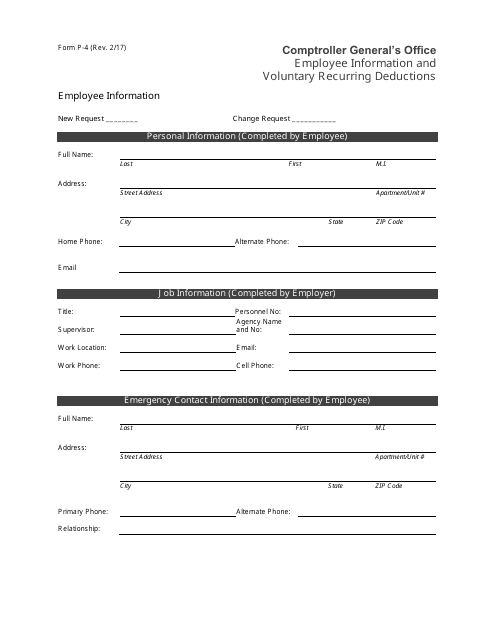

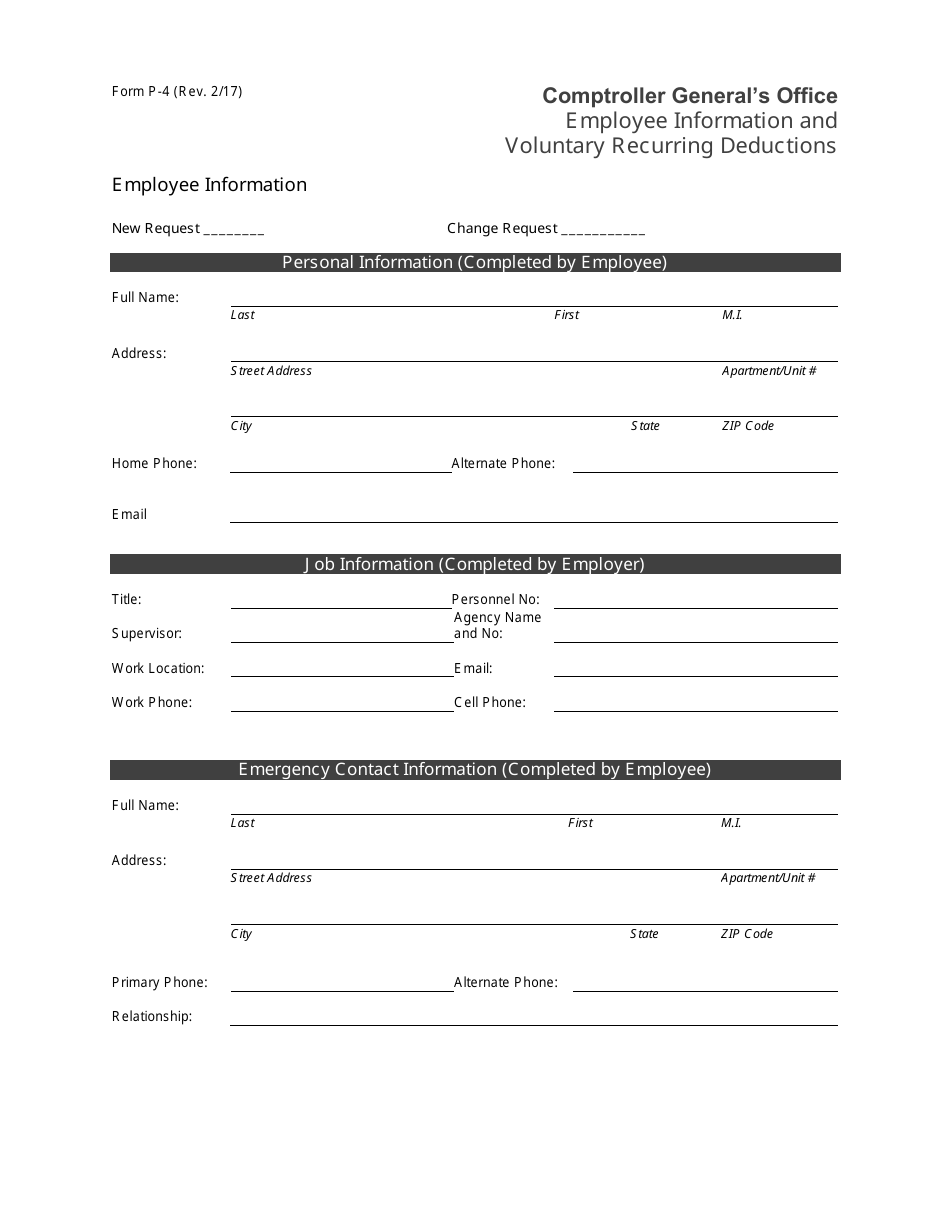

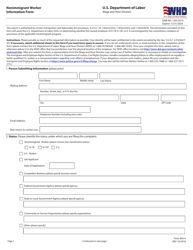

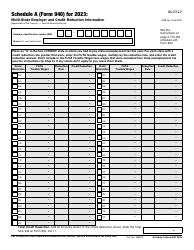

Form P-4 Employee Information and Voluntary Recurring Deductions - South Carolina

What Is Form P-4?

This is a legal form that was released by the South Carolina Comptroller General - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

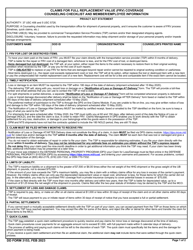

Q: What is Form P-4?

A: Form P-4 is the Employee Information and Voluntary Recurring Deductions form for South Carolina.

Q: What is the purpose of Form P-4?

A: The purpose of Form P-4 is to provide information about employees and their voluntary recurring deductions.

Q: Who needs to fill out Form P-4?

A: Employers in South Carolina need to fill out Form P-4 for each employee.

Q: What information is required on Form P-4?

A: Form P-4 requires information such as the employee's name, Social Security number, address, and voluntary deductions.

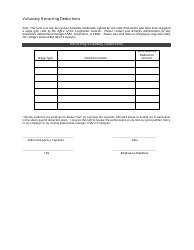

Q: What are voluntary recurring deductions?

A: Voluntary recurring deductions are deductions that employees choose to have taken out of their paycheck on a regular basis, such as health insurance or retirement contributions.

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the South Carolina Comptroller General;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form P-4 by clicking the link below or browse more documents and templates provided by the South Carolina Comptroller General.