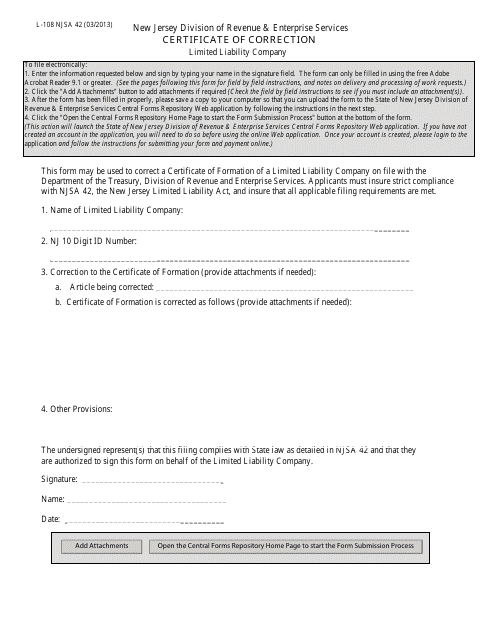

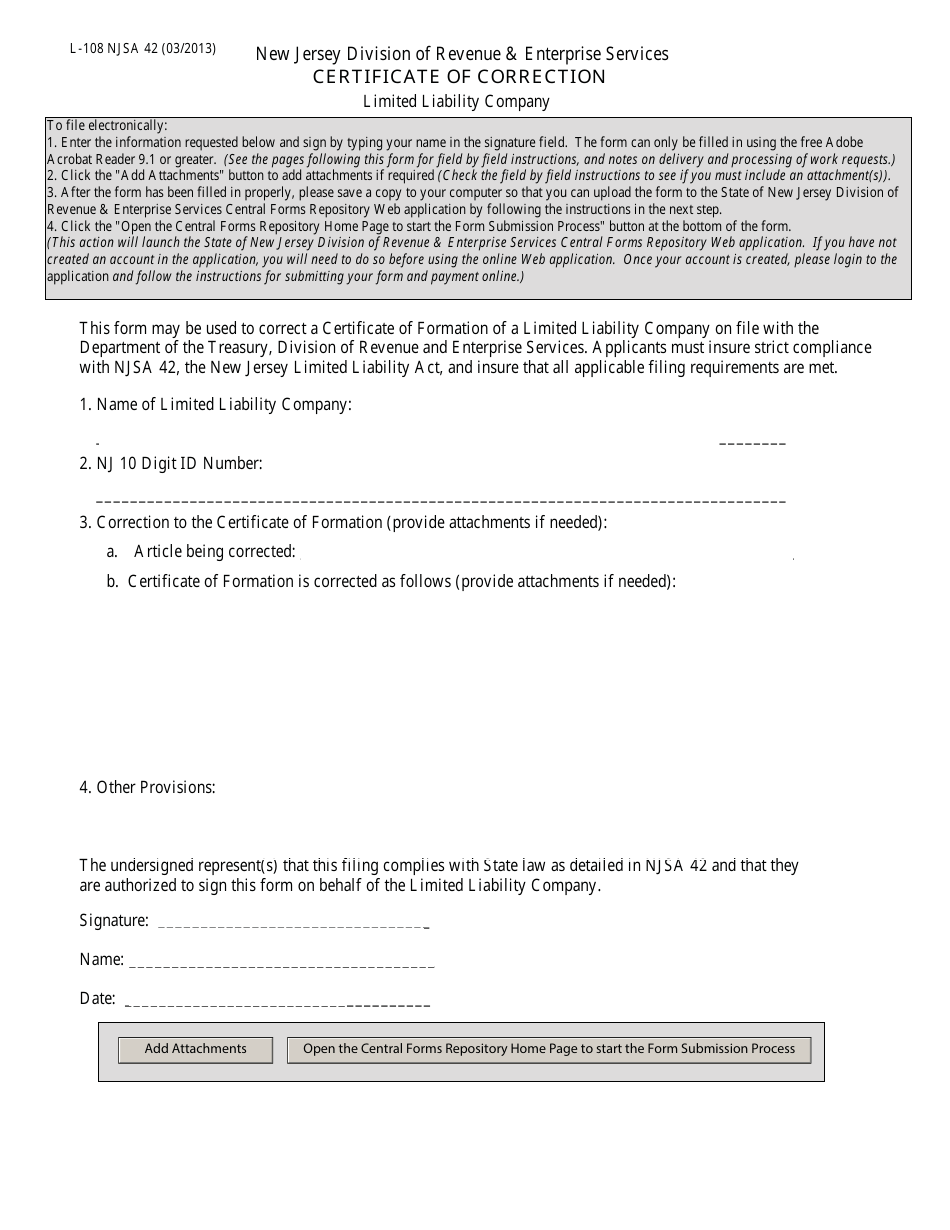

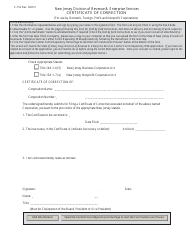

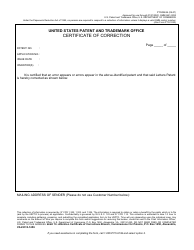

Form l-108 Certificate of Correction - New Jersey

What Is Form l-108?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-108?

A: Form L-108 is a Certificate of Correction in New Jersey.

Q: When is Form L-108 used?

A: Form L-108 is used to correct errors on previously filed documents with the New Jersey Division of Revenue.

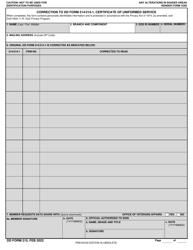

Q: What types of errors can be corrected using Form L-108?

A: Form L-108 can be used to correct errors in the name of a business entity, the name and address of a registered agent, or the address of a domestic business entity.

Q: Are there any fees associated with filing Form L-108?

A: Yes, there is a $25 fee for filing Form L-108.

Q: What is the deadline for filing Form L-108?

A: There is no specific deadline for filing Form L-108, but it is recommended to file it as soon as errors are discovered.

Q: Is Form L-108 required to be notarized?

A: No, Form L-108 does not require notarization.

Q: What happens after filing Form L-108?

A: Once Form L-108 is filed, the New Jersey Division of Revenue will review the correction and update their records accordingly.

Form Details:

- Released on March 1, 2013;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form l-108 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.