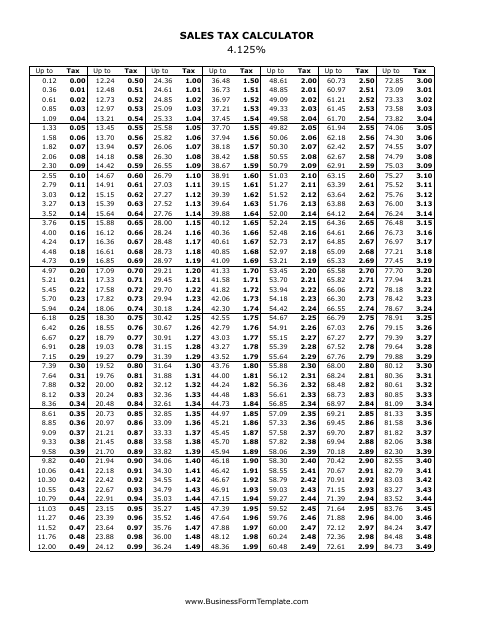

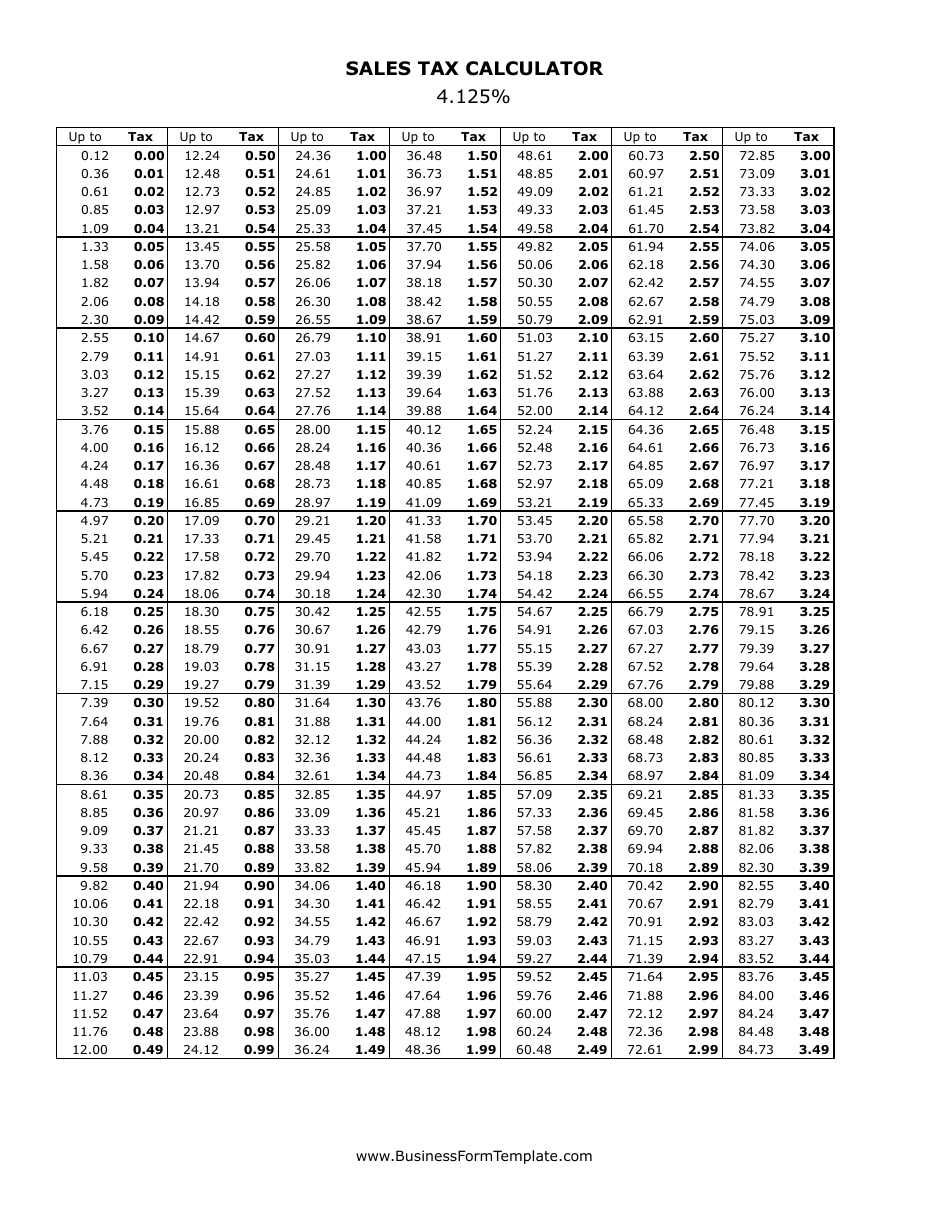

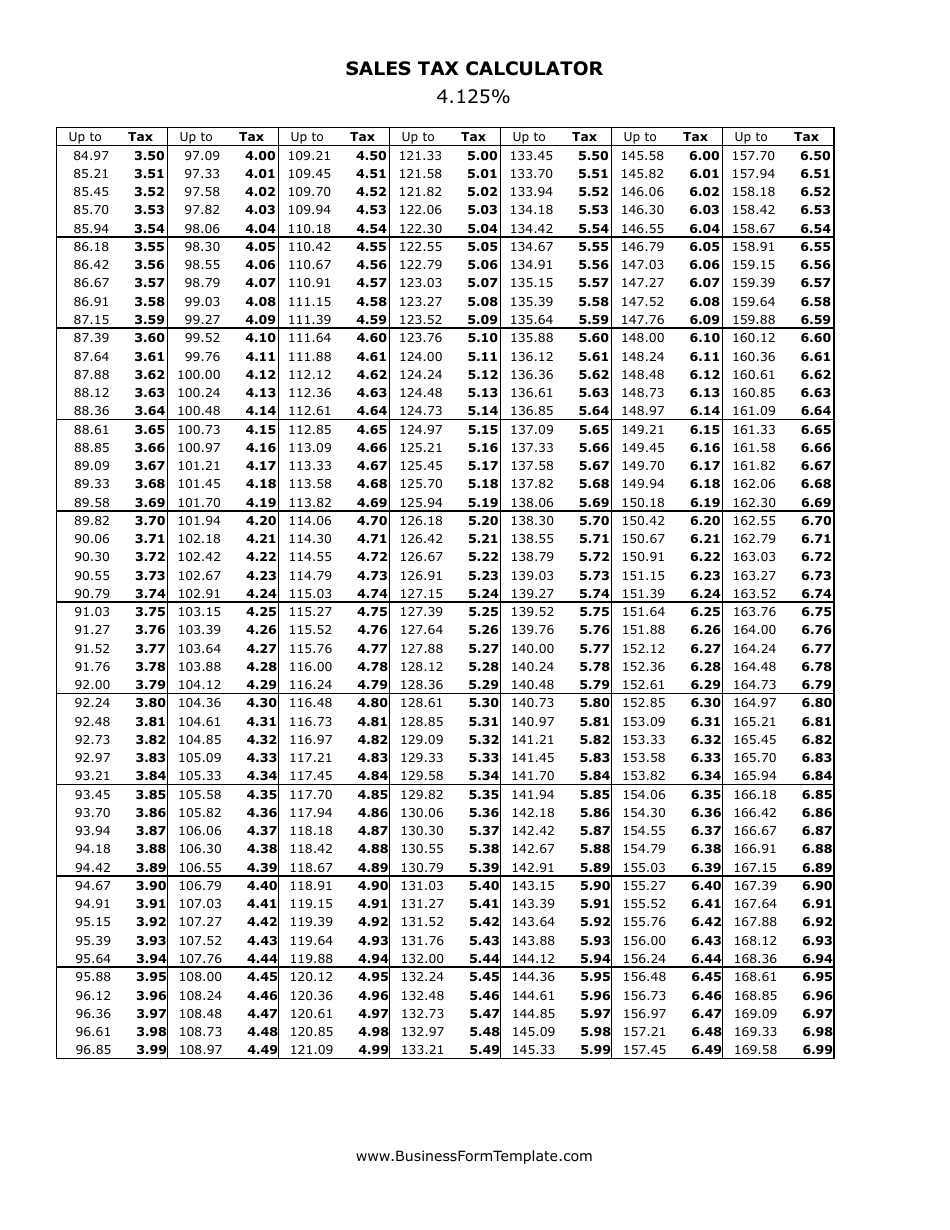

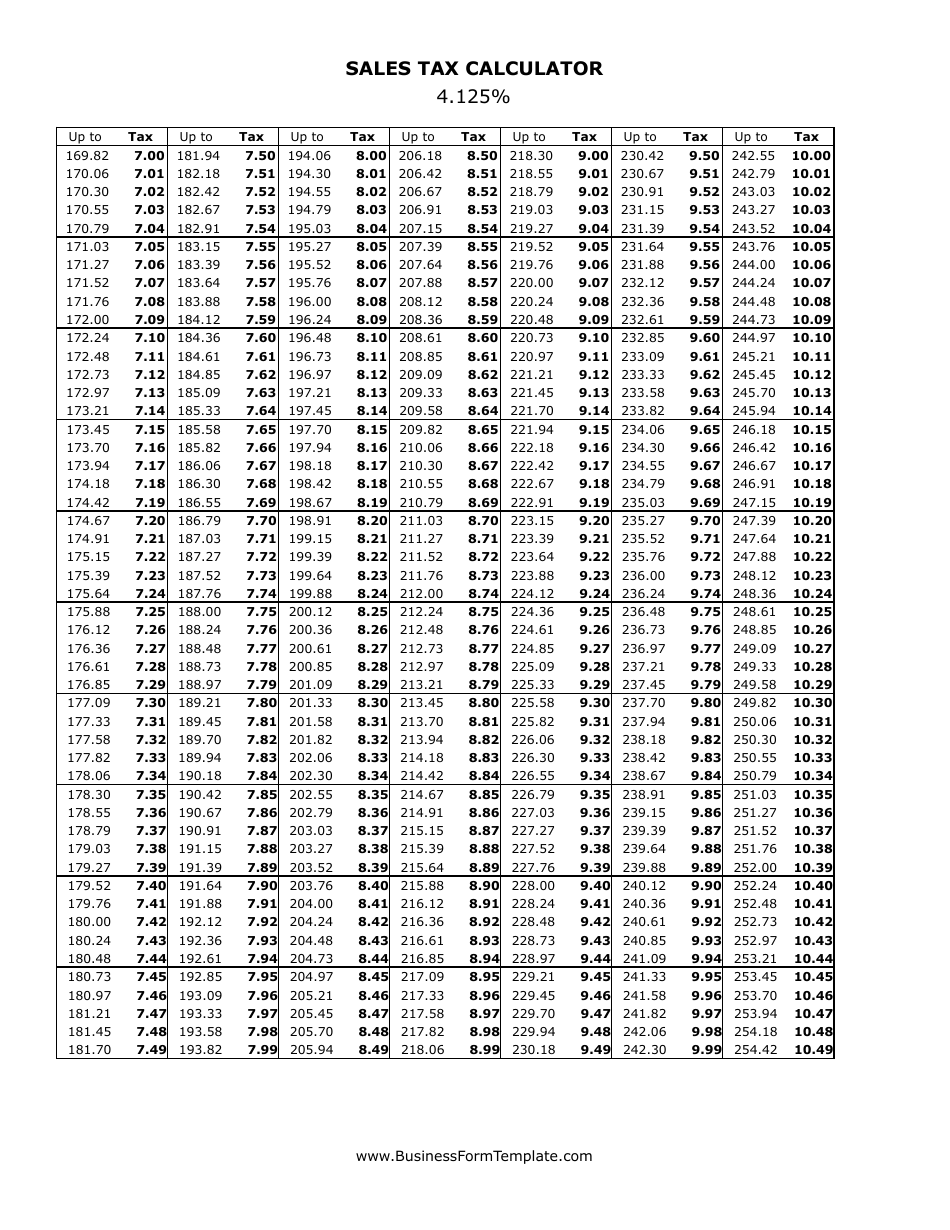

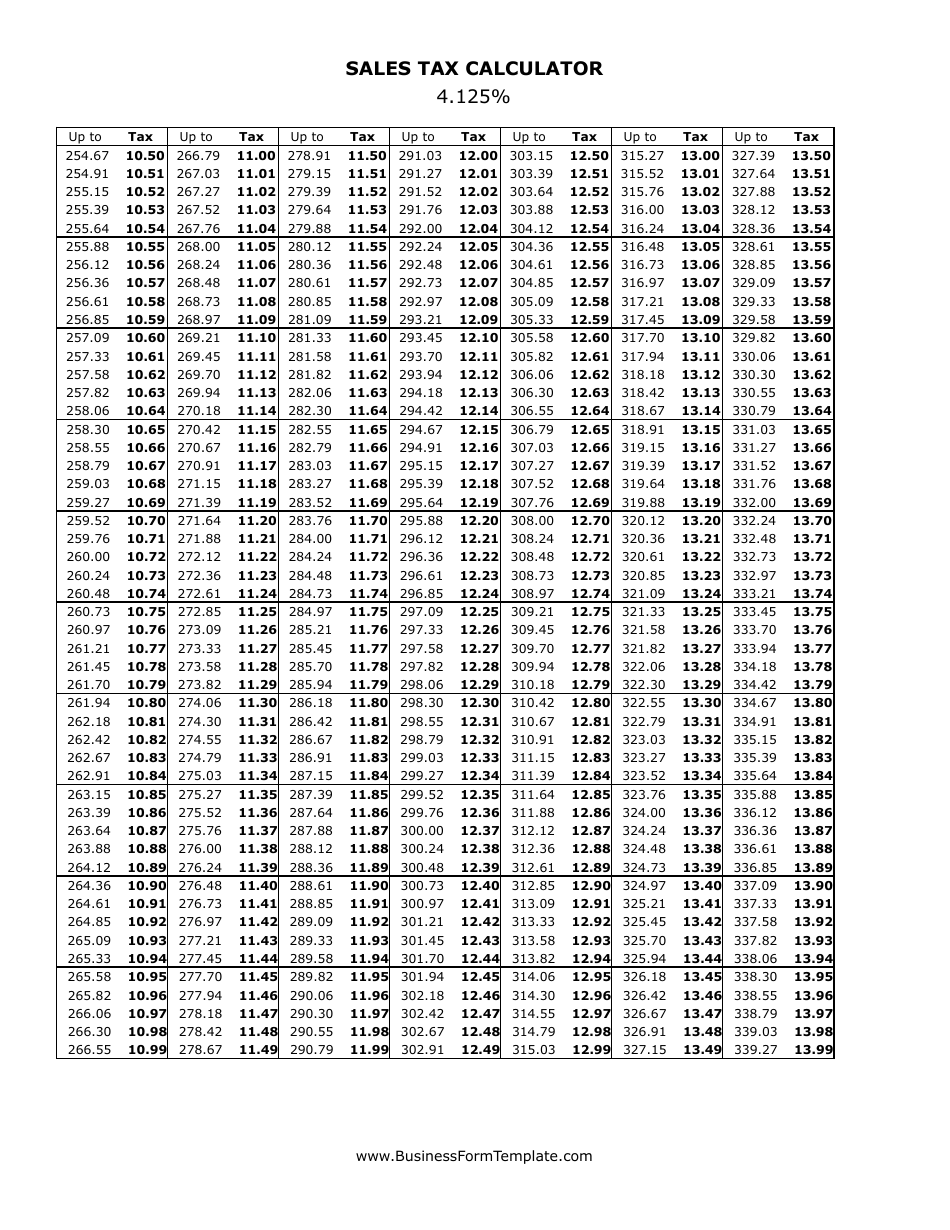

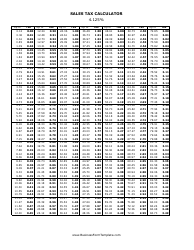

4.125% Sales Tax Calculator

A 4.125% Sales Tax Calculator is used to calculate the amount of sales tax that needs to be applied to a purchase of goods or services.

The 4.125% Sales Tax Calculator is typically filed by the individual or business responsible for collecting and remitting sales tax to the relevant tax authority.

FAQ

Q: What is the sales tax rate?

A: The sales tax rate is 4.125%.

Q: How do I calculate sales tax?

A: To calculate sales tax, multiply the purchase amount by 0.04125.

Q: What is the total amount with sales tax?

A: The total amount with sales tax is the sum of the purchase amount and the sales tax amount.

Q: How can I find out the sales tax amount?

A: To find out the sales tax amount, multiply the purchase amount by 0.04125.

Q: Can I round the sales tax amount?

A: It is generally recommended to round the sales tax amount to the nearest cent.

Q: Are there any exemptions to this sales tax rate?

A: Specific exemptions may apply depending on the jurisdiction and the type of items being purchased.