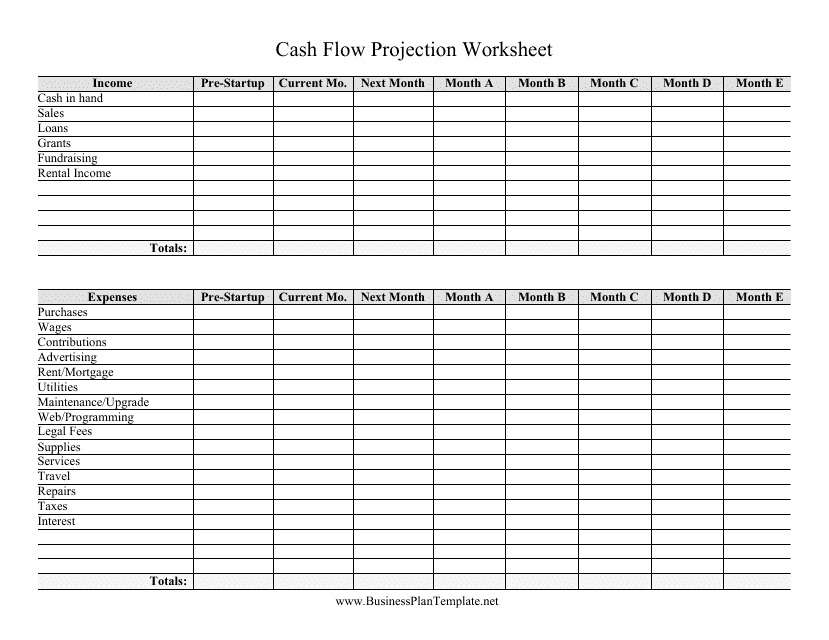

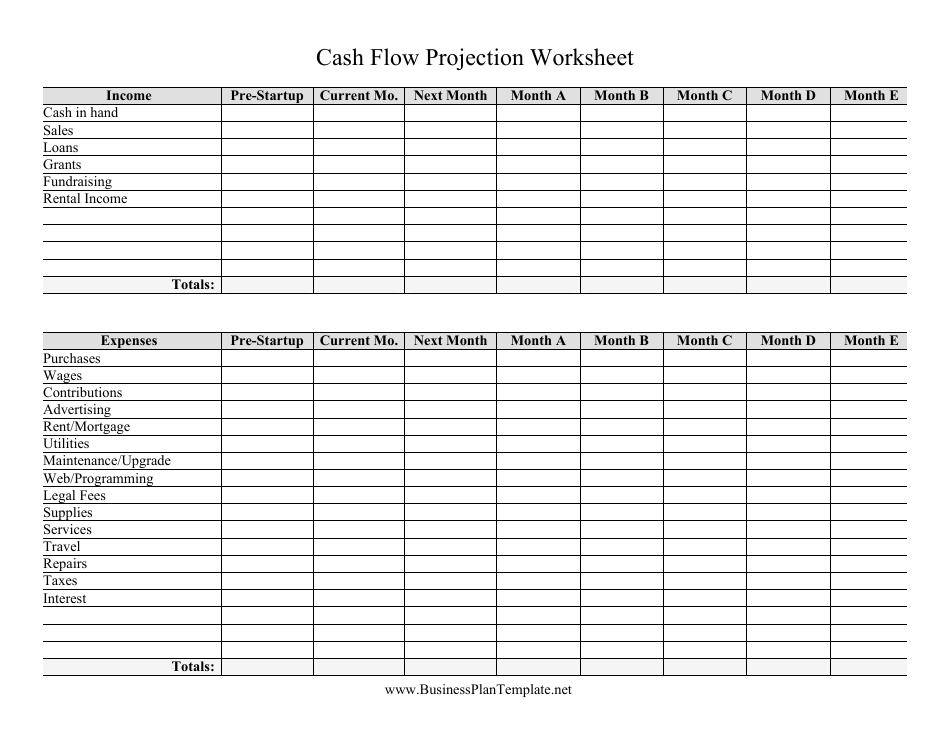

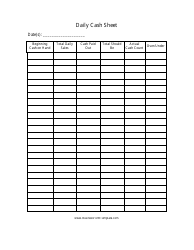

Cash Flow Projection Spreadsheet

A Cash Flow Projection Spreadsheet is used to forecast and track the inflow and outflow of cash in a business over a specific period of time. It helps business owners and managers to understand and plan for their cash flow needs, such as managing expenses, predicting revenue, and ensuring sufficient funds to pay bills and debts.

The person responsible for filing the cash flow projection spreadsheet varies depending on the organization or company. In some cases, it may be the finance department or the accounting department. However, it could also be the responsibility of the person in charge of budgeting or financial planning. It is best to consult with the specific organization to determine who is responsible for filing the cash flow projection spreadsheet.

FAQ

Q: What is a cash flow projection spreadsheet?

A: A cash flow projection spreadsheet is a tool used to estimate and track the flow of cash in and out of a business over a specific period of time.

Q: Why is a cash flow projection spreadsheet important?

A: A cash flow projection spreadsheet is important because it helps businesses forecast their future cash flows, which is crucial for planning and managing finances effectively.

Q: How does a cash flow projection spreadsheet work?

A: A cash flow projection spreadsheet works by inputting information on cash inflows (such as sales and investments) and outflows (such as operating expenses and loan payments) to calculate the net cash position at the end of each period.

Q: What are the benefits of using a cash flow projection spreadsheet?

A: Using a cash flow projection spreadsheet helps businesses understand their cash position, identify potential cash shortfalls or surpluses, make informed financial decisions, and plan for long-term sustainability.

Q: What information is needed to create a cash flow projection spreadsheet?

A: To create a cash flow projection spreadsheet, you need information on your expected cash inflows, such as sales revenue, loans, and investments, as well as your anticipated cash outflows, such as expenses, wages, and loan payments.

Q: Are there any available templates or software for creating a cash flow projection spreadsheet?

A: Yes, there are various templates and software available that can help you create a cash flow projection spreadsheet, including pre-designed Excel templates and dedicated cash flow forecasting software.

Q: How often should a cash flow projection spreadsheet be updated?

A: It is recommended to update your cash flow projection spreadsheet regularly, such as monthly or quarterly, to ensure it reflects accurate and up-to-date financial information.

Q: Who can benefit from using a cash flow projection spreadsheet?

A: Any business, whether small or large, can benefit from using a cash flow projection spreadsheet as it helps in managing cash flow, making informed financial decisions, and ensuring long-term financial stability.