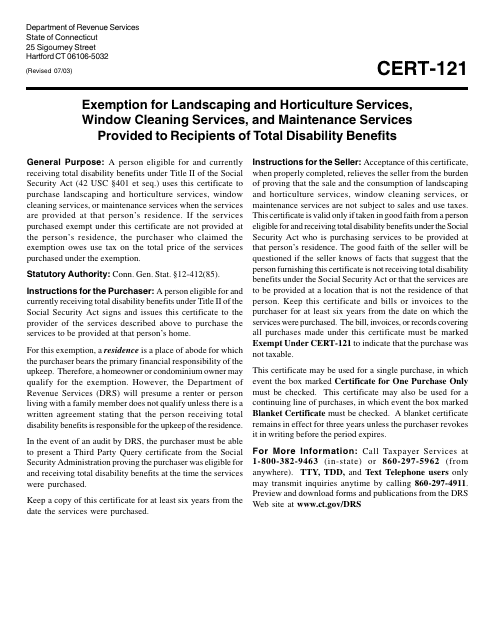

Form CERT-121 Exemption for Landscaping and Horticulture Services, Window Cleaning Services, and Maintenance Services Provided to Recipients of Total Disability Benefits - Connecticut

What Is Form CERT-121?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CERT-121?

A: CERT-121 is an exemption form for certain types of services provided to recipients of total disability benefits in Connecticut.

Q: What services does CERT-121 exempt?

A: CERT-121 exempts landscaping and horticulture services, window cleaning services, and maintenance services provided to recipients of total disability benefits.

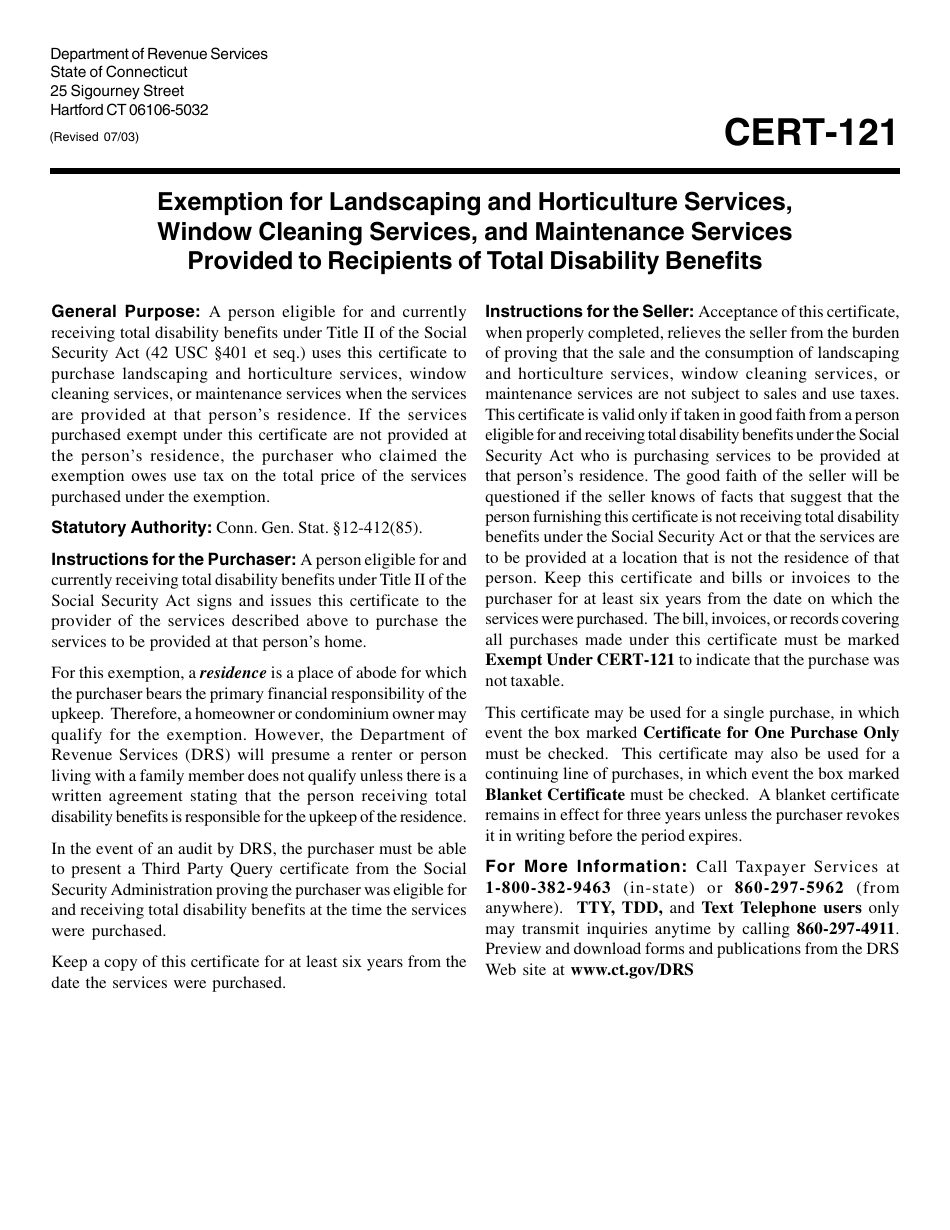

Q: Who is eligible for the exemption?

A: Recipients of total disability benefits in Connecticut are eligible for the exemption.

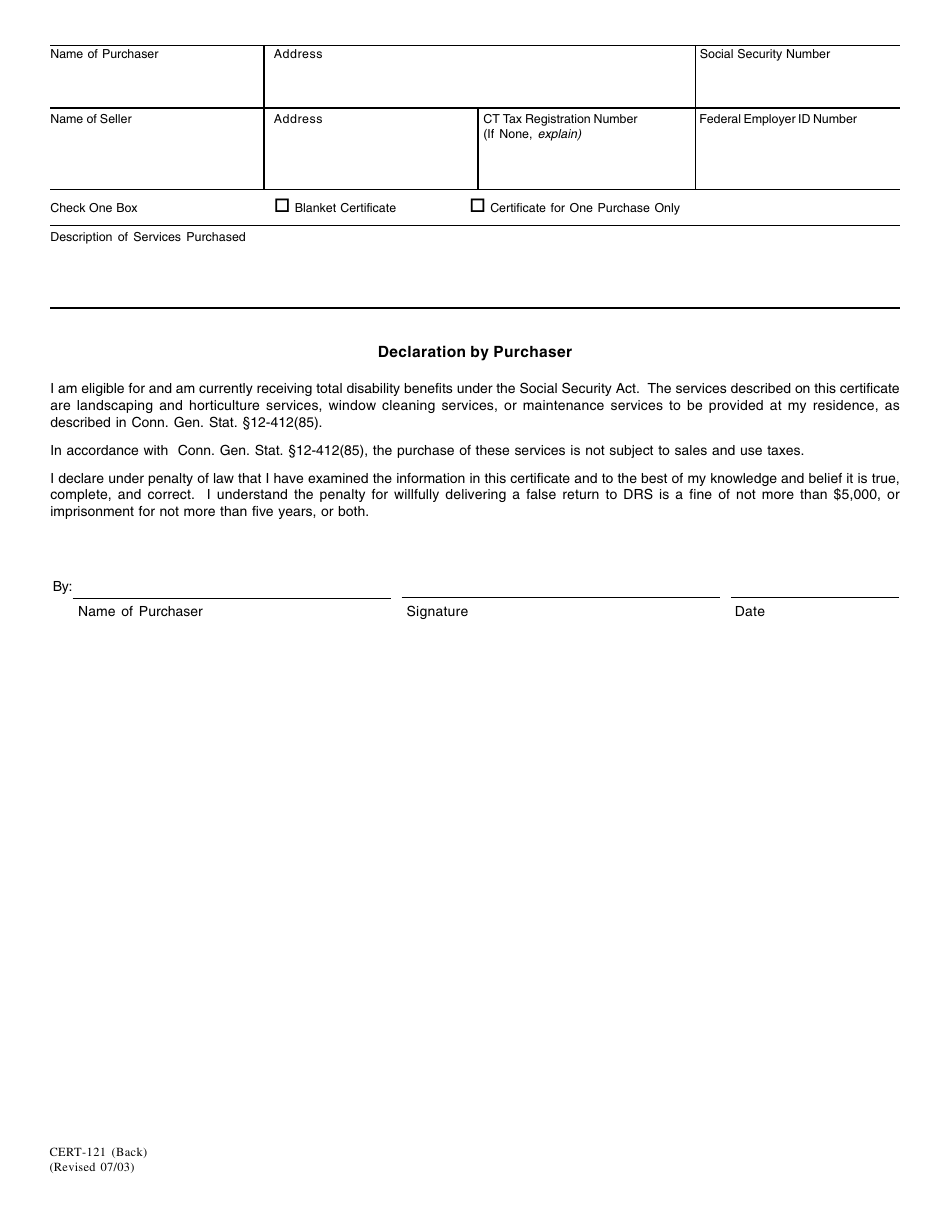

Q: How do I apply for the exemption?

A: You can apply for the exemption by completing and submitting CERT-121 form to the Connecticut Department of Revenue Services.

Q: Is there a deadline for applying?

A: There is no specific deadline mentioned for applying, but it is advisable to submit the form as soon as possible.

Q: Are there any other requirements for the exemption?

A: Yes, you need to provide proper documentation supporting your total disability status along with the CERT-121 form.

Q: What are total disability benefits?

A: Total disability benefits are financial benefits provided to individuals who are totally disabled and unable to work.

Q: Will I be exempt from paying taxes on these services if I qualify?

A: Yes, if you qualify for the exemption and your application is approved, you will be exempt from paying taxes on the specified services.

Q: Can I use the exemption for services provided by any landscaping, window cleaning, or maintenance company?

A: No, the exemption only applies to services provided by companies that are registered with the Connecticut Department of Revenue Services.

Form Details:

- Released on July 1, 2003;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CERT-121 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.