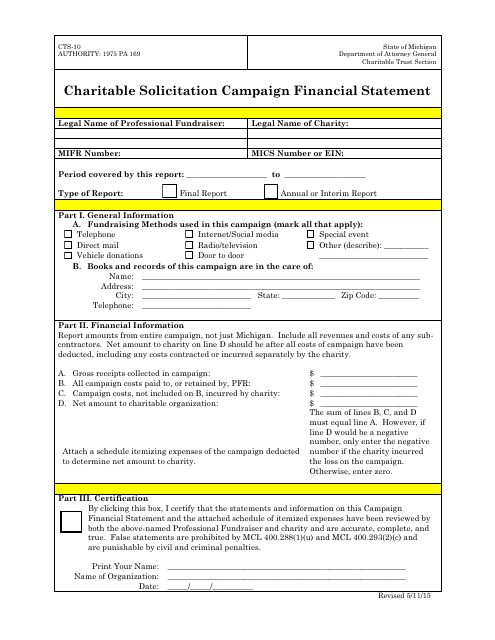

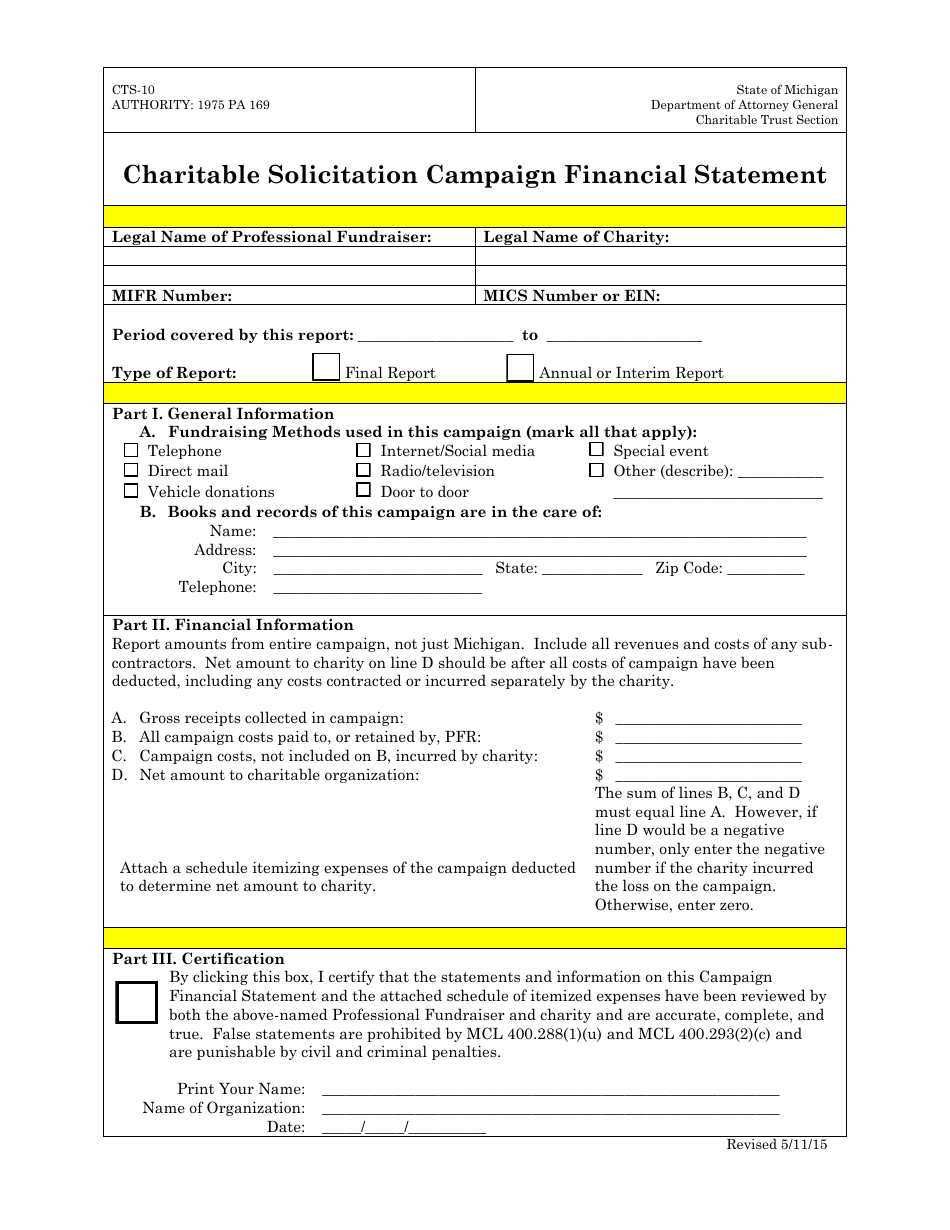

Form CTS-10 Charitable Solicitation Campaign Financial Statement - Michigan

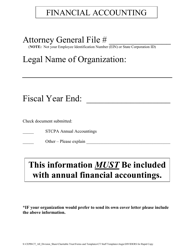

What Is Form CTS-10?

This is a legal form that was released by the Michigan Department of Attorney General - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CTS-10?

A: Form CTS-10 is the Charitable Solicitation Campaign Financial Statement in Michigan.

Q: Who needs to file Form CTS-10?

A: Nonprofit organizations conducting charitable solicitation campaigns in Michigan need to file Form CTS-10.

Q: What information is required on Form CTS-10?

A: Form CTS-10 requires organizations to provide financial information related to their charitable solicitation campaigns, including revenue, expenses, and use of funds.

Q: When is Form CTS-10 due?

A: Form CTS-10 is due no later than 180 days after the close of a nonprofit organization's fiscal year.

Form Details:

- Released on May 11, 2015;

- The latest edition provided by the Michigan Department of Attorney General;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CTS-10 by clicking the link below or browse more documents and templates provided by the Michigan Department of Attorney General.