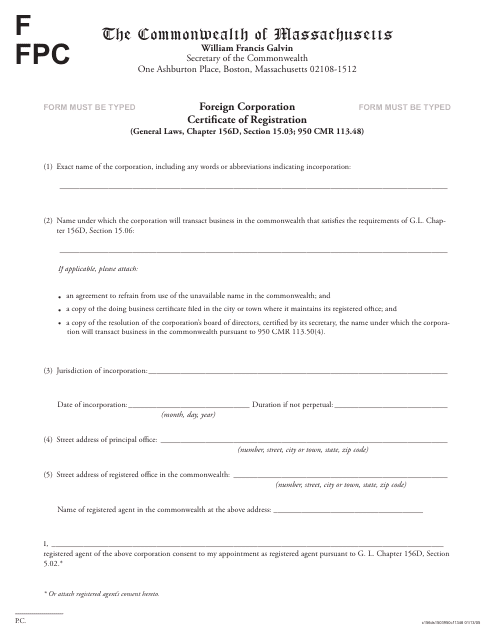

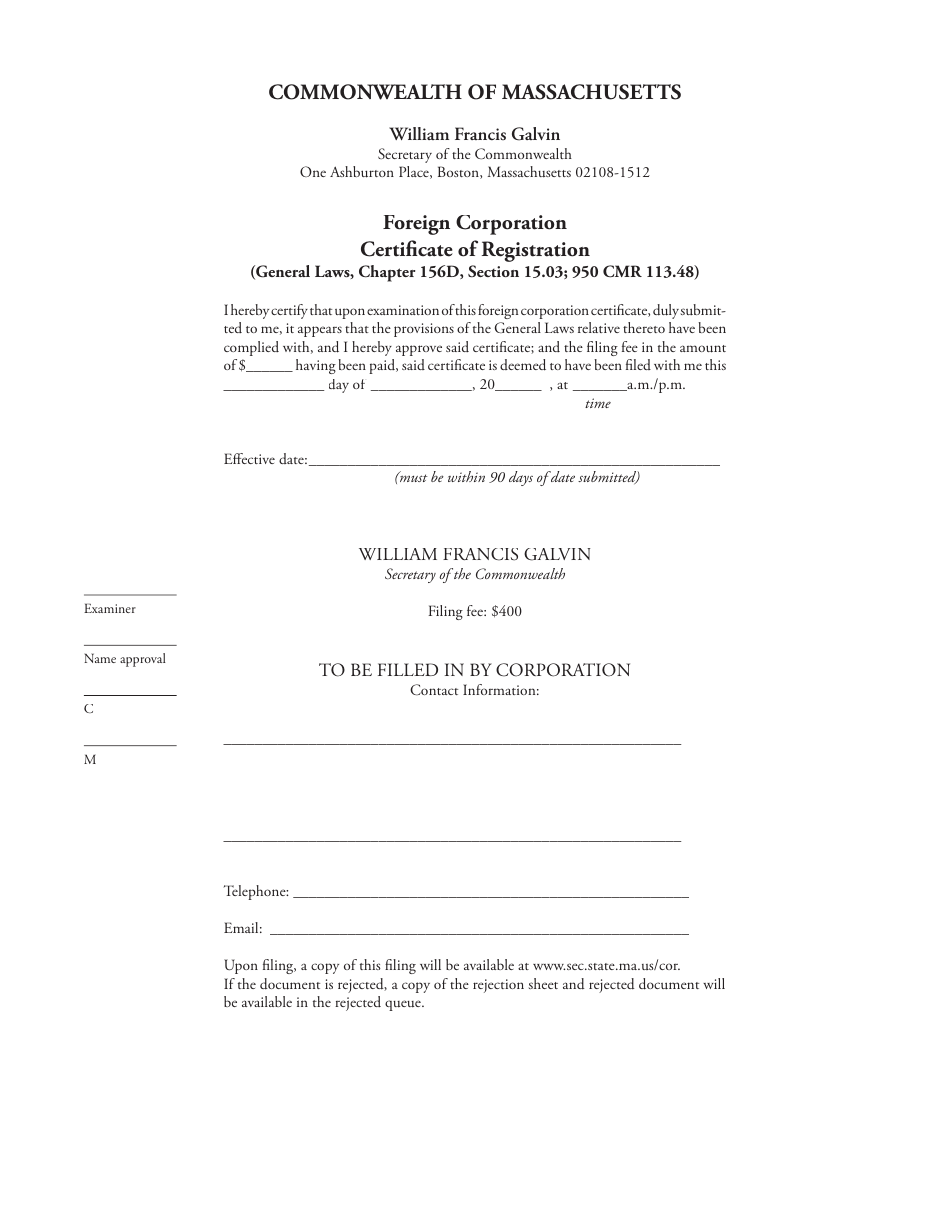

Form FPC Foreign Corporation Certificate of Registration (General Laws, Chapter 156d, Section 15.03; 950 Cmr 113.48) - Massachusetts

What Is Form FPC?

This is a legal form that was released by the Secretary of the Commonwealth of Massachusetts - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FPC?

A: Form FPC is the Foreign Corporation Certificate of Registration.

Q: What is the purpose of Form FPC?

A: The purpose of Form FPC is to register a foreign corporation in the state of Massachusetts.

Q: Which laws govern Form FPC?

A: Form FPC is governed by the General Laws, Chapter 156d, Section 15.03; and 950 Cmr 113.48 in Massachusetts.

Q: Who needs to file Form FPC?

A: Foreign corporations that wish to conduct business in Massachusetts need to file Form FPC.

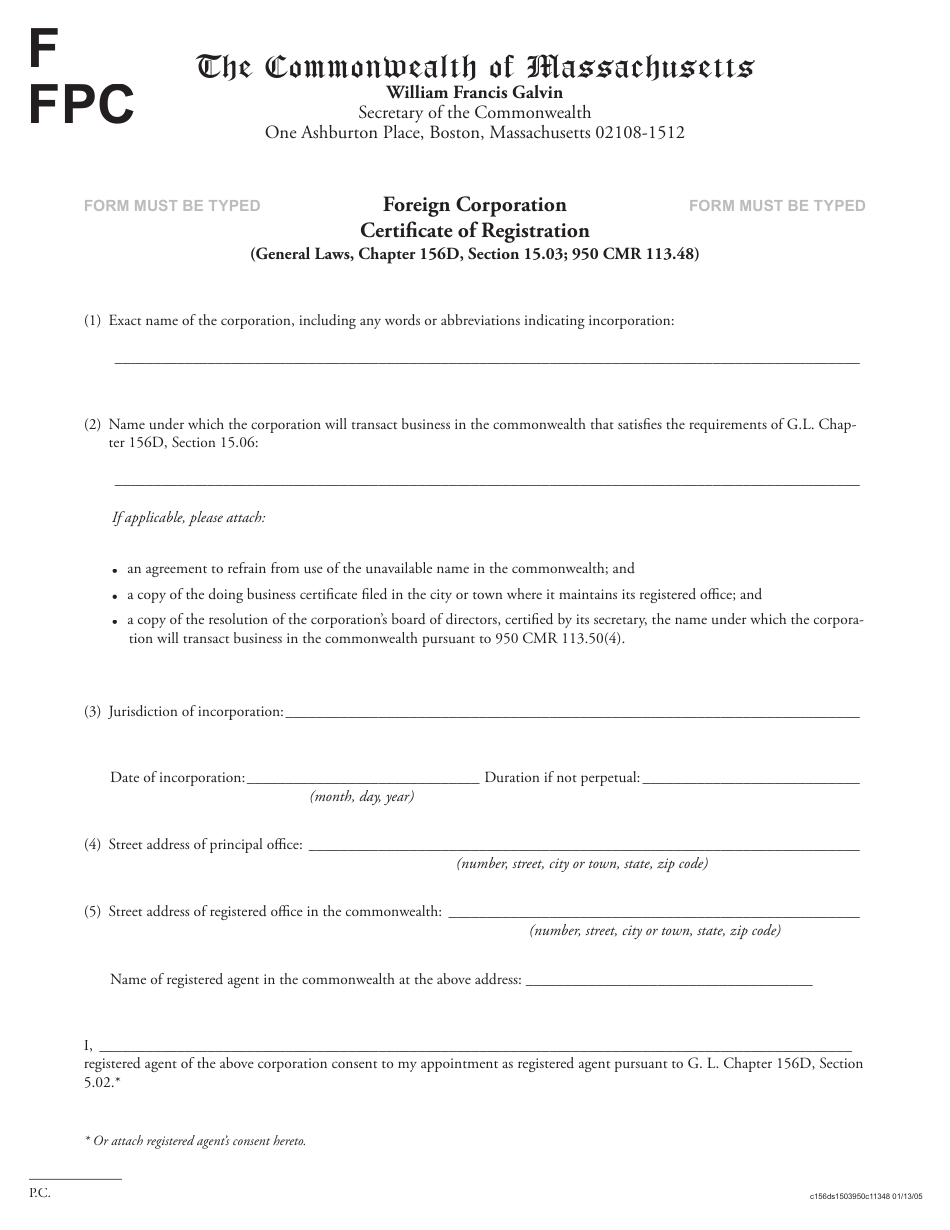

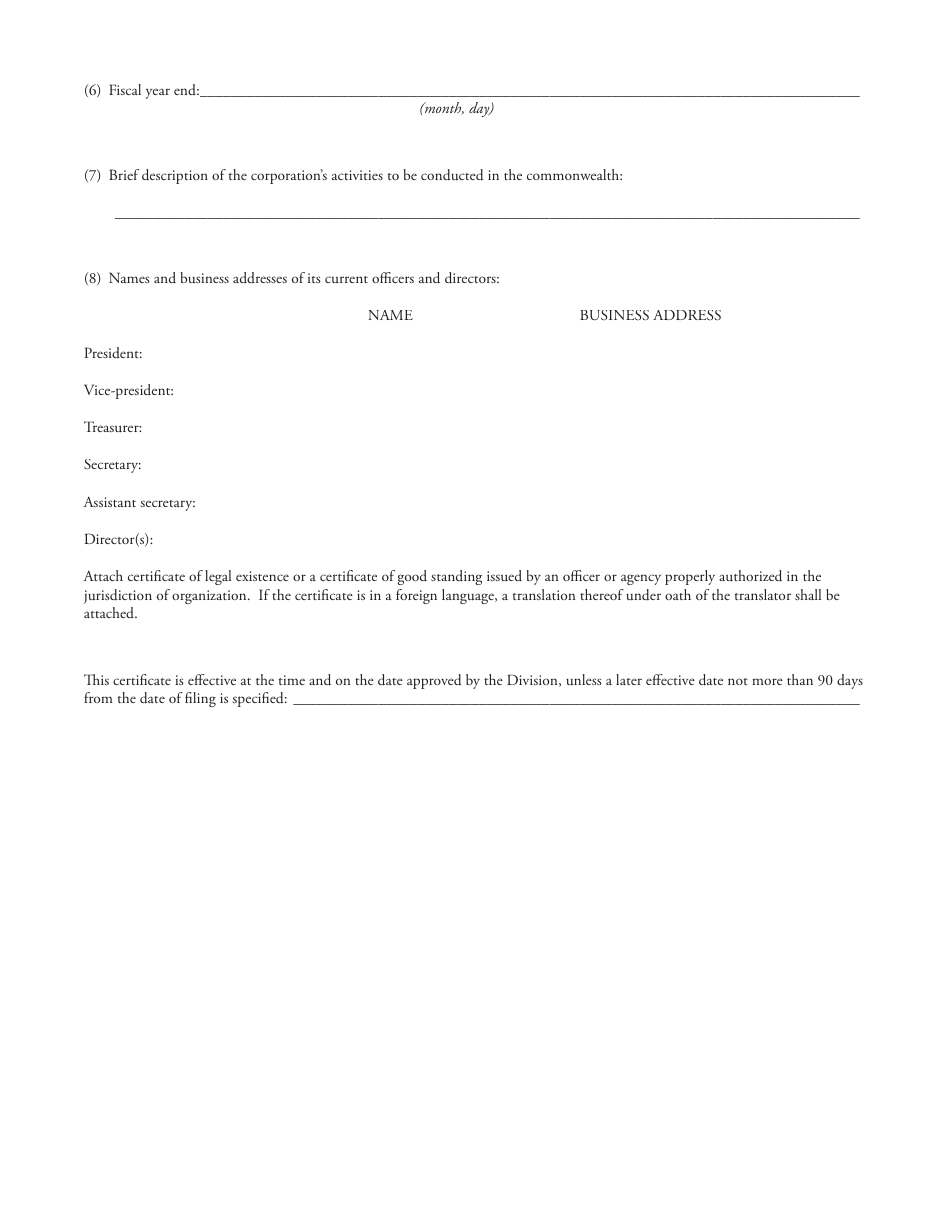

Q: What information is required on Form FPC?

A: Form FPC requires information about the foreign corporation, including its name, jurisdiction of formation, principal office address, registered agent, and purpose of the corporation.

Q: Is Form FPC renewable?

A: No, Form FPC is not renewable. The foreign corporation needs to file an annual report with the Massachusetts Secretary of the Commonwealth to remain in good standing.

Q: What is the penalty for not filing Form FPC?

A: Failure to file Form FPC can result in penalties, such as the inability to maintain a lawsuit in Massachusetts and fines.

Q: Can a foreign corporation do business in Massachusetts without filing Form FPC?

A: No, a foreign corporation must file Form FPC to legally conduct business in Massachusetts.

Form Details:

- Released on January 13, 2005;

- The latest edition provided by the Secretary of the Commonwealth of Massachusetts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FPC by clicking the link below or browse more documents and templates provided by the Secretary of the Commonwealth of Massachusetts.