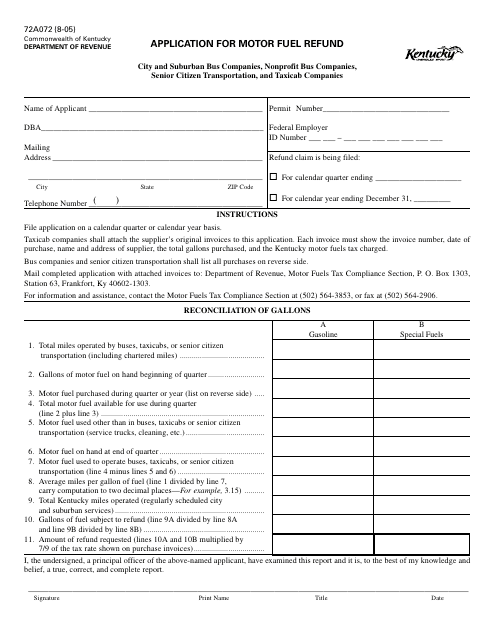

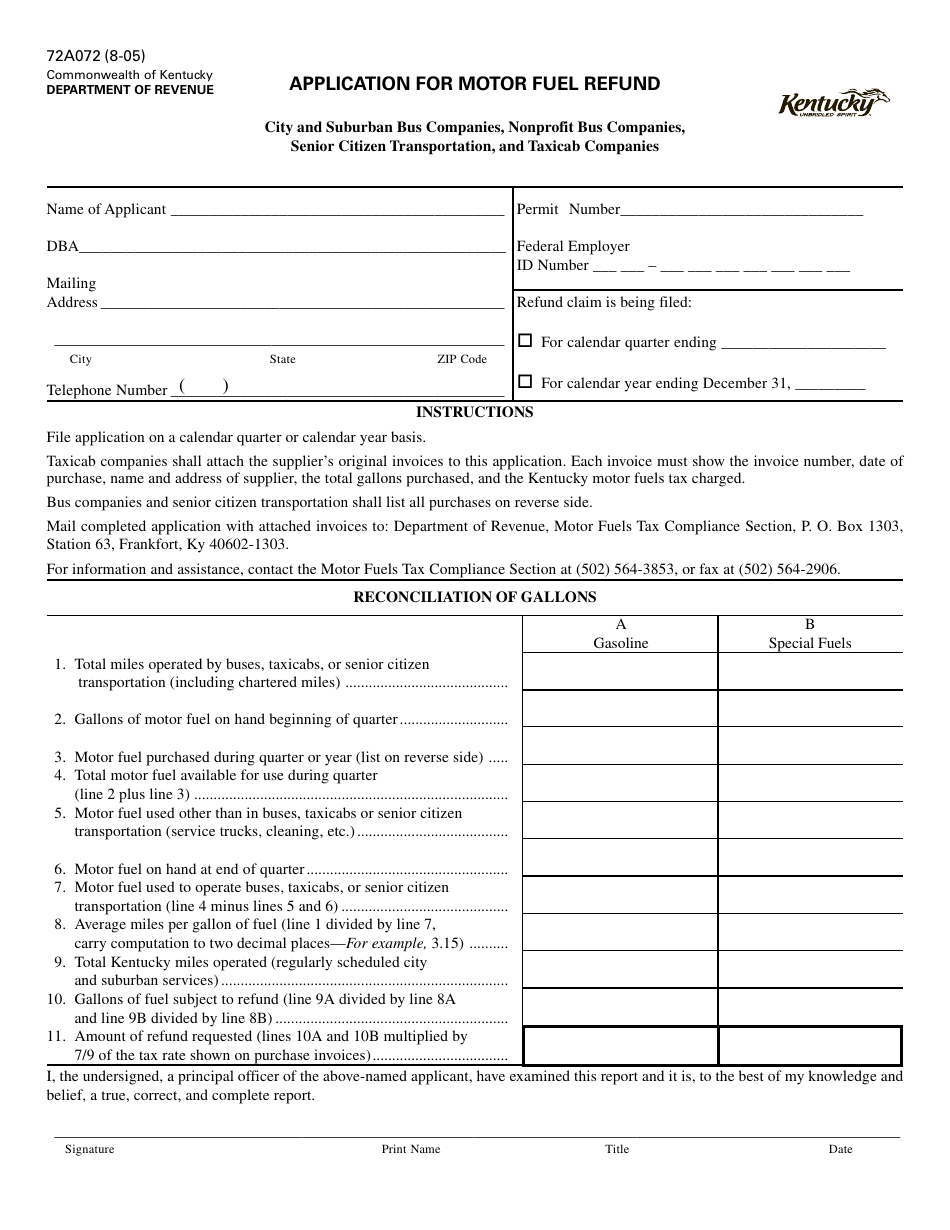

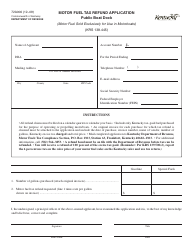

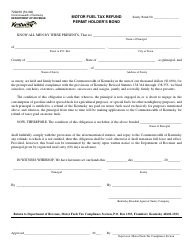

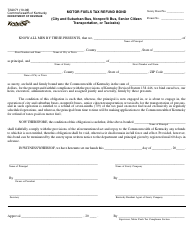

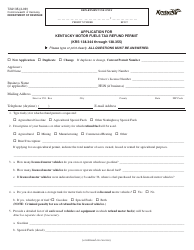

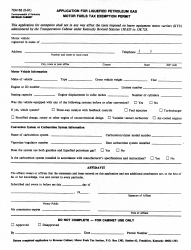

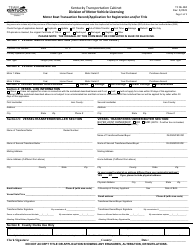

Form 72A072 Application for Motor Fuel Refund - Kentucky

What Is Form 72A072?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

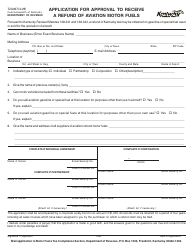

Q: What is Form 72A072?

A: Form 72A072 is the application for motor fuel refund in Kentucky.

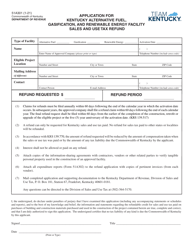

Q: What is motor fuel refund?

A: Motor fuel refund is a refund of taxes paid on motor fuel.

Q: Who can file Form 72A072?

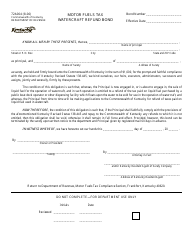

A: Any person or entity who paid motor fuel taxes in Kentucky may file Form 72A072.

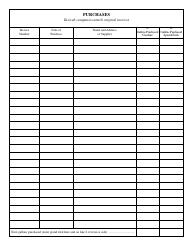

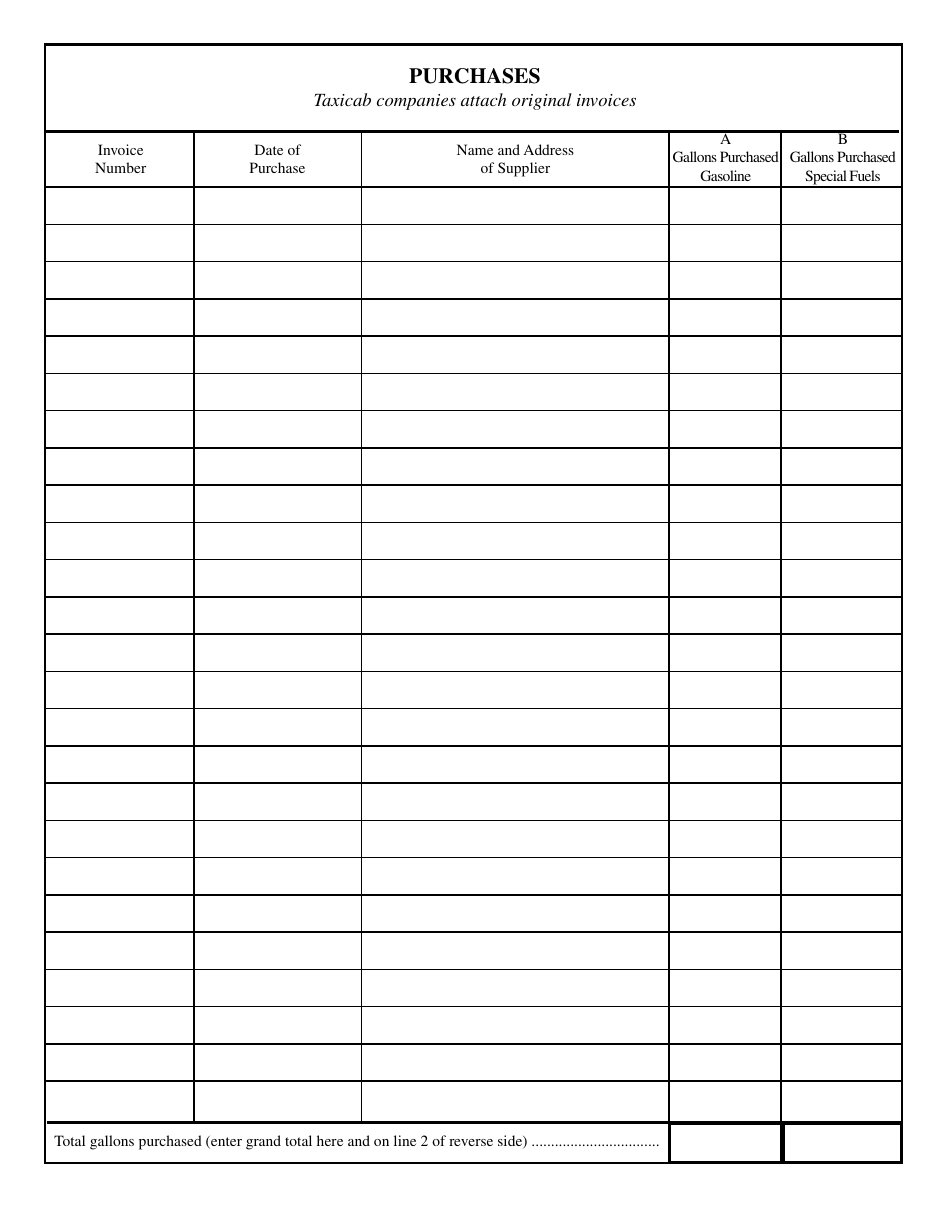

Q: What documents do I need to include with Form 72A072?

A: You may need to include copies of fuel invoices, tax returns, or other supporting documents with Form 72A072.

Q: When should I file Form 72A072?

A: Form 72A072 should be filed within three years from the date the tax was paid.

Q: Is there a fee to file Form 72A072?

A: There is no fee to file Form 72A072.

Q: Can I file Form 72A072 electronically?

A: Currently, Form 72A072 can only be filed by mail or fax.

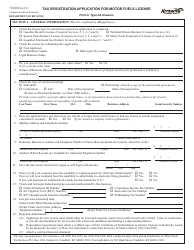

Form Details:

- Released on August 1, 2005;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A072 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.