This version of the form is not currently in use and is provided for reference only. Download this version of

Form UITL-100

for the current year.

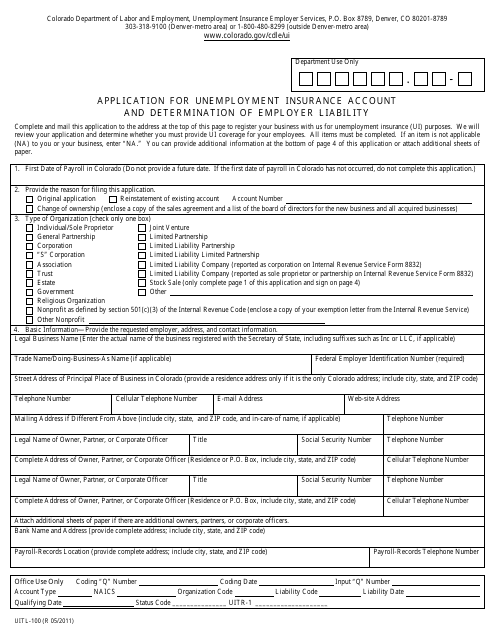

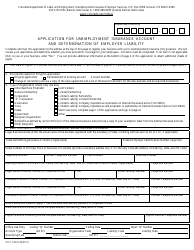

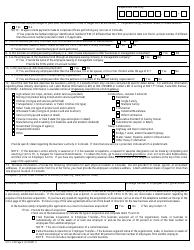

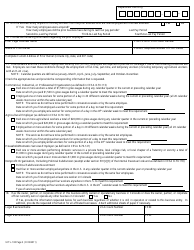

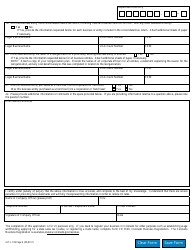

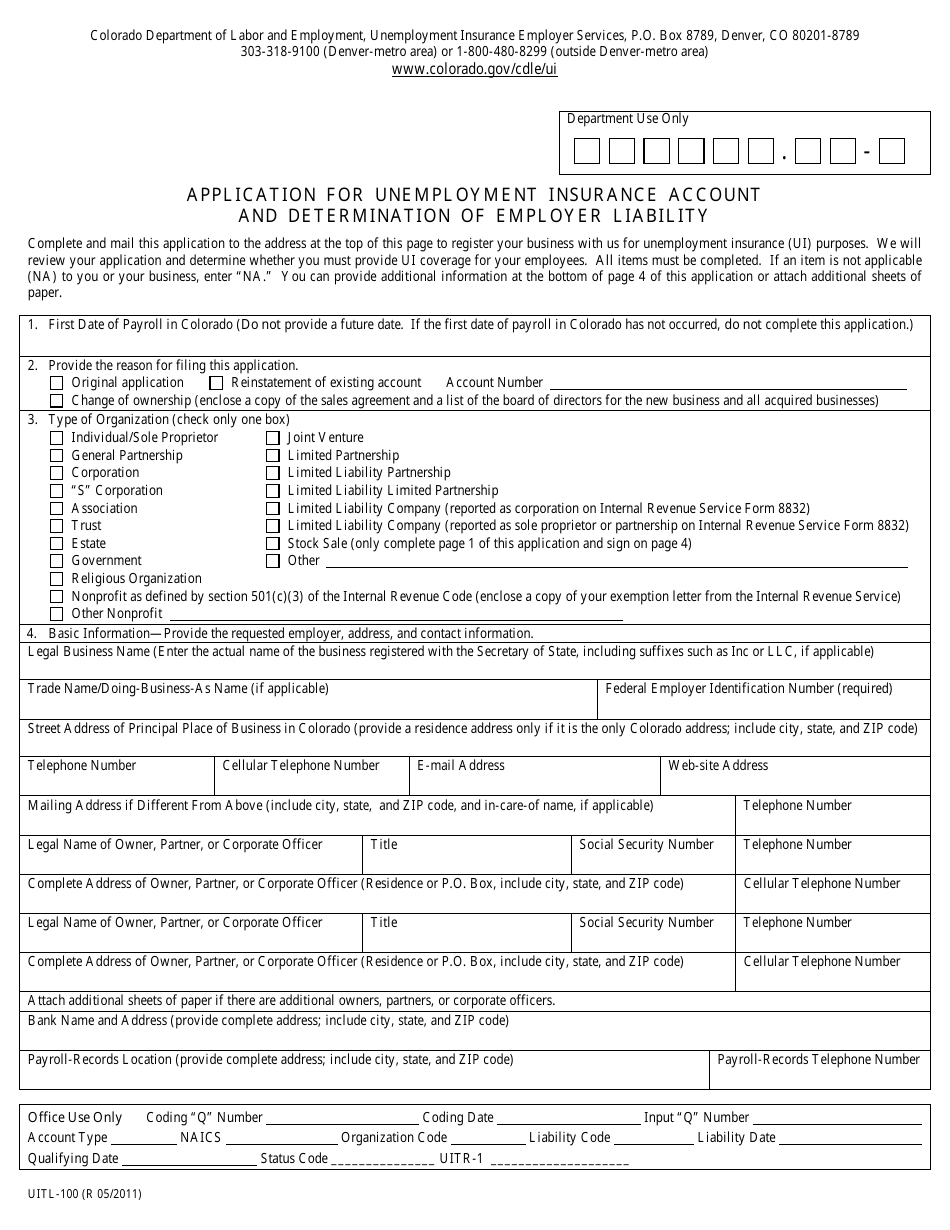

Form UITL-100 Application for Unemployment Insurance Account and Determination of Employer Liability - Colorado

What Is Form UITL-100?

This is a legal form that was released by the Colorado Department of Labor and Employment - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is UITL-100?

A: UITL-100 is the application form for Unemployment Insurance Account and Determination of Employer Liability in Colorado.

Q: Who needs to complete UITL-100?

A: Employers in Colorado who are liable for unemployment insurance must complete UITL-100.

Q: What is the purpose of UITL-100?

A: UITL-100 is used to establish an employer's unemployment insurance account and determine their liability for unemployment insurance taxes.

Q: What information is required in UITL-100?

A: UITL-100 requires information about the employer, such as business name, contact information, and ownership details.

Q: Are there any fees associated with UITL-100?

A: No, there are no fees associated with submitting UITL-100.

Q: What is the deadline for submitting UITL-100?

A: UITL-100 should be submitted within 20 days of becoming liable for unemployment insurance taxes.

Q: What happens after submitting UITL-100?

A: After submitting UITL-100, the Colorado Department of Labor and Employment will review the application and determine the employer's liability for unemployment insurance taxes.

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the Colorado Department of Labor and Employment;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UITL-100 by clicking the link below or browse more documents and templates provided by the Colorado Department of Labor and Employment.