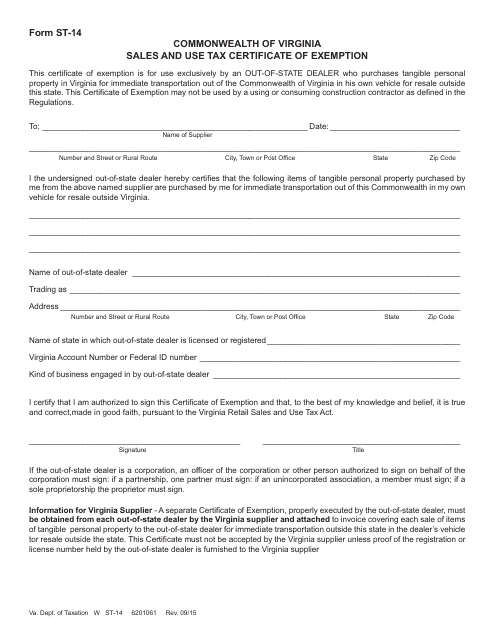

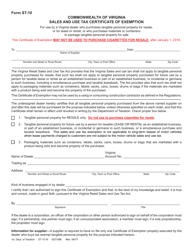

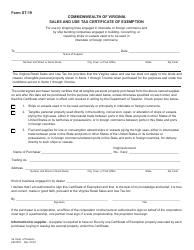

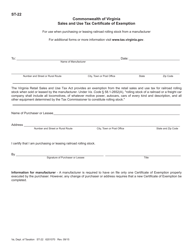

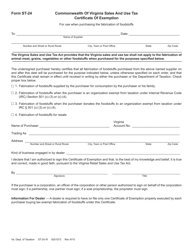

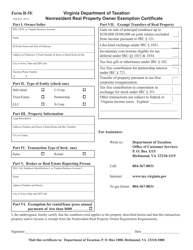

Form ST-14 Out-of-State Resale Dealer Exemption Certificate - Virginia

What Is Form ST-14?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-14?

A: Form ST-14 is the Out-of-State Resale Dealer Exemption Certificate used in Virginia.

Q: Who should use Form ST-14?

A: Out-of-state resale dealers who want to claim exemption from sales tax in Virginia should use Form ST-14.

Q: What is the purpose of Form ST-14?

A: The purpose of Form ST-14 is to provide evidence that an out-of-state resale dealer is registered to collect sales tax in their home state and is therefore eligible for exemption from sales tax in Virginia.

Q: How long is Form ST-14 valid for?

A: Form ST-14 is valid for one year from the date of issue.

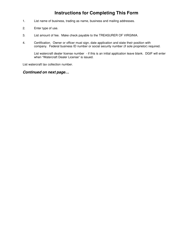

Q: What information is required on Form ST-14?

A: Form ST-14 requires the out-of-state resale dealer's name, address, Taxpayer Identification Number (TIN), and the name and address of their home statetax authority.

Form Details:

- Released on September 1, 2015;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-14 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.