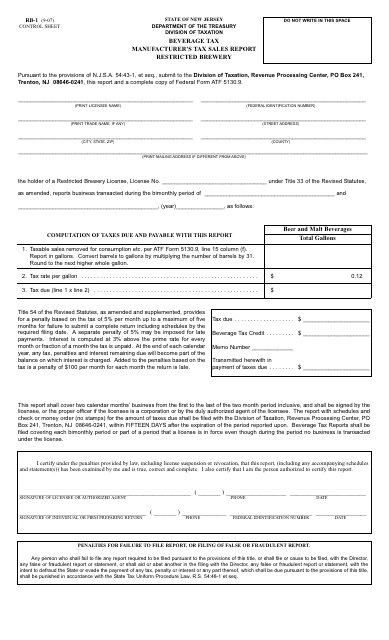

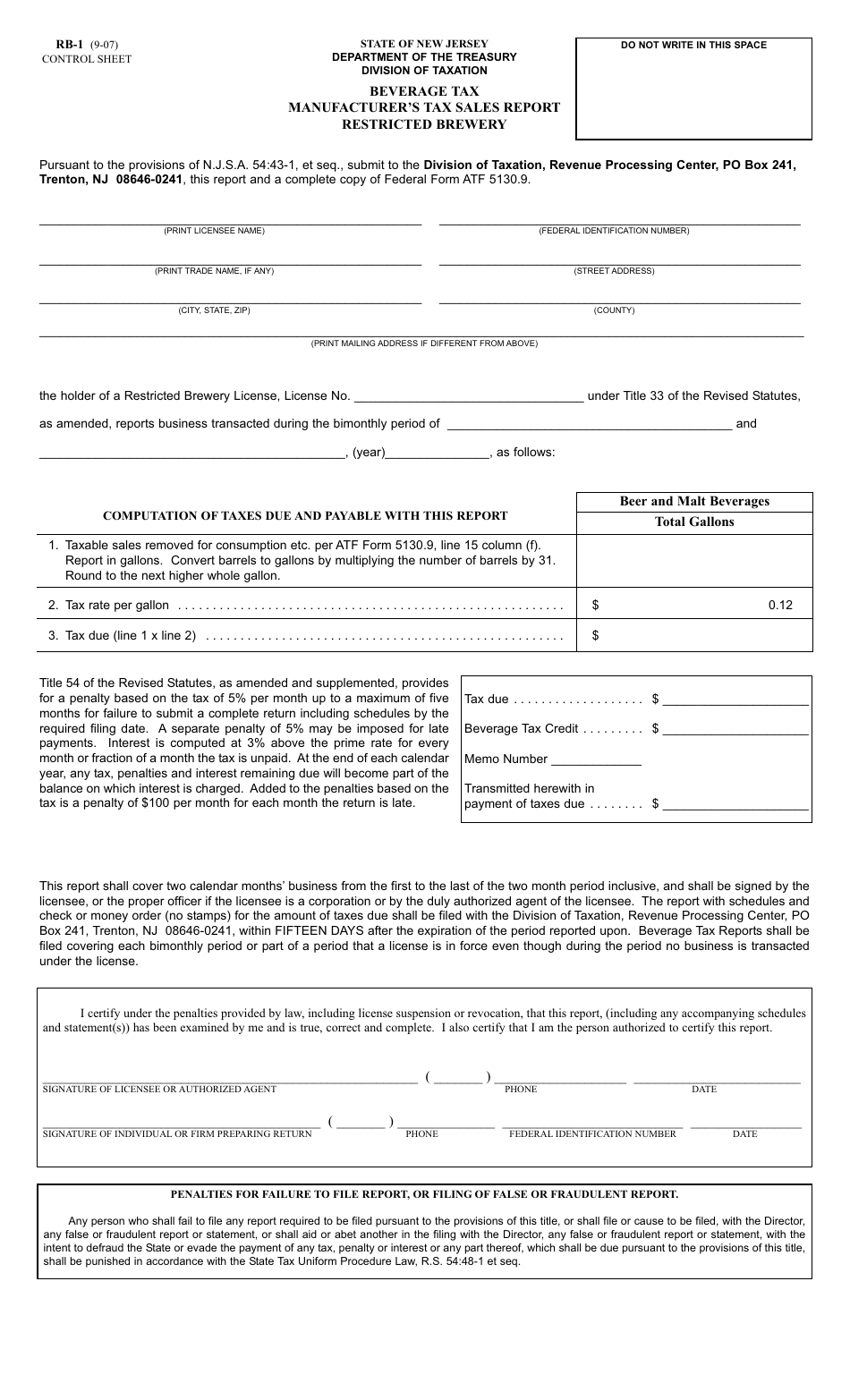

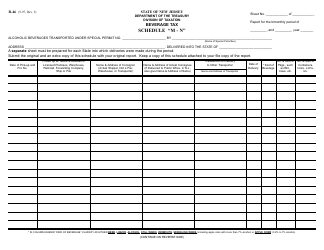

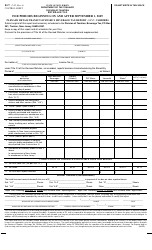

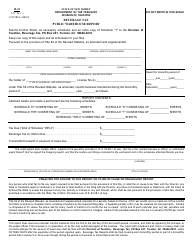

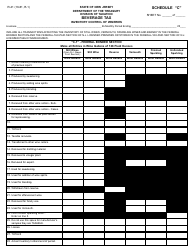

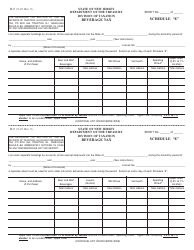

Form RB-1 Beverage Tax Manufacturer's Tax Sales Report - Restricted Brewery - New Jersey

What Is Form RB-1?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RB-1?

A: Form RB-1 is a Beverage Tax Manufacturer's Tax Sales Report for Restricted Brewery in New Jersey.

Q: Who needs to file Form RB-1?

A: Restricted breweries in New Jersey need to file Form RB-1.

Q: What is the purpose of Form RB-1?

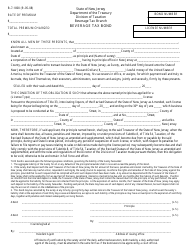

A: Form RB-1 is used to report and pay beverage tax by restricted breweries in New Jersey.

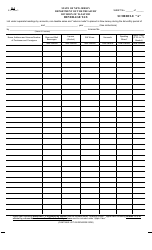

Q: What information is required on Form RB-1?

A: Form RB-1 requires information such as sales and tax collected on different types of beverages.

Q: When is Form RB-1 due?

A: Form RB-1 is due on a monthly basis, with the deadline being the 20th day of the following month.

Q: Is there a penalty for late filing of Form RB-1?

A: Yes, there is a penalty for late filing of Form RB-1, and interest may also be charged on unpaid taxes.

Form Details:

- Released on September 1, 2007;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RB-1 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.