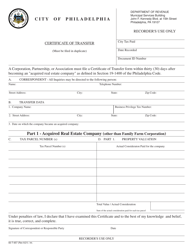

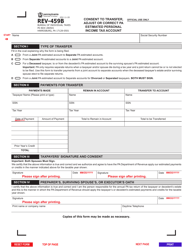

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 82-127

for the current year.

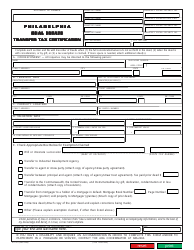

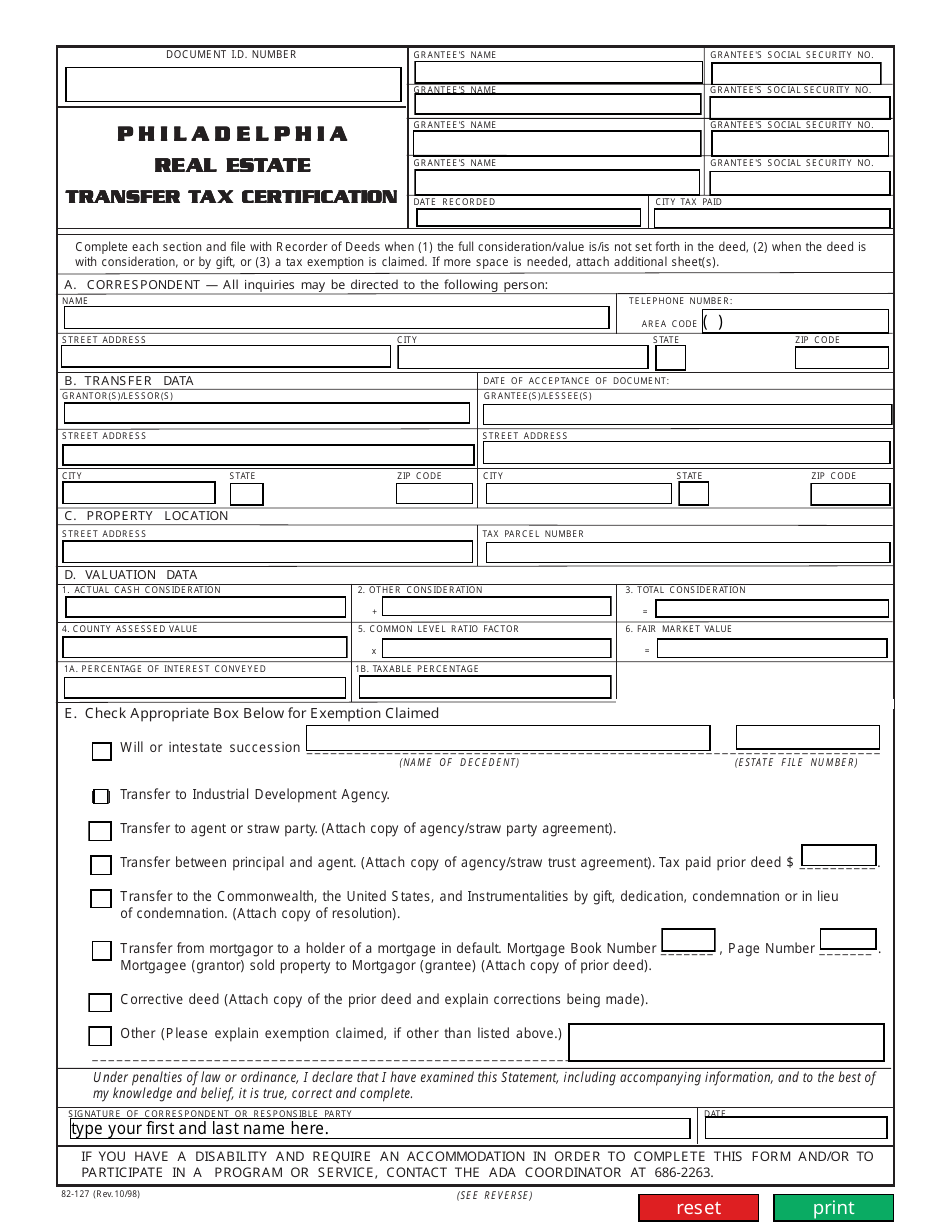

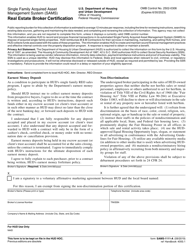

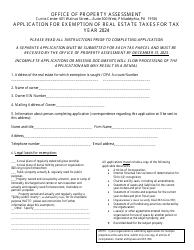

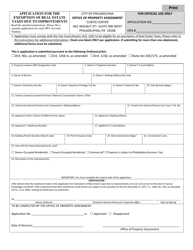

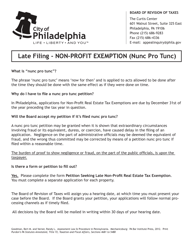

Form 82-127 Real Estate Transfer Tax Certification - City of Philadelphia, Pennsylvania

What Is Form 82-127?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 82-127?

A: Form 82-127 is the Real Estate Transfer Tax Certification form used in the City of Philadelphia, Pennsylvania.

Q: What is the purpose of Form 82-127?

A: The purpose of Form 82-127 is to certify the payment of real estate transfer tax in Philadelphia.

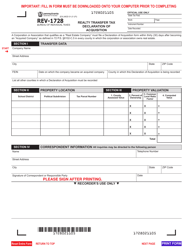

Q: When is Form 82-127 required?

A: Form 82-127 is required for all real estate transactions in Philadelphia where transfer tax is due.

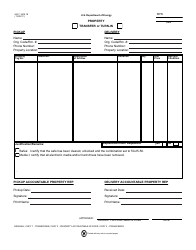

Q: What information is needed to fill out Form 82-127?

A: The form requires information such as the property address, buyer and seller names, purchase price, and information about any exemptions or abatements.

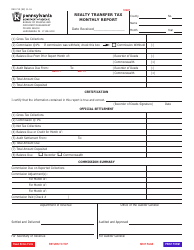

Q: Who is responsible for filing Form 82-127?

A: The responsibility for filing Form 82-127 lies with the buyer or the buyer's agent.

Q: Are there any fees associated with filing Form 82-127?

A: Yes, there is a fee for filing Form 82-127. The fee amount varies depending on the purchase price of the property.

Q: Can Form 82-127 be filed electronically?

A: Yes, Form 82-127 can be filed electronically through the City of Philadelphia's eFile/ePay system.

Q: What happens after Form 82-127 is filed?

A: After Form 82-127 is filed and the transfer tax is paid, the certification is issued, and the transaction can proceed.

Q: Is Form 82-127 specific to Philadelphia only?

A: Yes, Form 82-127 is specific to the City of Philadelphia in Pennsylvania. Other cities may have their own transfer tax certification forms.

Form Details:

- Released on October 1, 1998;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 82-127 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.