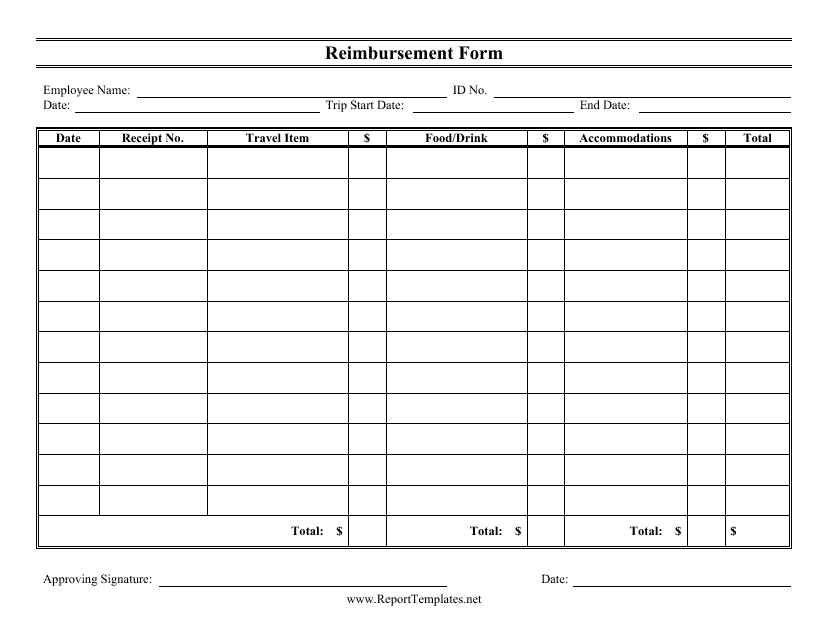

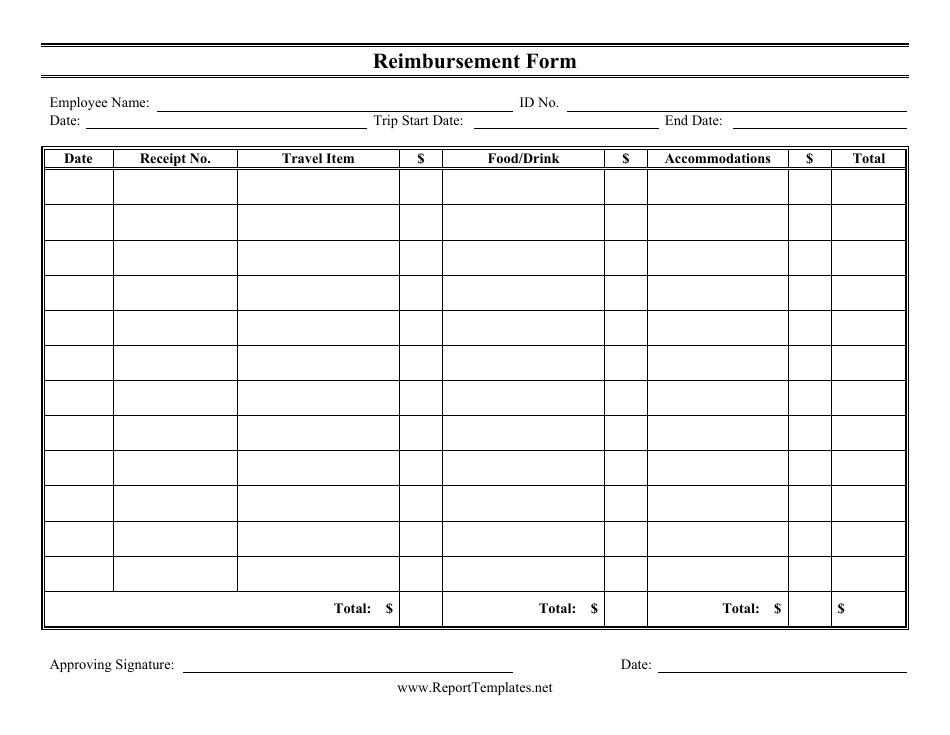

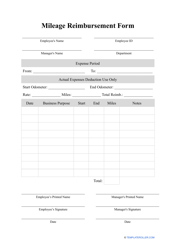

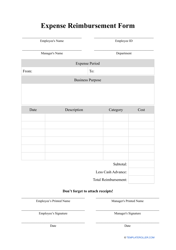

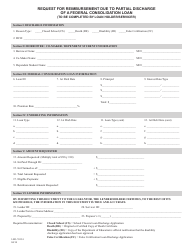

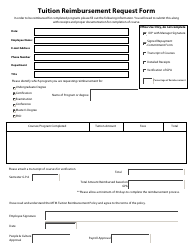

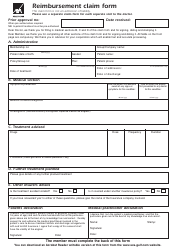

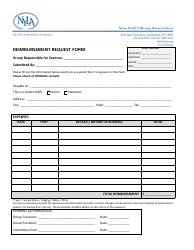

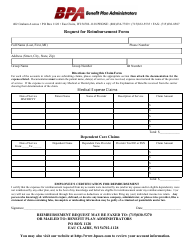

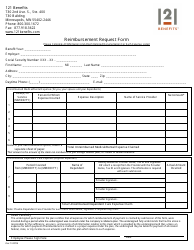

Reimbursement Form

A Reimbursement Form is used to request reimbursement for expenses that were incurred for business purposes, such as travel, meals, or other business-related costs. It allows individuals to submit their expenses to be reviewed and approved for reimbursement by their employer or organization.

The person who incurred the expenses typically files the reimbursement form.

FAQ

Q: What is a reimbursement form?

A: A reimbursement form is a document that allows you to request reimbursement for expenses you have incurred.

Q: Why would I need to use a reimbursement form?

A: You would need to use a reimbursement form if you have spent money on behalf of an organization or employer and need to be reimbursed.

Q: What kind of expenses can I request reimbursement for?

A: You can request reimbursement for various types of expenses such as travel, meals, office supplies, and other approved business-related expenses.

Q: How do I fill out a reimbursement form?

A: To fill out a reimbursement form, you usually need to provide your personal information, the date and details of the expense, and any supporting documentation such as receipts.

Q: Who do I submit my reimbursement form to?

A: You usually need to submit your reimbursement form to the appropriate person or department within the organization or employer you are seeking reimbursement from.

Q: How long does it take to receive reimbursement after submitting a form?

A: The time it takes to receive reimbursement after submitting a form can vary depending on the organization or employer's process, but it is typically within a few weeks.

Q: Are there any limitations to what expenses can be reimbursed?

A: Yes, there may be limitations on what expenses can be reimbursed. It is best to check with your organization or employer's reimbursement policies for specific guidelines.

Q: Can I get reimbursed for expenses incurred outside of work?

A: It depends on the organization or employer's policies. Some may allow reimbursement for certain types of personal expenses if they are related to work or job duties.

Q: Are there any tax implications for reimbursement?

A: There may be tax implications for reimbursement, especially if the reimbursements are considered taxable income. It is recommended to consult with a tax professional for guidance.