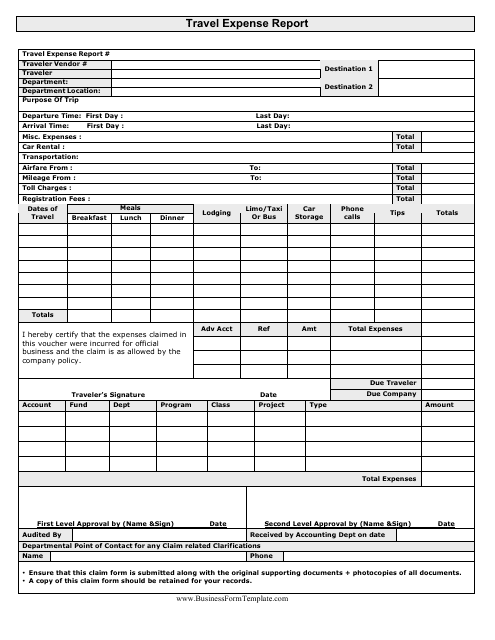

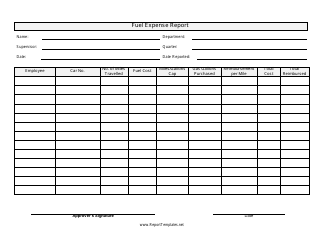

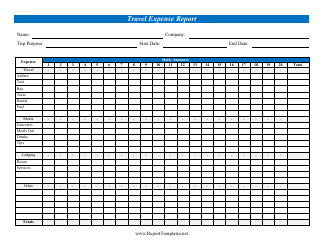

Travel Expense Report Template - Big Table

The Travel Expense Report Template - Big Table is used for organizing and tracking travel expenses. It provides a structured format for recording details such as transportation costs, lodging expenses, meals, and other miscellaneous expenses incurred during a trip.

FAQ

Q: What is a travel expense report?

A: A travel expense report is a document used to track and record expenses incurred during business travel.

Q: Why do I need a travel expense report?

A: A travel expense report helps you keep track of your expenses and ensures you can be reimbursed for eligible expenses.

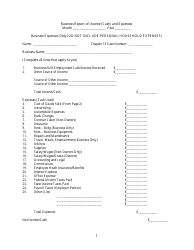

Q: What should be included in a travel expense report?

A: A travel expense report should include details of each expense such as date, description, amount, and any receipts or supporting documentation.

Q: How do I fill out a travel expense report?

A: Fill out a travel expense report by entering all necessary details for each expense incurred during your business travel.

Q: What information do I need to provide in a travel expense report?

A: You need to provide details such as the purpose of the trip, date of travel, destination, complete expense breakdown, and any supporting documentation.

Q: Who should I submit my travel expense report to?

A: Submit your travel expense report to your employer or supervisor, following your company's specific guidelines and procedures.

Q: When should I submit my travel expense report?

A: Submit your travel expense report as soon as possible after your business trip to ensure timely reimbursement.

Q: What expenses can be included in a travel expense report?

A: Expenses that can typically be included in a travel expense report include transportation, accommodation, meals, conference fees, and other miscellaneous expenses directly related to business travel.

Q: What expenses are not eligible for reimbursement?

A: Expenses that are not directly related to business travel, personal expenses, and expenses that exceed your company's expense policy limits are typically not eligible for reimbursement.