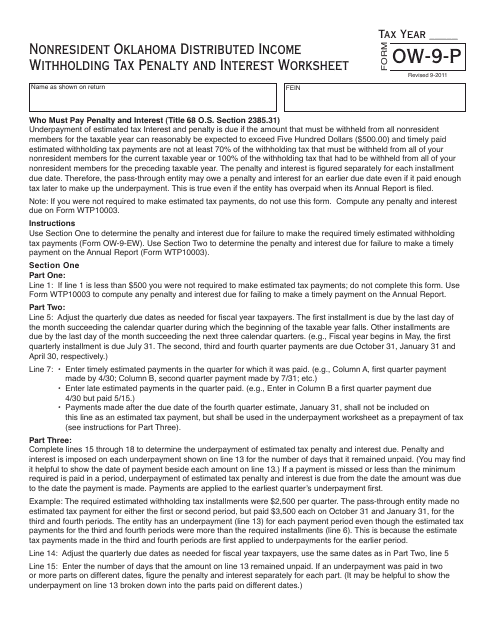

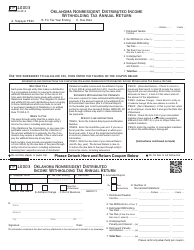

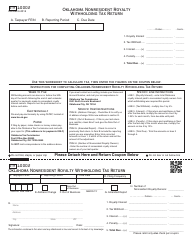

Form OW-9-P Nonresident Oklahoma Distributed Income Withholding Tax Penalty and Interest Worksheet - Oklahoma

What Is Form OW-9-P?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OW-9-P?

A: Form OW-9-P is the Nonresident Oklahoma Distributed Income WithholdingTax Penalty and Interest Worksheet.

Q: Who needs to file Form OW-9-P?

A: Form OW-9-P is used by nonresident individuals who need to calculate their penalty and interest owed for failing to withhold and remit Oklahoma income taxes.

Q: What is the purpose of Form OW-9-P?

A: The purpose of Form OW-9-P is to determine the penalty and interest owed by nonresident individuals for not properly withholding and remitting Oklahoma income taxes.

Q: When is Form OW-9-P due?

A: Form OW-9-P is due on the same date as the corresponding income tax return, typically April 15th.

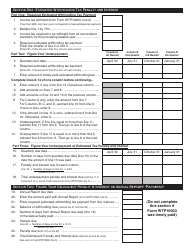

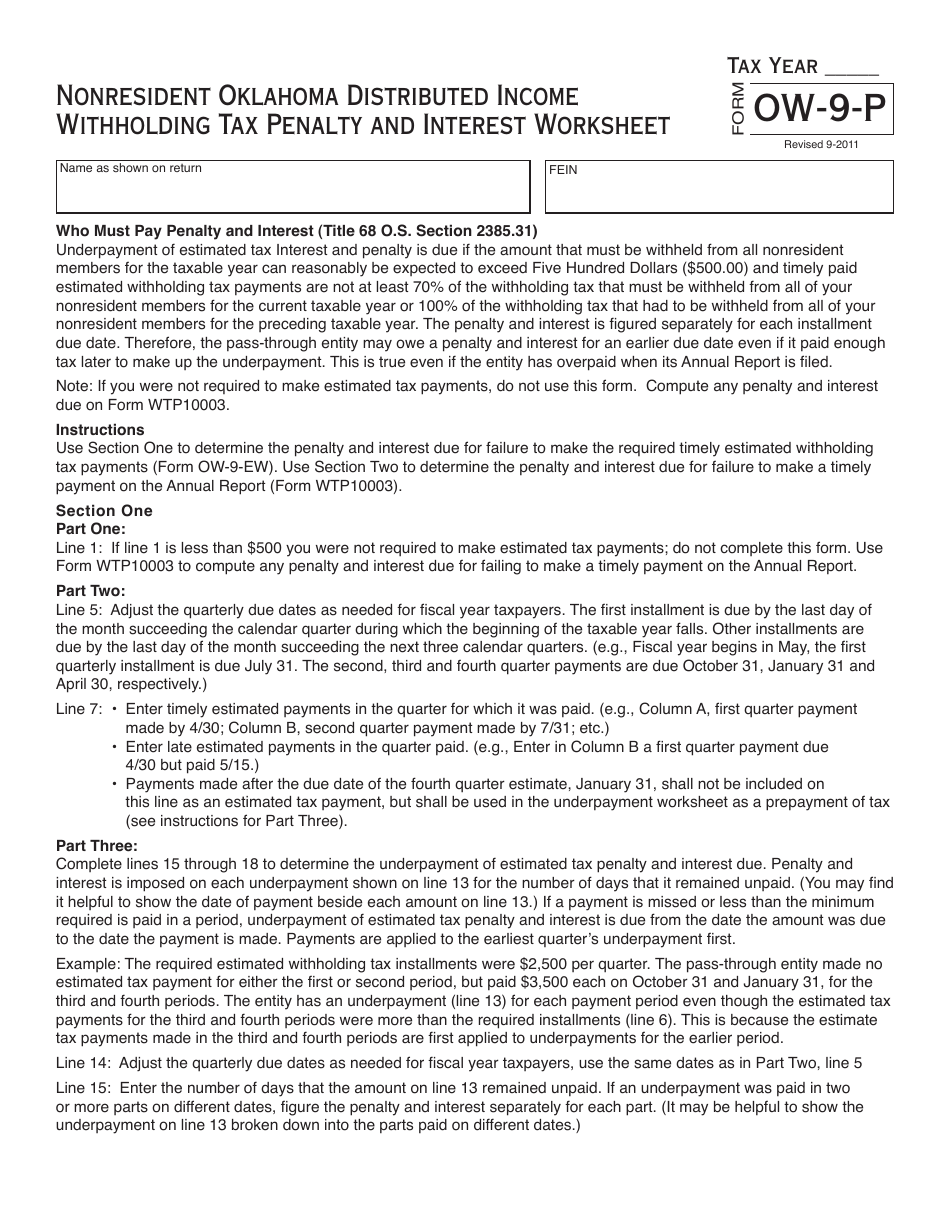

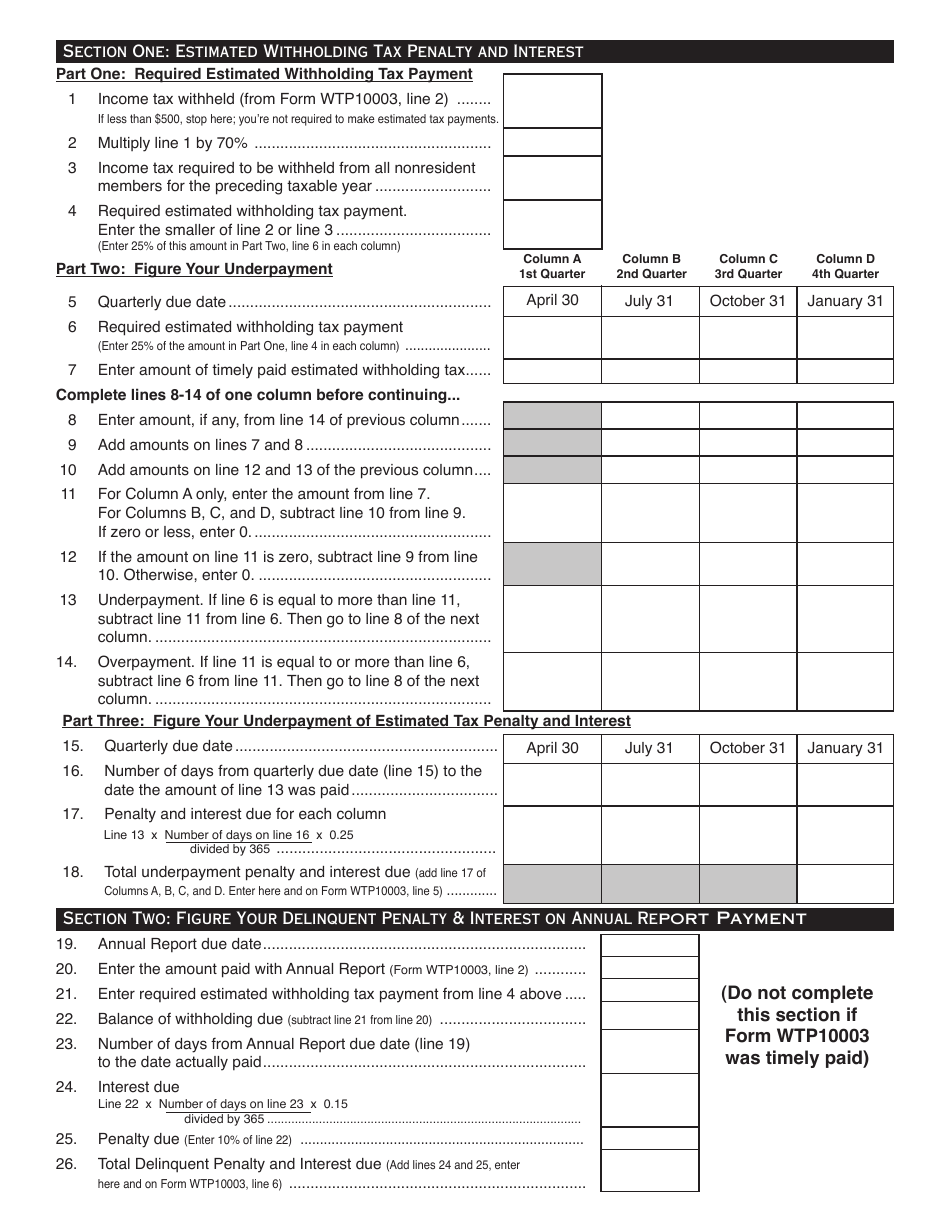

Q: How do I fill out Form OW-9-P?

A: You need to provide your personal information, details of the distributed income, and calculate the penalty and interest based on the provided instructions on the form.

Q: What happens if I don't file Form OW-9-P?

A: If you fail to file Form OW-9-P and pay the penalty and interest owed, you may face additional penalties and interest charges from the Oklahoma Tax Commission.

Form Details:

- Released on September 1, 2011;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OW-9-P by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.