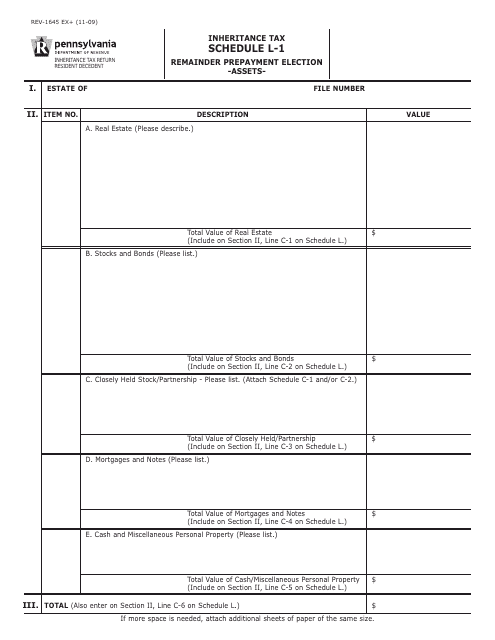

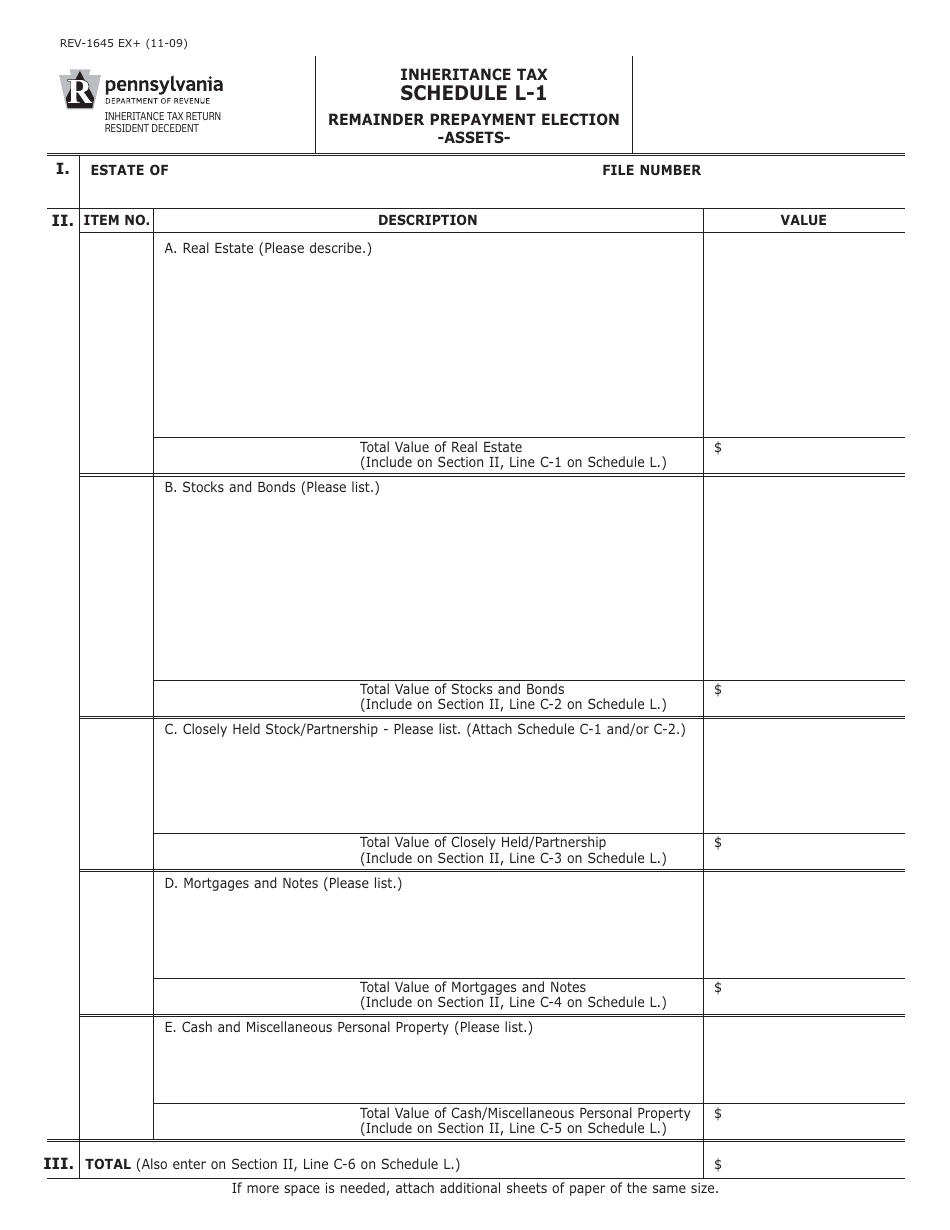

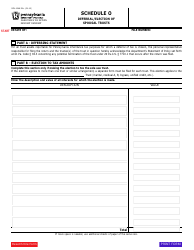

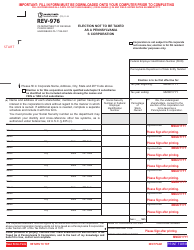

Form REV-1645 Schedule L-1 Remainder Prepayment Election - Assets - Pennsylvania

What Is Form REV-1645 Schedule L-1?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1645 Schedule L-1?

A: Form REV-1645 Schedule L-1 is a form used in Pennsylvania for making a remainder prepayment election for assets.

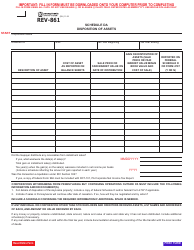

Q: What is a remainder prepayment election?

A: A remainder prepayment election is a tax payment made in advance for assets owned by an individual or business.

Q: What are the assets covered in Schedule L-1?

A: Schedule L-1 covers various types of assets, including real estate, machinery, equipment, and intangible assets.

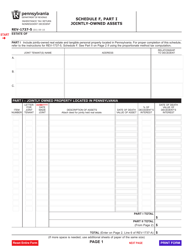

Q: Who needs to file Schedule L-1?

A: Any individual or business in Pennsylvania that wants to make a remainder prepayment election for their assets needs to file Schedule L-1.

Q: What is the purpose of filing Schedule L-1?

A: Filing Schedule L-1 allows individuals and businesses to make an advanced tax payment on their assets, which can help reduce future tax liabilities.

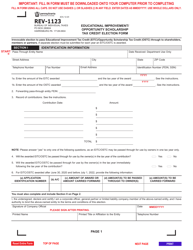

Form Details:

- Released on November 1, 2009;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV-1645 Schedule L-1 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.