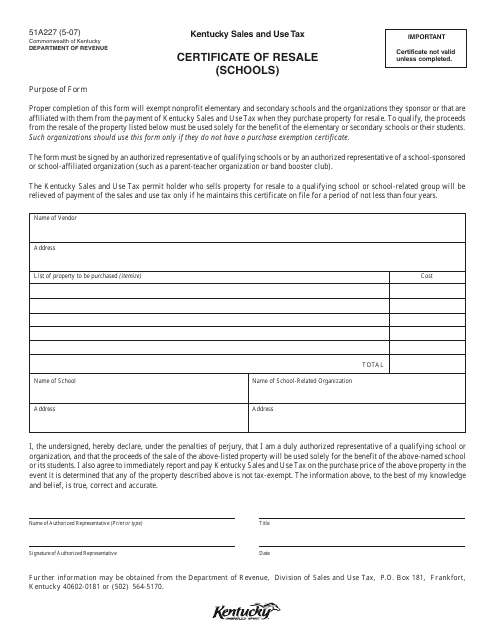

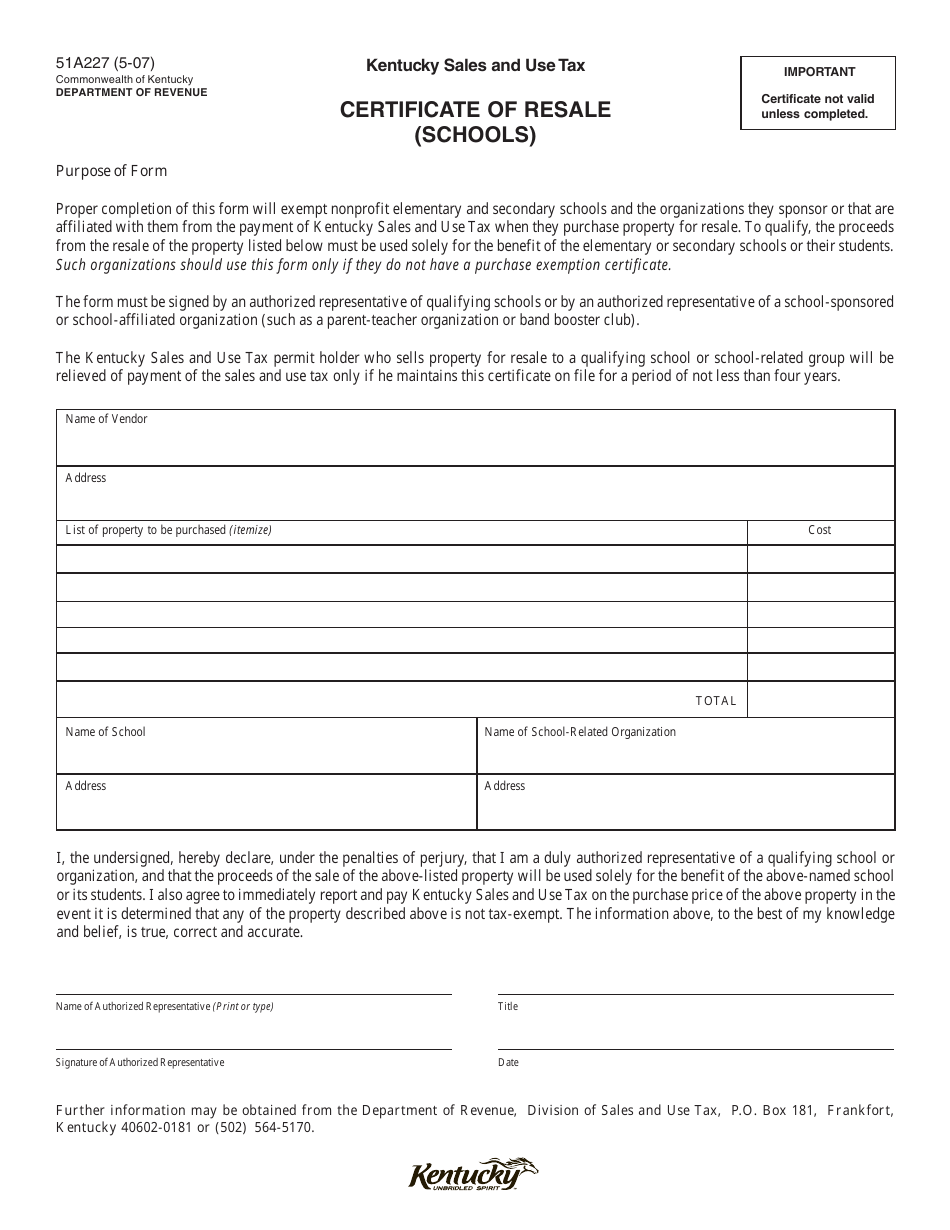

Form 51A227 Certificate of Resale (Schools) - Kentucky

What Is Form 51A227?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 51A227?

A: Form 51A227 is a Certificate of Resale specifically for schools in Kentucky.

Q: Who needs to fill out Form 51A227?

A: Schools in Kentucky who are purchasing items for resale need to fill out Form 51A227.

Q: Why do schools need to fill out Form 51A227?

A: Schools need to fill out Form 51A227 to provide proof that they are purchasing items for resale and are eligible for sales tax exemption.

Q: Are all schools in Kentucky eligible for sales tax exemption?

A: No, only schools that meet specific criteria are eligible for sales tax exemption. Form 51A227 helps determine if a school qualifies for exemption.

Q: What information is required on Form 51A227?

A: Form 51A227 requires information such as the school's name, address, tax identification number, and a description of the items being purchased for resale.

Q: How often does Form 51A227 need to be filed?

A: Form 51A227 needs to be filed with each purchase made by a school for resale purposes.

Q: Can schools in Kentucky purchase items for personal use tax-free?

A: No, Form 51A227 is specifically for purchases made by schools for resale. Personal use purchases are not eligible for sales tax exemption.

Form Details:

- Released on May 1, 2007;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 51A227 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.