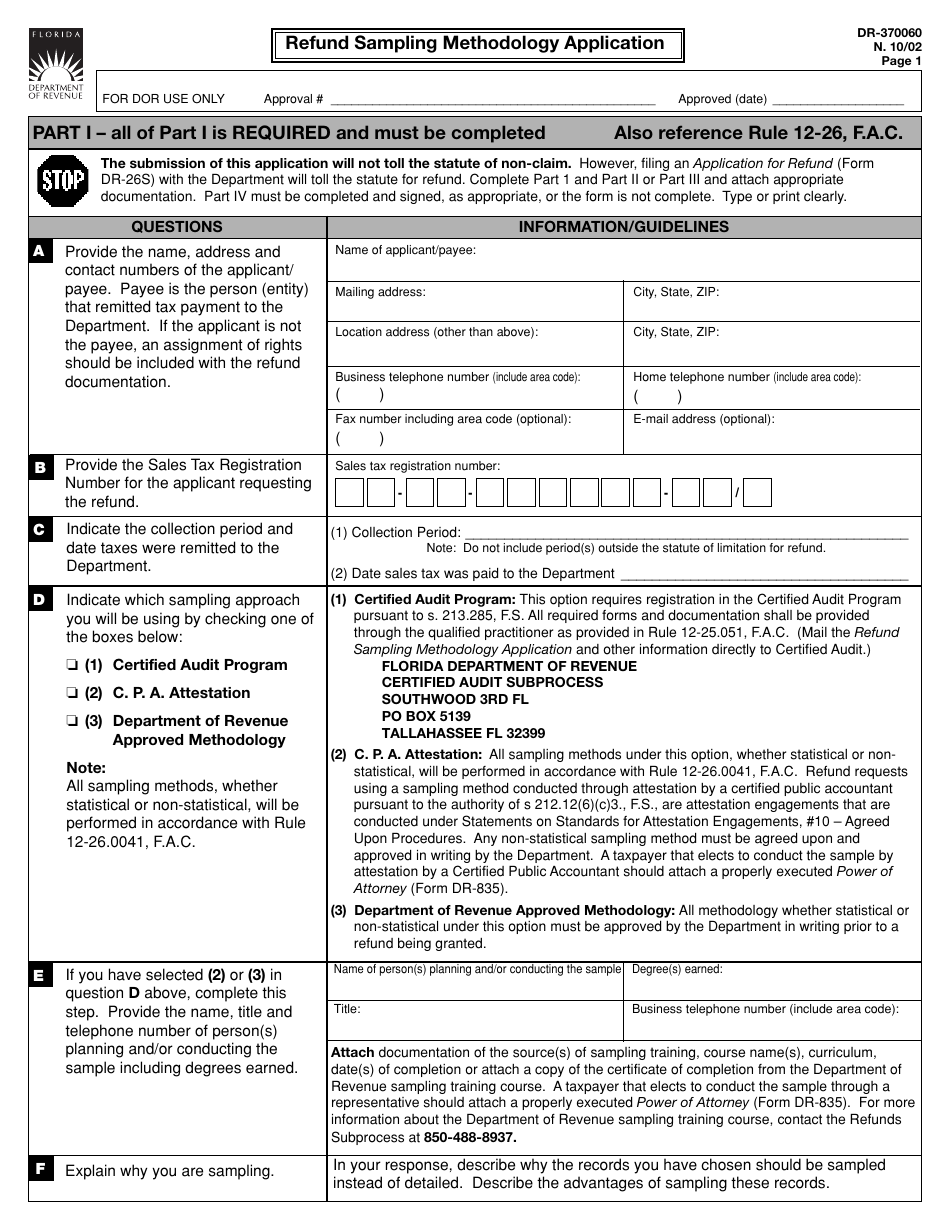

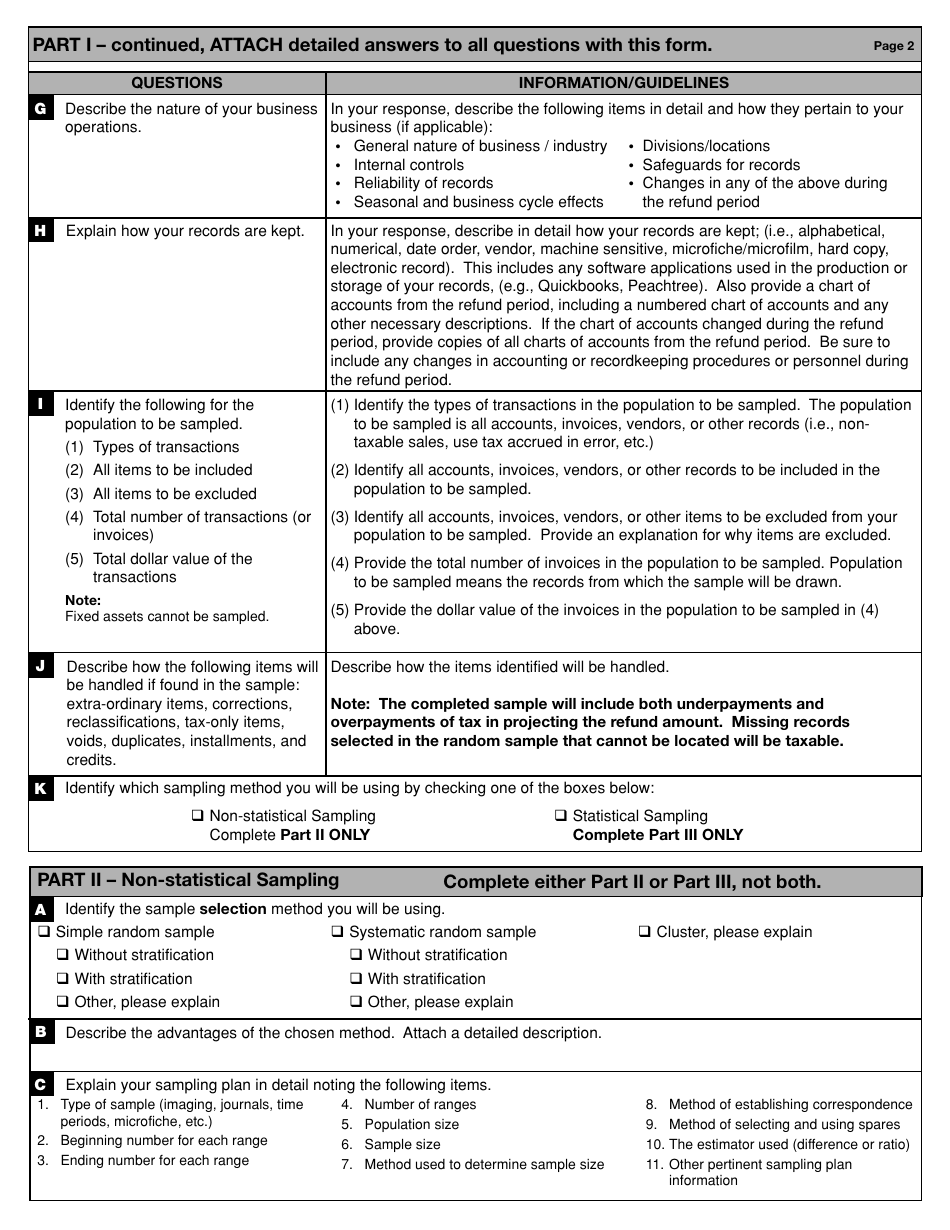

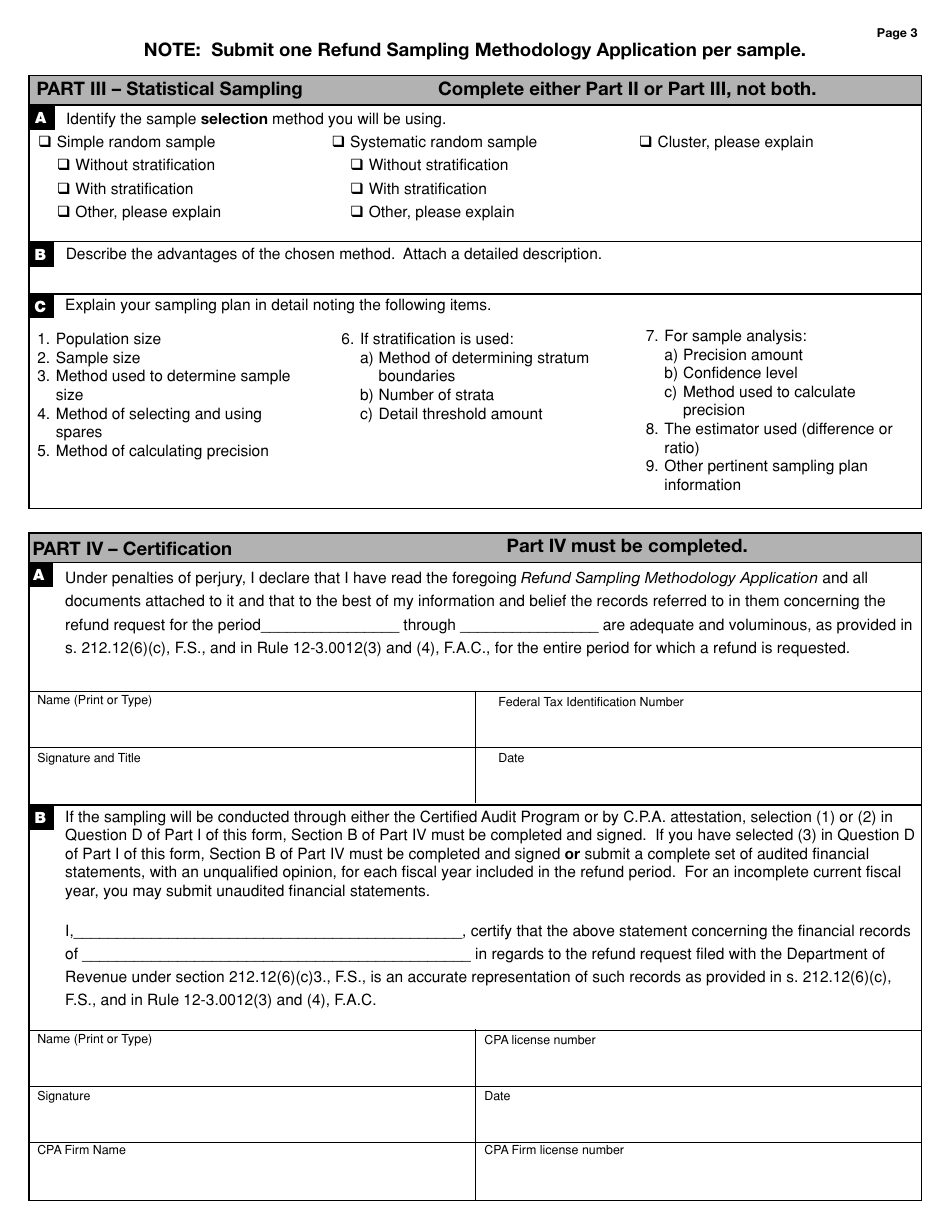

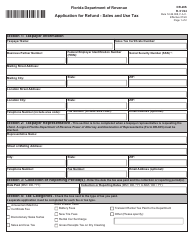

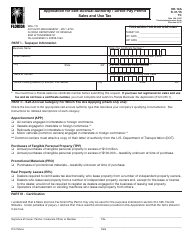

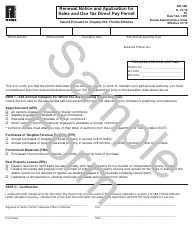

Form DR-370060 Refund Sampling Methodology Application for Sales and Use Tax - Florida

What Is Form DR-370060?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-370060?

A: Form DR-370060 is an application for sales and use tax refund sampling methodology in Florida.

Q: What is the purpose of Form DR-370060?

A: The purpose of Form DR-370060 is to apply for permission to use a sampling methodology for calculating sales and use taxrefund claims in Florida.

Q: What is a sampling methodology?

A: A sampling methodology is a statistical technique used to estimate the total refund amount based on a representative sample of transactions.

Q: Who can use Form DR-370060?

A: Any taxpayer who wishes to apply for permission to use a sampling methodology for sales and use tax refund claims in Florida can use Form DR-370060.

Q: Are there any fees associated with Form DR-370060?

A: No, there are no fees associated with filing Form DR-370060.

Q: What supporting documents should be included with Form DR-370060?

A: You should include a detailed description of the sampling methodology, a sample plan, and any other relevant supporting documents with Form DR-370060.

Q: How long does it take to process Form DR-370060?

A: The processing time for Form DR-370060 may vary, but the Florida Department of Revenue aims to process applications within a reasonable time frame.

Q: Can I appeal if my application on Form DR-370060 is denied?

A: Yes, if your application on Form DR-370060 is denied, you have the right to appeal the decision.

Form Details:

- Released on October 1, 2002;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-370060 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.