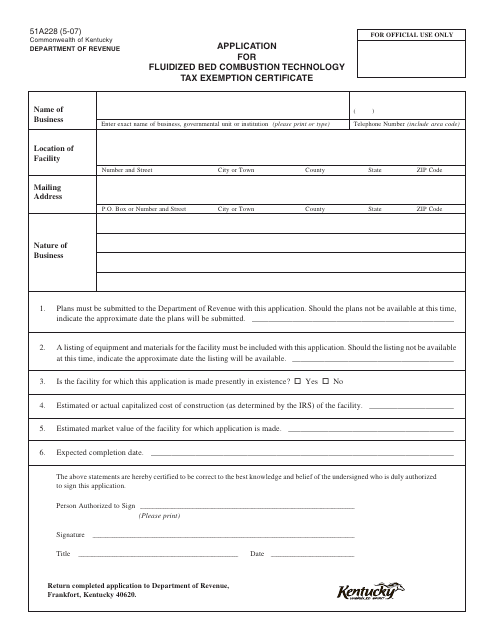

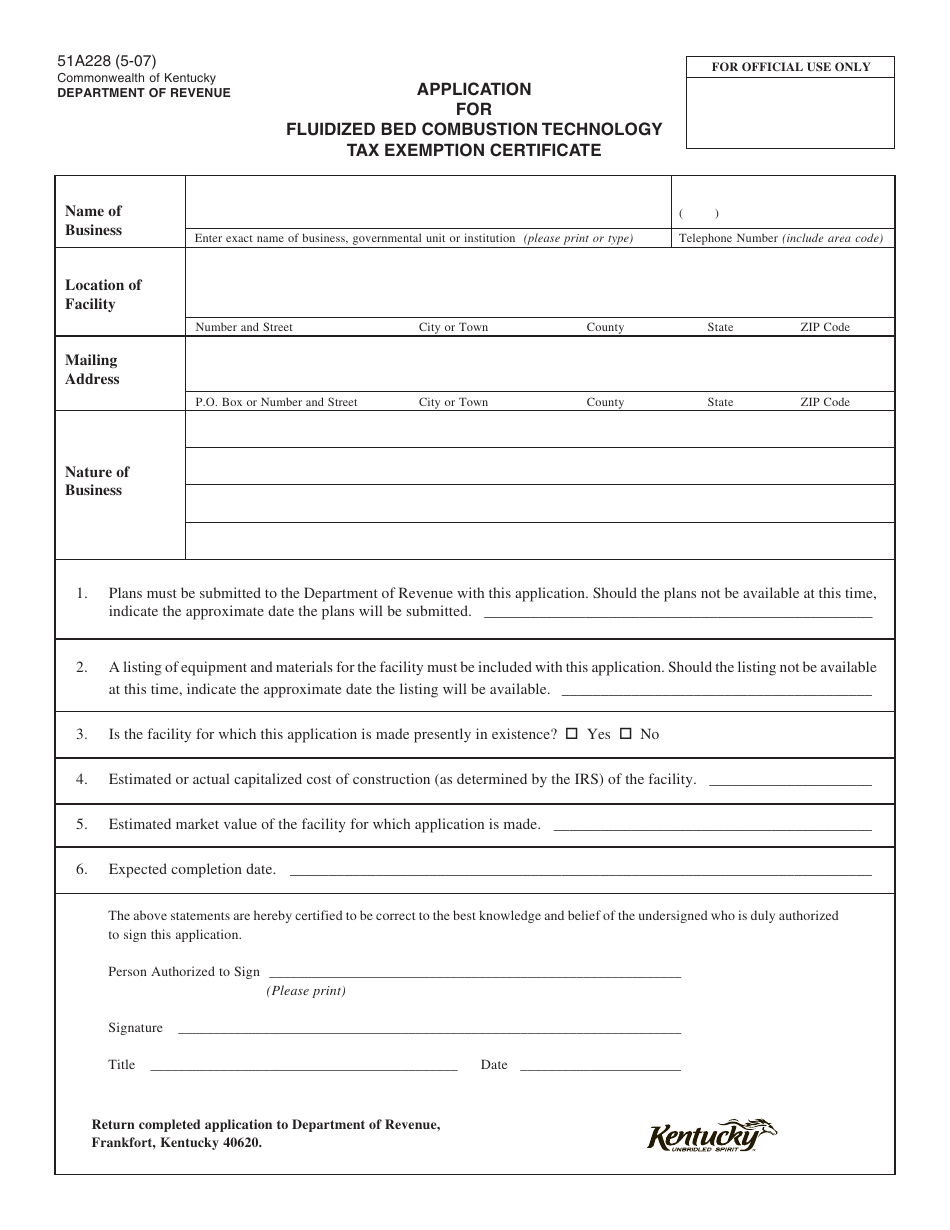

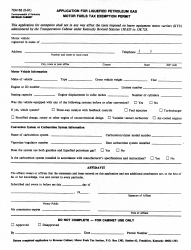

Form 51A228 Application for Fluidized Bed Combustion Technology Tax Exemption Certificate - Kentucky

What Is Form 51A228?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 51A228?

A: Form 51A228 is the application for Fluidized Bed Combustion Technology Tax Exemption Certificate in Kentucky.

Q: What is the purpose of Form 51A228?

A: The purpose of Form 51A228 is to apply for a tax exemption certificate for fluidized bed combustion technology in Kentucky.

Q: Who needs to fill out Form 51A228?

A: Anyone who wants to apply for a tax exemption certificate for fluidized bed combustion technology in Kentucky needs to fill out Form 51A228.

Q: Is there a fee for filing Form 51A228?

A: No, there is no fee for filing Form 51A228.

Q: What information is required on Form 51A228?

A: The form requires information such as the applicant's name, contact information, description of the equipment, and the estimated cost of the equipment.

Q: How long does it take to process Form 51A228?

A: The processing time for Form 51A228 can vary, but it typically takes a few weeks.

Q: What is the benefit of obtaining a tax exemption certificate for fluidized bed combustion technology?

A: The tax exemption certificate allows the applicant to be exempt from certain taxes related to fluidized bed combustion technology in Kentucky.

Q: Can I apply for a tax exemption certificate if I have already purchased the equipment?

A: Yes, you can still apply for a tax exemption certificate even if you have already purchased the equipment, as long as it meets the eligibility criteria.

Form Details:

- Released on May 1, 2007;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 51A228 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.