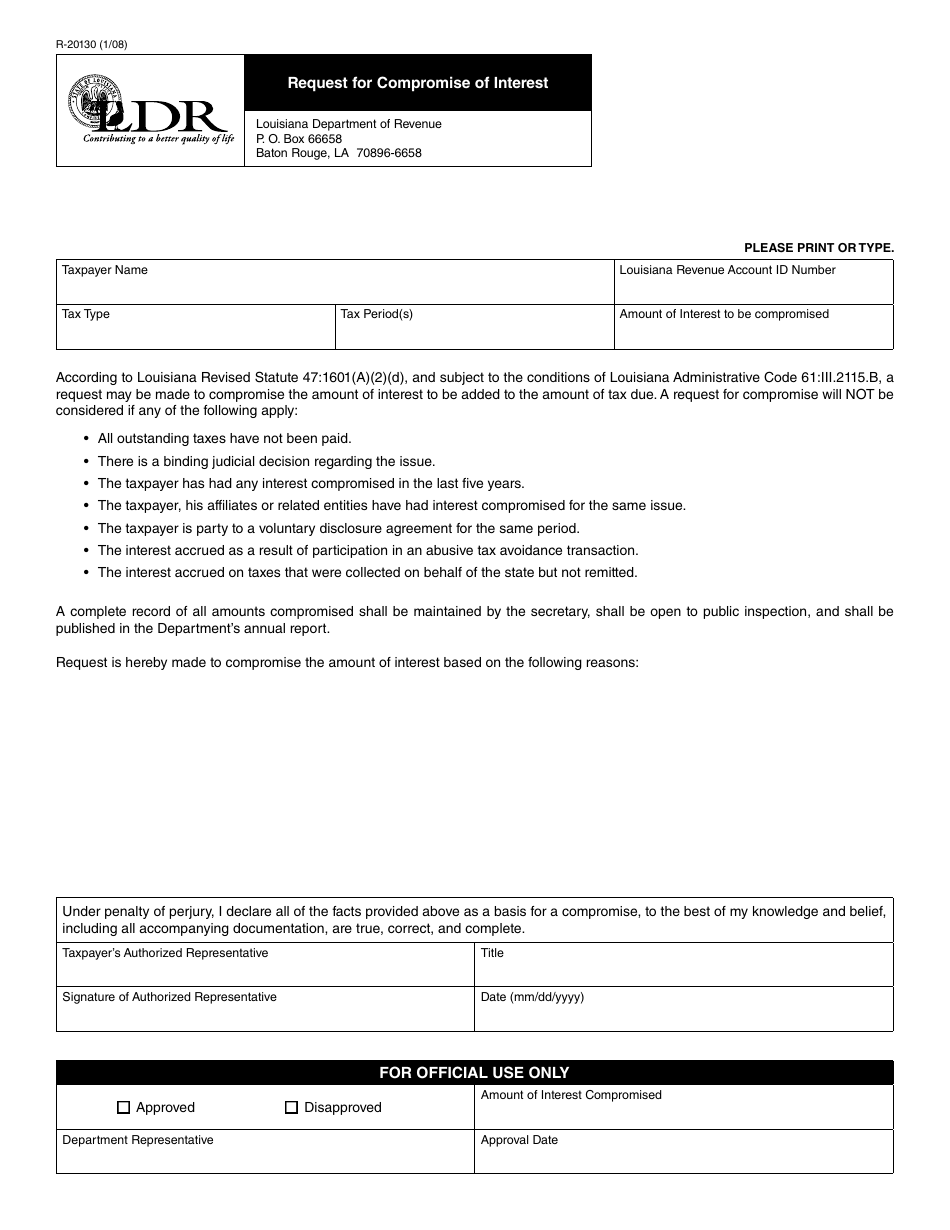

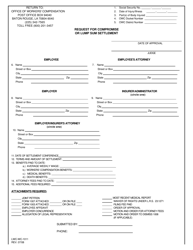

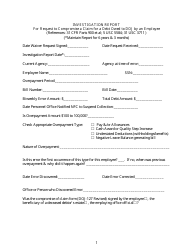

Form R-20130 Request for Compromise of Interest - Louisiana

What Is Form R-20130?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-20130?

A: Form R-20130 is a request for compromise of interest in Louisiana.

Q: What is a request for compromise of interest?

A: A request for compromise of interest is a formal application to the state of Louisiana to reduce or eliminate the amount of interest owed on a tax debt.

Q: Who can use Form R-20130?

A: Anyone who owes interest on a tax debt in Louisiana can use Form R-20130 to request a compromise of interest.

Q: What information do I need to provide on Form R-20130?

A: You will need to provide your personal information, details about your tax debt, and reasons why you believe a compromise of interest is warranted.

Q: Is there a fee for submitting Form R-20130?

A: No, there is no fee for submitting Form R-20130.

Q: What happens after I submit Form R-20130?

A: After you submit Form R-20130, the Louisiana Department of Revenue will review your request and make a decision on whether to grant a compromise of interest.

Q: Are there any eligibility criteria for a compromise of interest?

A: Yes, the Louisiana Department of Revenue will consider factors such as your financial situation, your compliance history, and the reasonableness of your request when determining eligibility for a compromise of interest.

Q: Can I appeal a decision on my request for compromise of interest?

A: Yes, if your request for compromise of interest is denied, you have the right to appeal the decision.

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-20130 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.