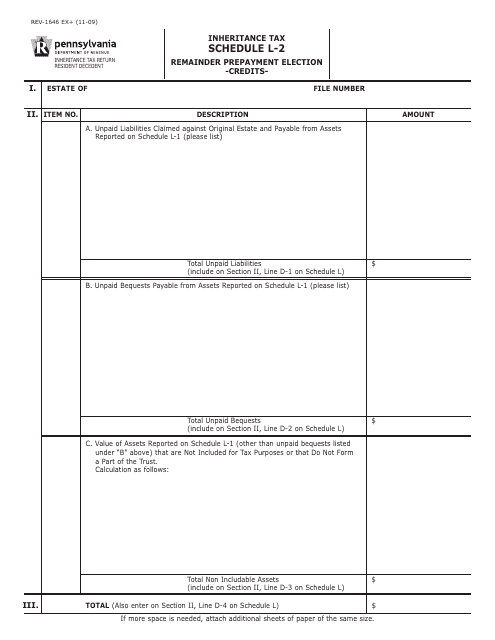

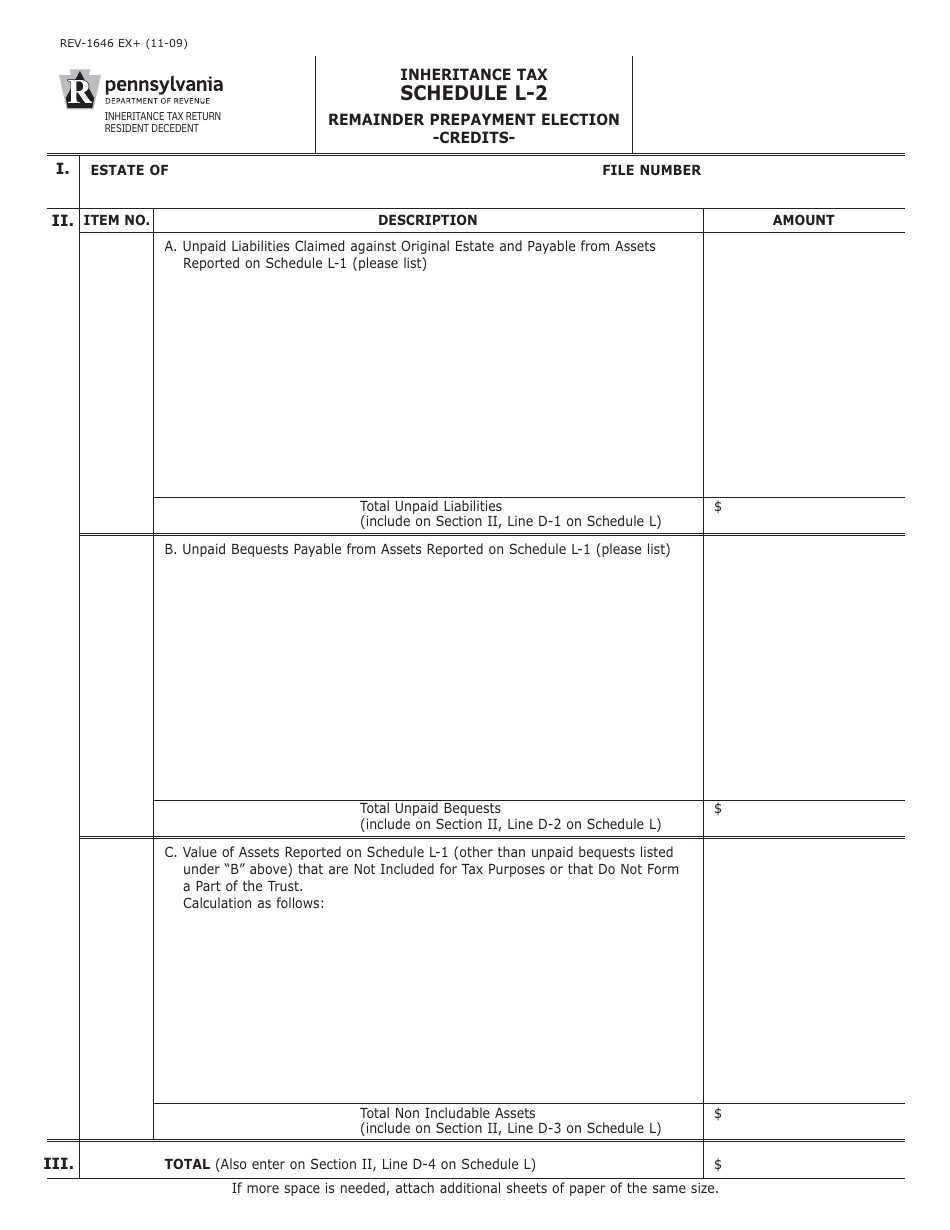

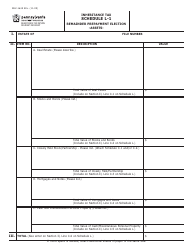

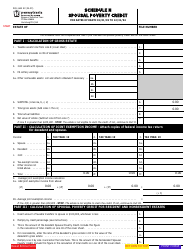

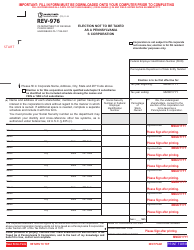

Form REV-1646 Schedule L-2 Remainder Prepayment Election - Credits - Pennsylvania

What Is Form REV-1646 Schedule L-2?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1646 Schedule L-2?

A: Form REV-1646 Schedule L-2 is a form used in Pennsylvania for making a remainder prepayment election for credits.

Q: What is a remainder prepayment election?

A: A remainder prepayment election allows taxpayers to make a prepayment of certain credits that can be carried forward to future tax years.

Q: What are credits?

A: Credits are amounts that can be used to offset taxes owed. They can be applied against the taxpayer's tax liability.

Q: What is Pennsylvania?

A: Pennsylvania is a state in the United States. It is known for its diverse geography, historic landmarks, and vibrant cities.

Q: Who needs to file Form REV-1646 Schedule L-2?

A: Taxpayers in Pennsylvania who want to make a remainder prepayment election for credits may need to file Form REV-1646 Schedule L-2.

Form Details:

- Released on November 1, 2009;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV-1646 Schedule L-2 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.