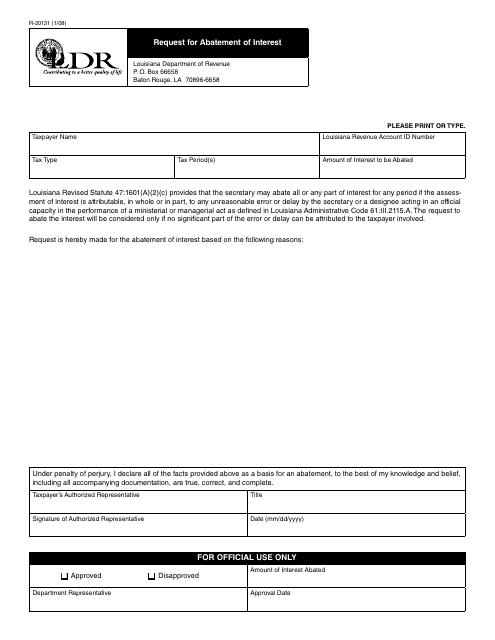

Form R-20131 Request for Abatement of Interest - Louisiana

What Is Form R-20131?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-20131?

A: Form R-20131 is a form used in Louisiana to request an abatement of interest on tax liabilities.

Q: What is an abatement of interest?

A: An abatement of interest is a request to have the interest charges on a tax liability reduced or waived.

Q: Why would someone request an abatement of interest?

A: Someone may request an abatement of interest if they believe there were extenuating circumstances that prevented them from paying their tax liability on time.

Q: What information is required on Form R-20131?

A: Form R-20131 requires information about the taxpayer, the tax liability in question, and the reason for requesting the abatement of interest.

Q: Is there a deadline for submitting Form R-20131?

A: Yes, Form R-20131 must be filed within 3 years from the date the interest was assessed.

Q: What happens after submitting Form R-20131?

A: After submitting Form R-20131, the Louisiana Department of Revenue will review the request and make a determination on whether to grant the abatement of interest.

Q: Can I appeal if my request for abatement of interest is denied?

A: Yes, if your request for abatement of interest is denied, you have the right to appeal the decision within 60 days of receiving the denial notice.

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-20131 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.