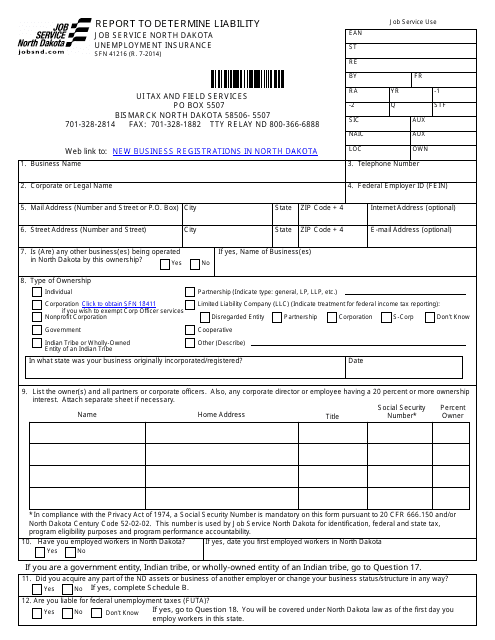

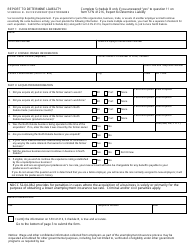

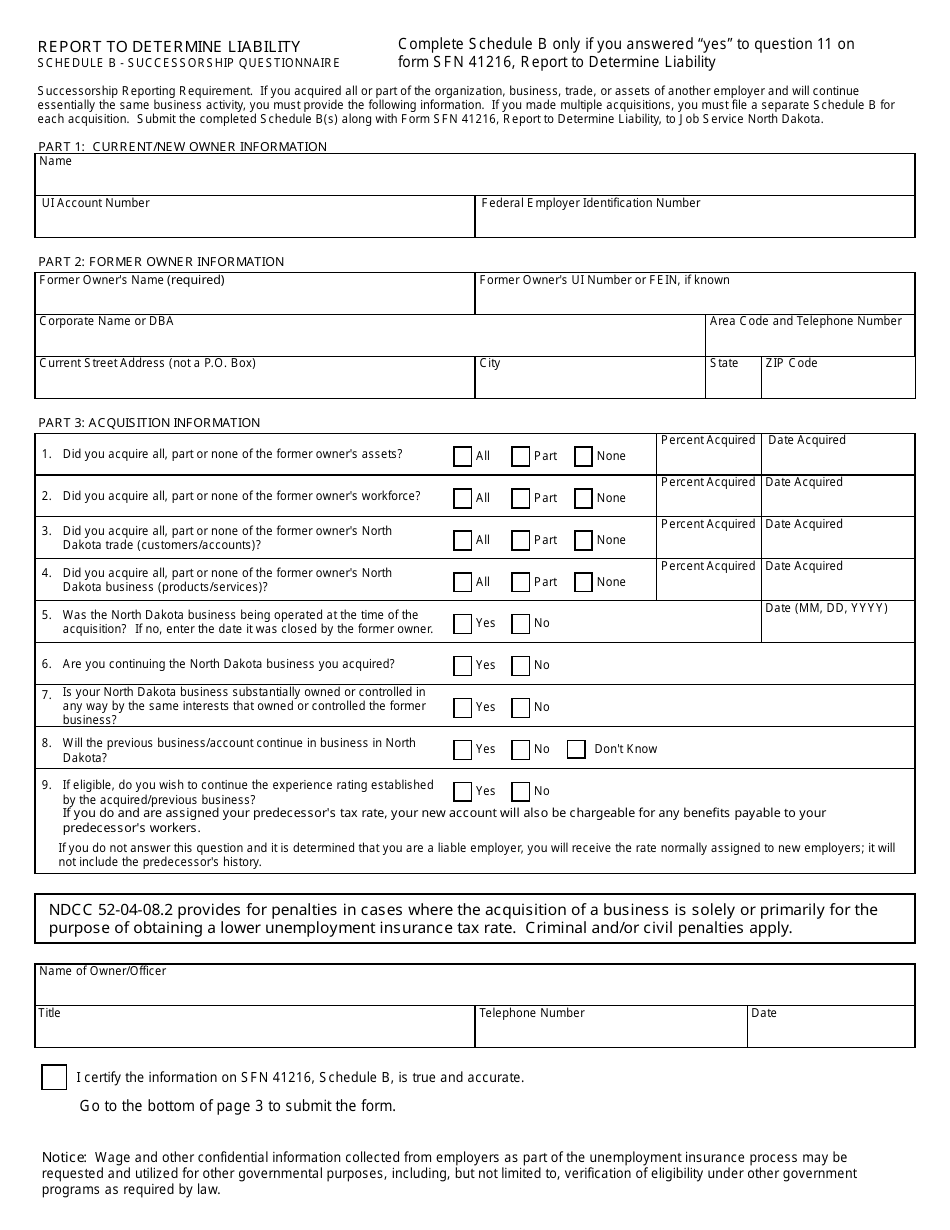

Form SFN41216 Report to Determine Liability - North Dakota

What Is Form SFN41216?

This is a legal form that was released by the Job Service North Dakota - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN41216?

A: Form SFN41216 is a report used to determine liability in North Dakota.

Q: Who uses Form SFN41216?

A: Form SFN41216 is used by individuals or businesses in North Dakota to report and determine liability.

Q: What is the purpose of Form SFN41216?

A: The purpose of Form SFN41216 is to calculate and report liability in North Dakota.

Q: When is Form SFN41216 due?

A: The deadline for submitting Form SFN41216 varies depending on the specific tax year and liability period.

Q: Are there any penalties for late submission of Form SFN41216?

A: Yes, there may be penalties for late submission of Form SFN41216. It is important to file the report on time to avoid any penalties.

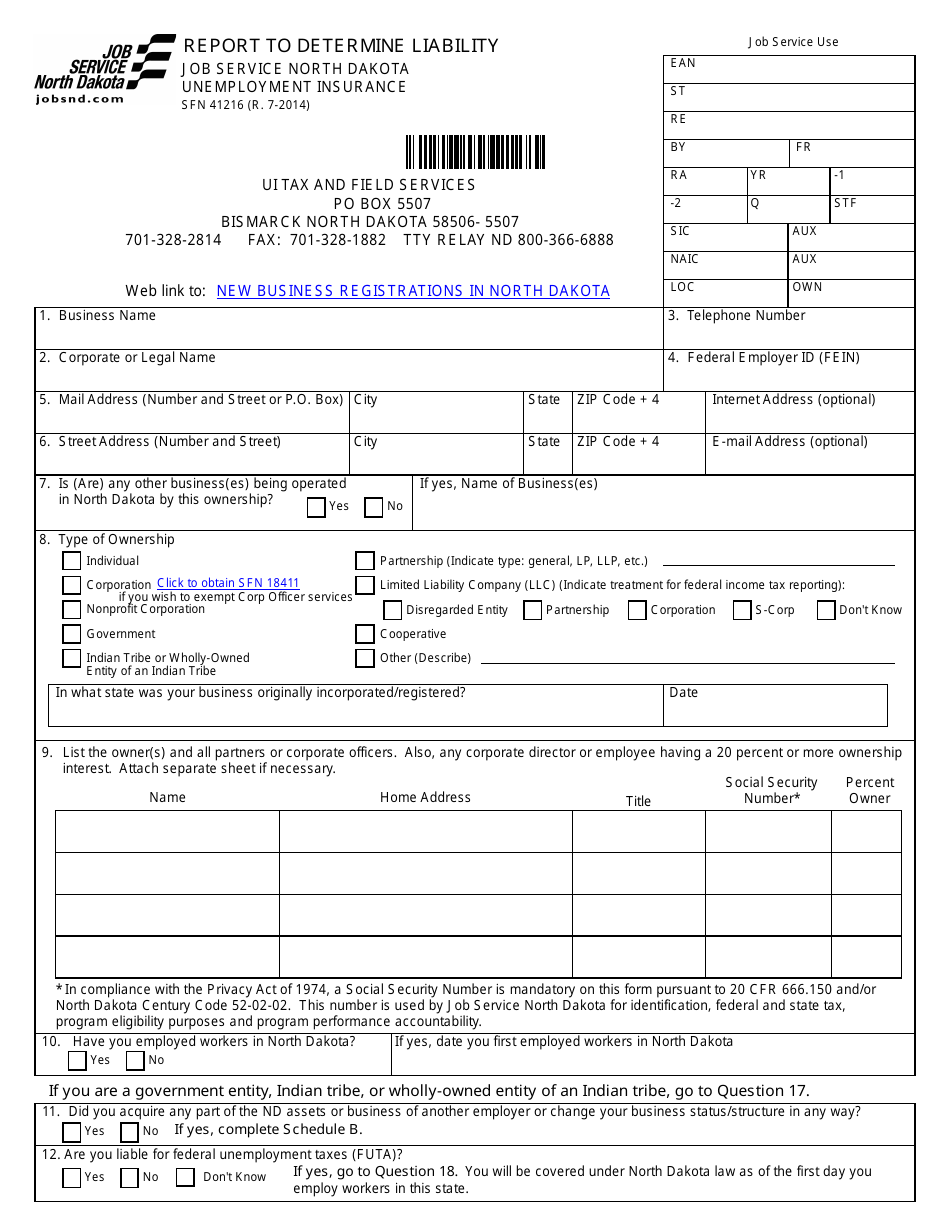

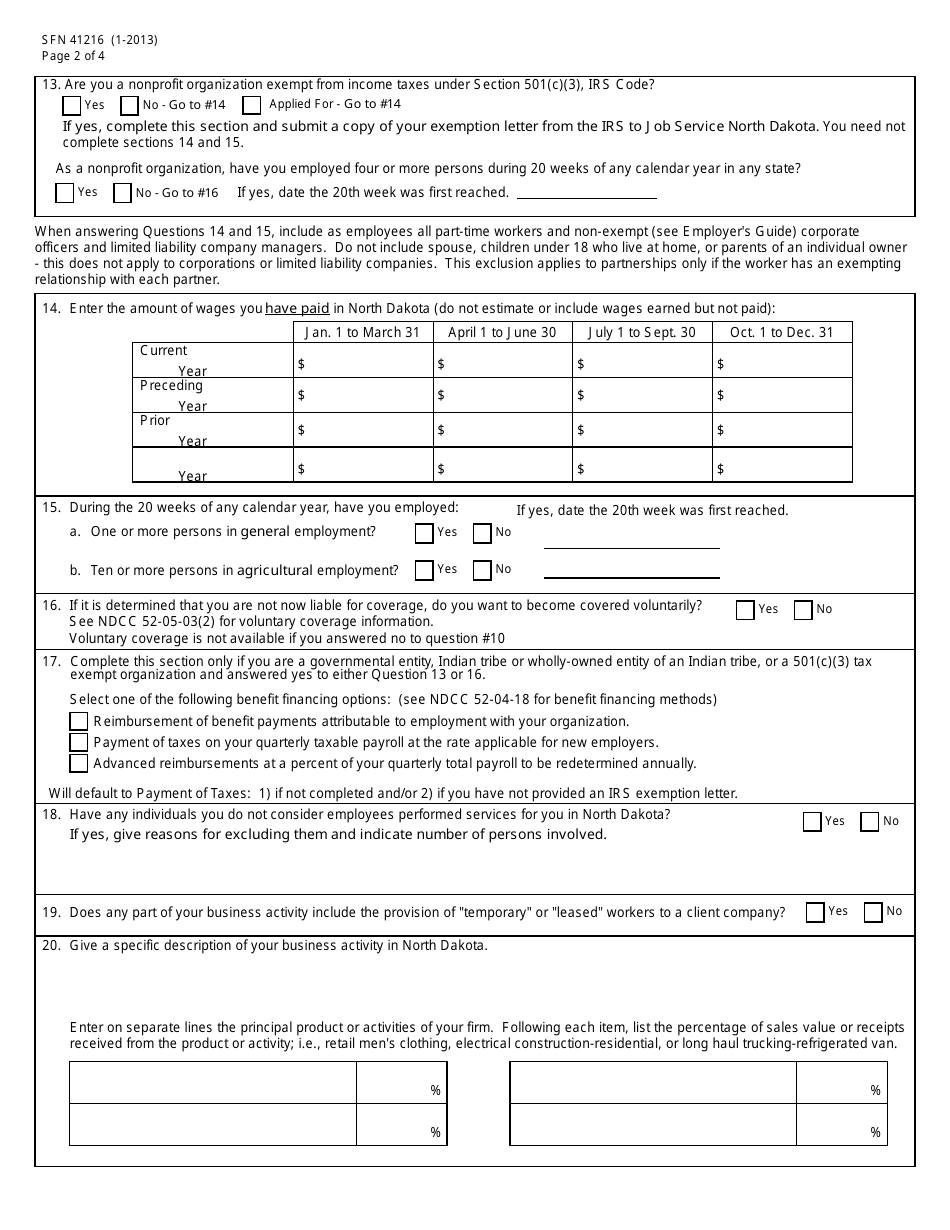

Q: What information is required to complete Form SFN41216?

A: The specific information required on Form SFN41216 may vary, but generally it includes income, expenses, and other financial details.

Form Details:

- Released on July 1, 2014;

- The latest edition provided by the Job Service North Dakota;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN41216 by clicking the link below or browse more documents and templates provided by the Job Service North Dakota.