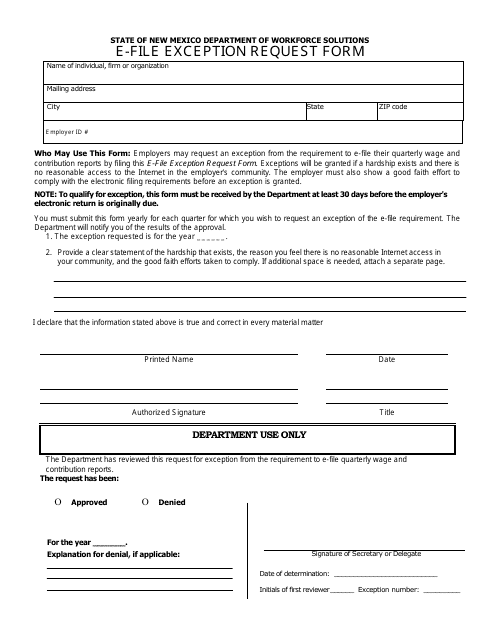

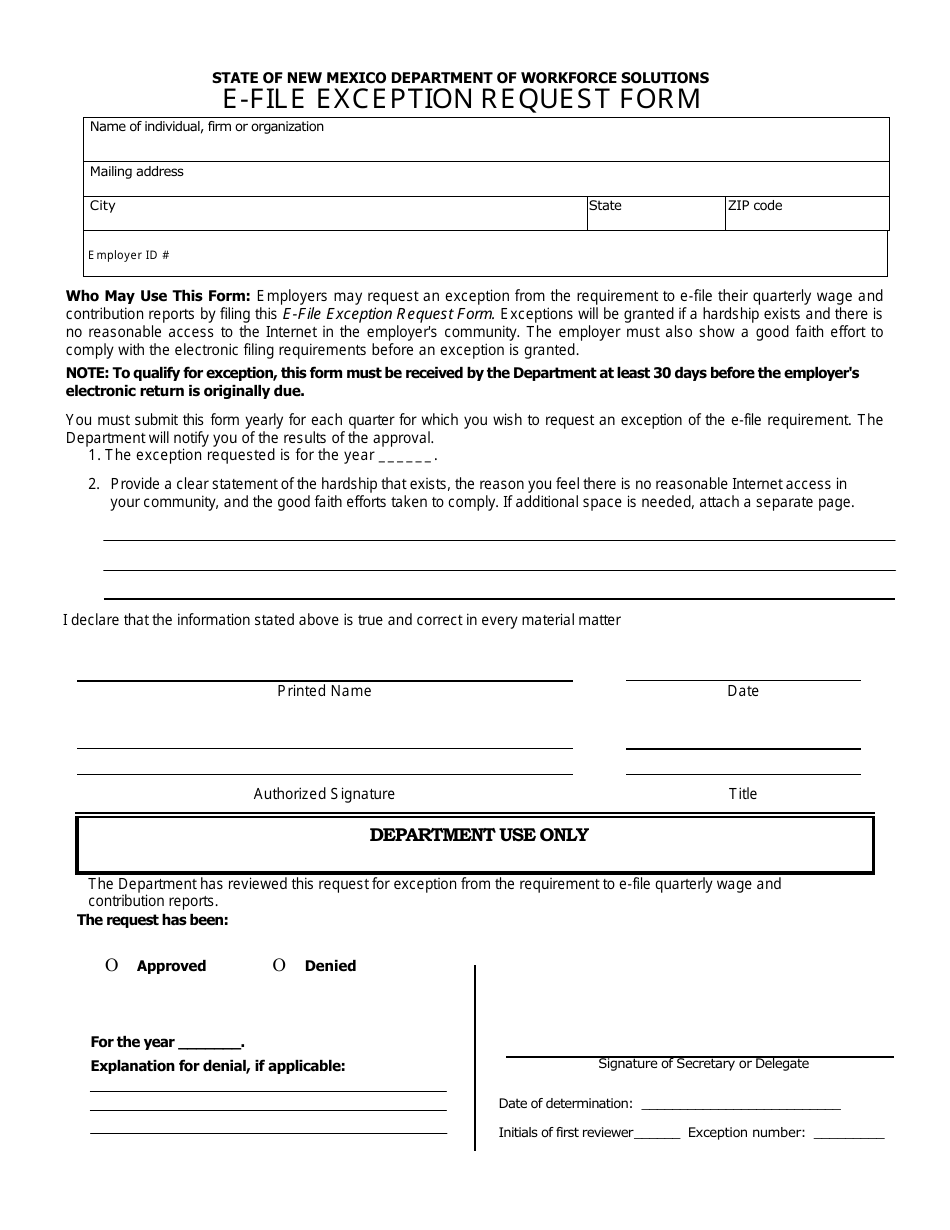

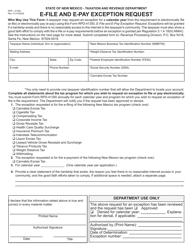

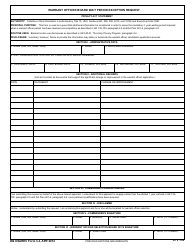

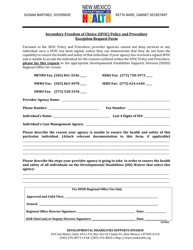

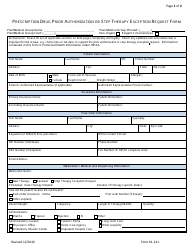

E-File Exception Request Form - New Mexico

E-File Exception Request Form is a legal document that was released by the New Mexico Department of Workforce Solutions - a government authority operating within New Mexico.

FAQ

Q: What is an E-File Exception Request Form?

A: The E-File Exception Request Form is a document used in New Mexico to request an exemption from electronic filing requirements.

Q: When is the E-File Exception Request Form used?

A: This form is used when a taxpayer is unable to electronically file their tax return due to a valid reason.

Q: Who can use the E-File Exception Request Form?

A: Any taxpayer in New Mexico who is unable to electronically file their tax return can use this form.

Q: What information is required on the E-File Exception Request Form?

A: The form generally requires information such as the taxpayer's name, address, tax year, reason for the exception request, and supporting documentation.

Q: Is there a deadline for submitting the E-File Exception Request Form?

A: Yes, the form should be submitted before the tax return filing deadline.

Q: What happens after I submit the E-File Exception Request Form?

A: The New Mexico Taxation and Revenue Department will review the request and notify the taxpayer of their decision.

Q: Can my E-File Exception Request be denied?

A: Yes, the department has the right to deny exception requests if they do not meet the requirements or if documentation is insufficient.

Q: What should I do if my E-File Exception Request is denied?

A: If your request is denied, you may need to file your tax return electronically or explore other options with the tax department.

Form Details:

- The latest edition currently provided by the New Mexico Department of Workforce Solutions;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New Mexico Department of Workforce Solutions.