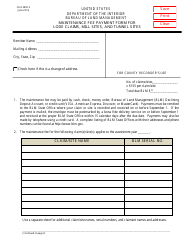

This version of the form is not currently in use and is provided for reference only. Download this version of

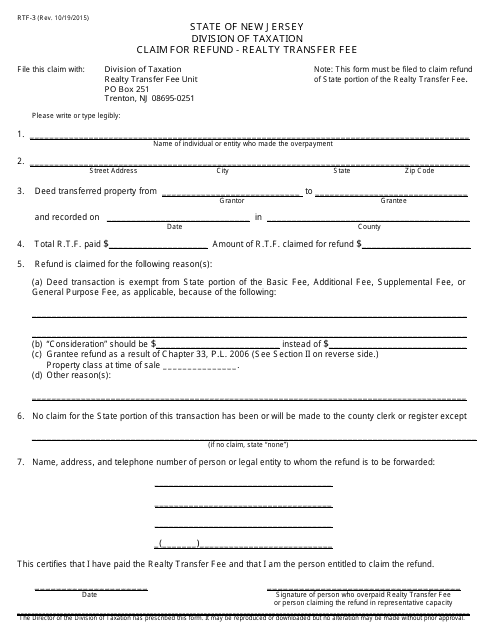

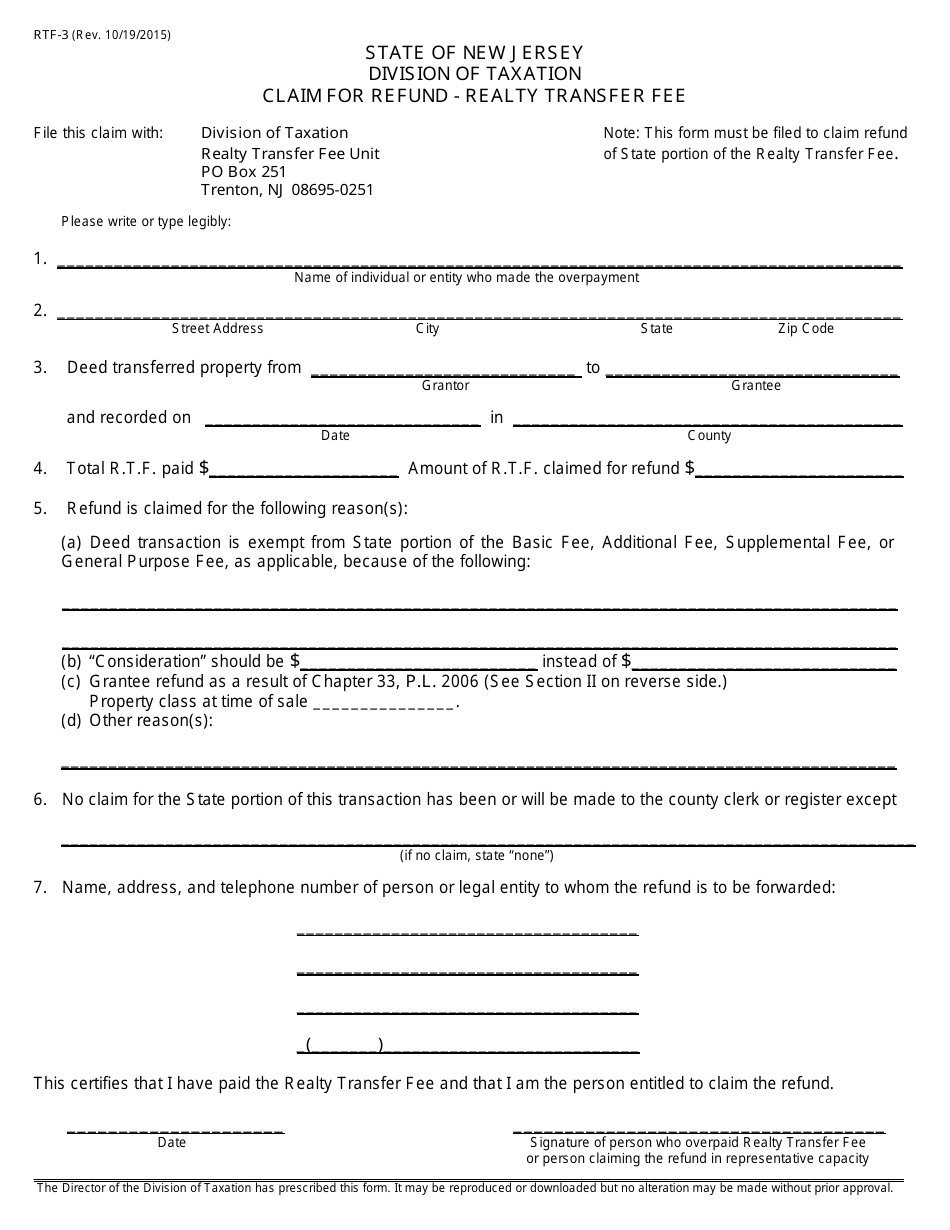

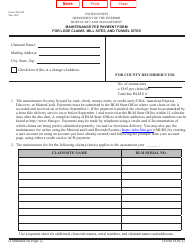

Form RTF-3

for the current year.

Form RTF-3 Claim for Refund - Realty Transfer Fee - New Jersey

What Is Form RTF-3?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RTF-3?

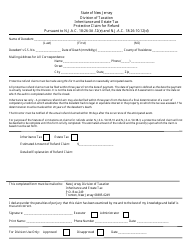

A: Form RTF-3 is the form used to file a claim for refund of the Realty Transfer Fee in New Jersey.

Q: What is the Realty Transfer Fee?

A: The Realty Transfer Fee is a fee paid by buyers or sellers upon the transfer of real property in New Jersey.

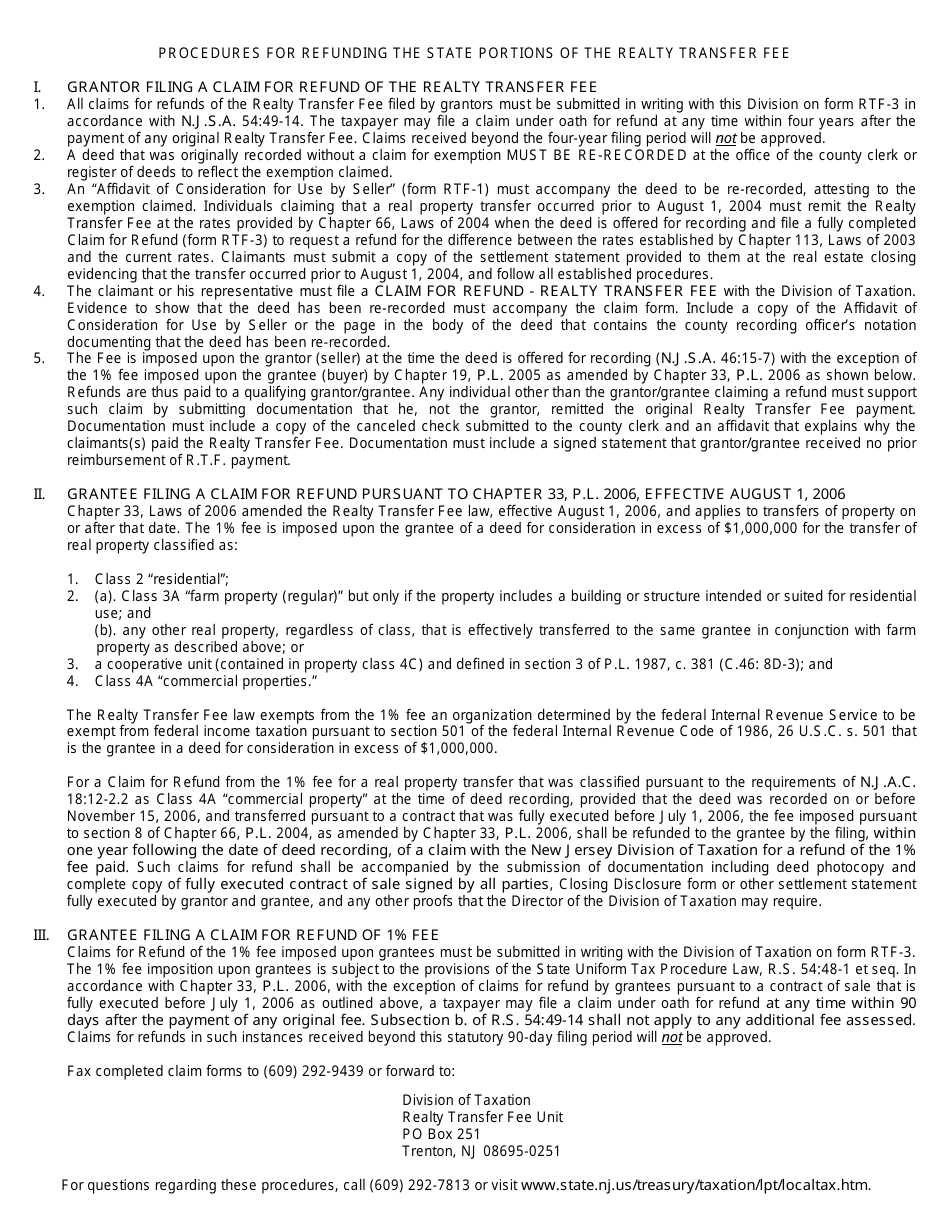

Q: Who can file a claim for refund?

A: Buyers or sellers who paid the Realty Transfer Fee can file a claim for refund.

Q: What is the purpose of filing a claim for refund?

A: The purpose of filing a claim for refund is to request a reimbursement of the Realty Transfer Fee that was overpaid or improperly paid.

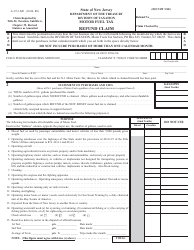

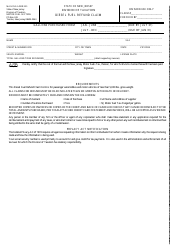

Q: What information is required on Form RTF-3?

A: Form RTF-3 requires details about the property transfer, fee payment, and reasons for the refund request.

Q: Are there any time limits for filing a claim for refund?

A: Yes, claims for refund must be filed within two years from the date of payment of the Realty Transfer Fee.

Q: How long does it take to process a claim for refund?

A: The processing time for a claim for refund can vary, but it generally takes several months.

Q: Is there a fee to file a claim for refund?

A: No, there is no fee to file a claim for refund of the Realty Transfer Fee.

Q: Can I file a claim for refund if I'm not a resident of New Jersey?

A: Yes, non-residents who paid the Realty Transfer Fee can also file a claim for refund.

Form Details:

- Released on October 19, 2015;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RTF-3 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.