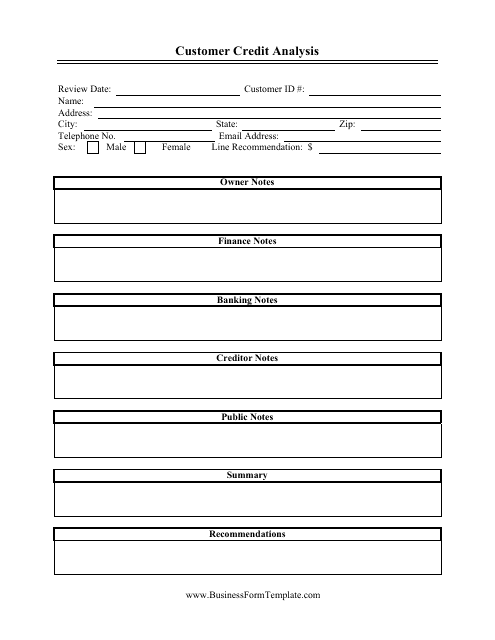

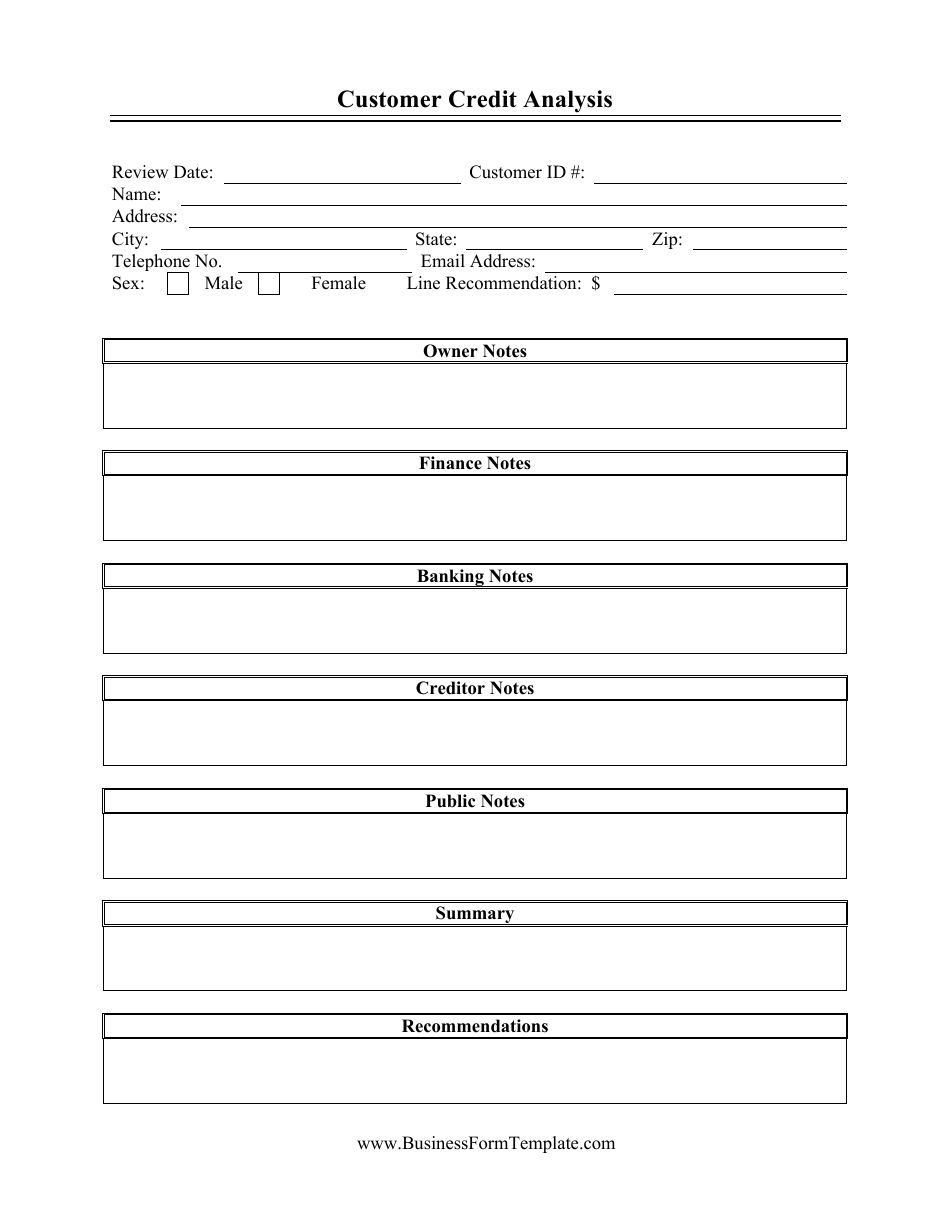

Customer Credit Analysis Report Template

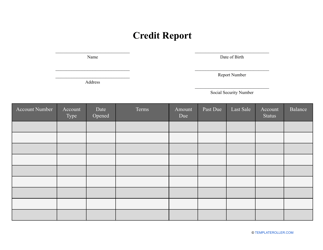

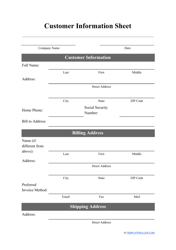

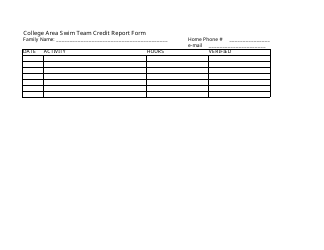

A Customer Credit Analysis Report Template is a tool used by financial institutions to evaluate the creditworthiness of a potential customer. This report helps assess the customer's financial stability, payment history, and ability to repay loans or credit. It provides a comprehensive analysis of the customer's credit history, income, debts, and other relevant factors to determine the risk level associated with extending credit to the customer. This template helps the financial institution make informed decisions regarding loan approvals or credit limits.

The Customer Credit Analysis Report template is typically filed and maintained by the lending institution or financial institution that conducts the credit analysis of the customer. This can include banks, credit unions, or other financial organizations.

FAQ

Q: What is a Customer Credit Analysis Report?

A: A Customer Credit Analysis Report is a document that analyzes a customer's creditworthiness and provides information about their credit history, payment behavior, and ability to fulfill financial obligations.

Q: Why is a Customer Credit Analysis Report important?

A: A Customer Credit Analysis Report is important because it helps businesses assess the credit risk associated with a customer. It provides insights into their past financial behavior and helps determine whether extending credit to them is a viable option.

Q: What information is included in a Customer Credit Analysis Report?

A: A Customer Credit Analysis Report typically includes the customer's credit score, credit history, payment history, outstanding debts, any bankruptcies or defaults, and also an evaluation of their overall creditworthiness.

Q: Who uses a Customer Credit Analysis Report?

A: Businesses and financial institutions use Customer Credit Analysis Reports to make informed decisions about extending credit to customers. These reports are commonly used by banks, lending institutions, credit card companies, and other entities involved in providing credit.

Q: How is a Customer Credit Analysis Report created?

A: A Customer Credit Analysis Report is created by gathering data about the customer's credit history from various sources such as credit bureaus, financial records, and past payment information. This information is then analyzed and compiled into a comprehensive report.

Q: What are the benefits of using a Customer Credit Analysis Report?

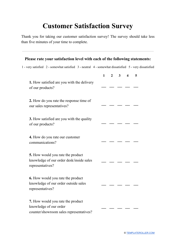

A: Using a Customer Credit Analysis Report helps businesses minimize the risk of non-payment or default by providing valuable insights into a customer's financial stability. It also helps in setting appropriate credit limits and terms based on the customer's creditworthiness.

Q: Are Customer Credit Analysis Reports always accurate?

A: Customer Credit Analysis Reports are generally reliable, but they can occasionally contain errors or outdated information. It's important for businesses to review the report carefully and cross-reference it with other sources to ensure accuracy.

Q: Can a poor credit history prevent a customer from obtaining credit?

A: Yes, a poor credit history can significantly impact a customer's ability to obtain credit. Lenders and businesses may view a poor credit history as a high-risk factor and may be hesitant to extend credit or may offer less favorable terms.

Q: Can a customer improve their creditworthiness over time?

A: Yes, customers can improve their creditworthiness over time by making timely payments, reducing outstanding debts, and demonstrating responsible financial behavior. Consistently practicing good credit habits can help rebuild credit and improve credit scores.

Q: Is it legal to deny credit based on a poor credit history?

A: In the United States, it is legal for businesses to deny credit based on a poor credit history. The Fair Credit Reporting Act allows businesses to consider a customer's creditworthiness as a factor in determining credit eligibility.