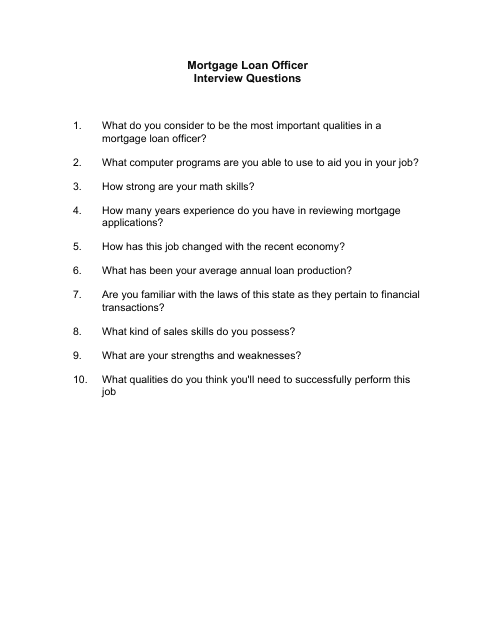

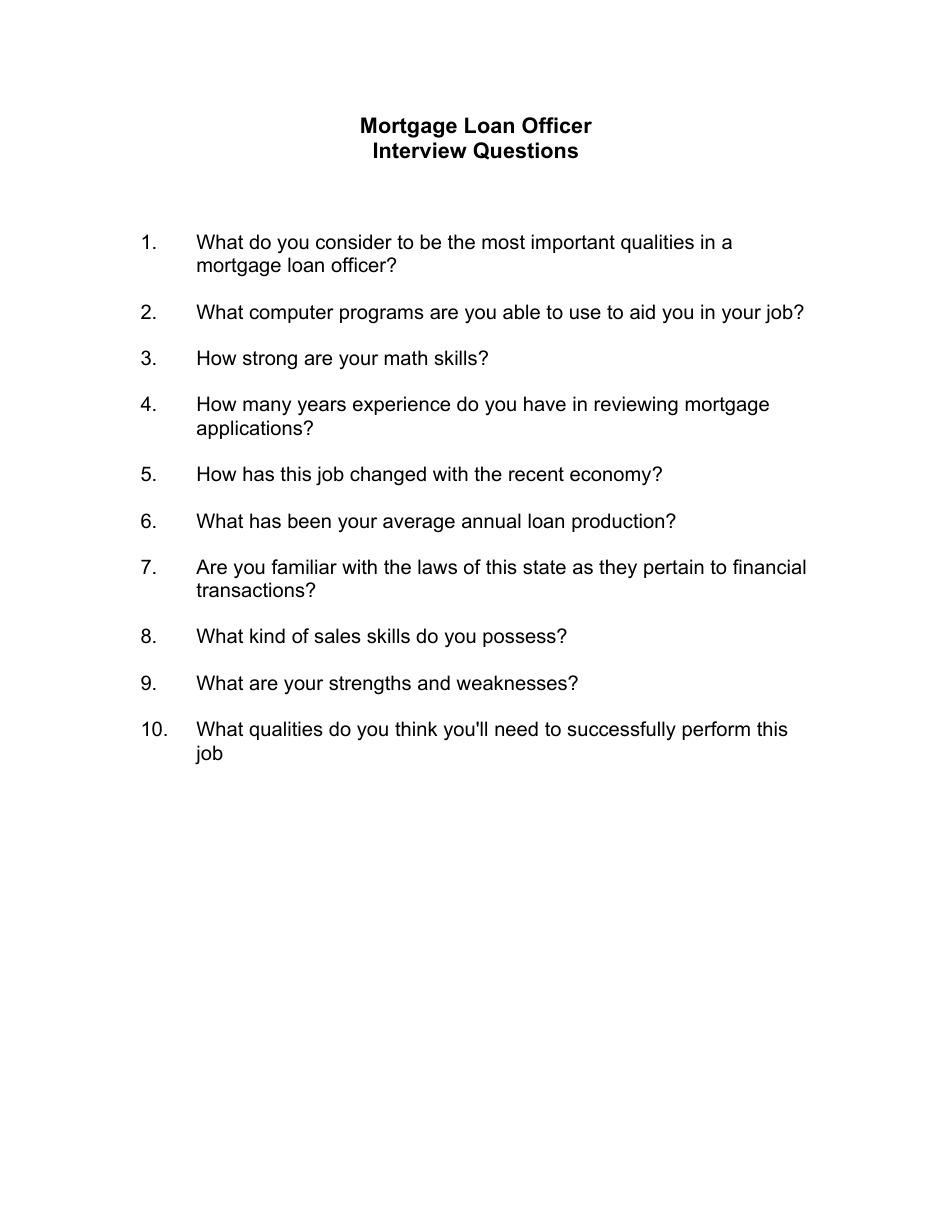

Sample Mortgage Loan Officer Interview Questions

Sample Mortgage Loan Officer Interview Questions are a collection of questions that employers may ask during an interview to assess the knowledge, skills, and experience of a candidate applying for the position of a mortgage loan officer. These questions help employers evaluate the candidate's suitability for the role and their ability to handle various aspects of the mortgage lending process.

The sample mortgage loan officer interview questions may be filed by various entities such as mortgage companies, financial institutions, recruitment agencies, or professional organizations.

FAQ

Q: What is a mortgage loan officer?

A: A mortgage loan officer is a professional who works with borrowers to help them secure a mortgage loan to purchase a home.

Q: What qualifications are typically required to become a mortgage loan officer?

A: Typically, a mortgage loan officer needs to have a high school diploma or equivalent, complete a pre-licensing education program, pass a state and national licensing exam, and often have prior experience in the financial industry.

Q: What are some important skills for a mortgage loan officer?

A: Important skills for a mortgage loan officer include strong communication skills, attention to detail, knowledge of mortgage products and regulations, sales and negotiation skills, and the ability to build and maintain relationships with clients.

Q: What is the role of a mortgage loan officer in the loan application process?

A: A mortgage loan officer guides borrowers through the loan application process, helps them gather necessary documents, assesses their financial situation, assists with loan product selection, and works to get their loan application approved by a lender.

Q: How do mortgage loan officers get paid?

A: Mortgage loan officers are typically paid on a commission basis, earning a percentage of the loan amount for each loan they successfully close. Some loan officers may also receive a base salary in addition to commission.

Q: What are some challenges that mortgage loan officers face?

A: Some challenges mortgage loan officers may face include a competitive market, fluctuating interest rates, changing regulations, and the need to continually generate leads and build a client base.