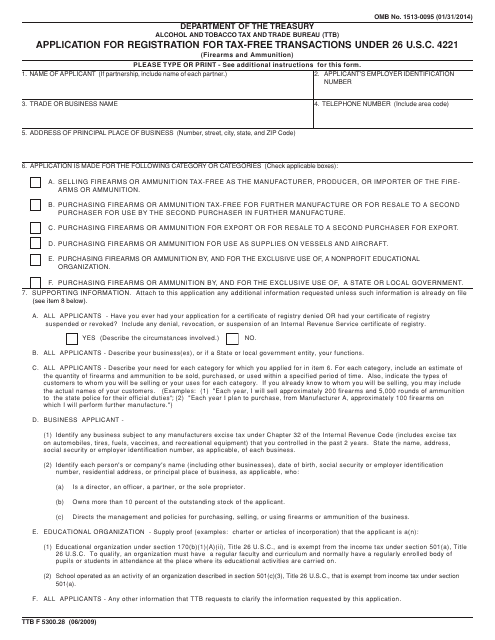

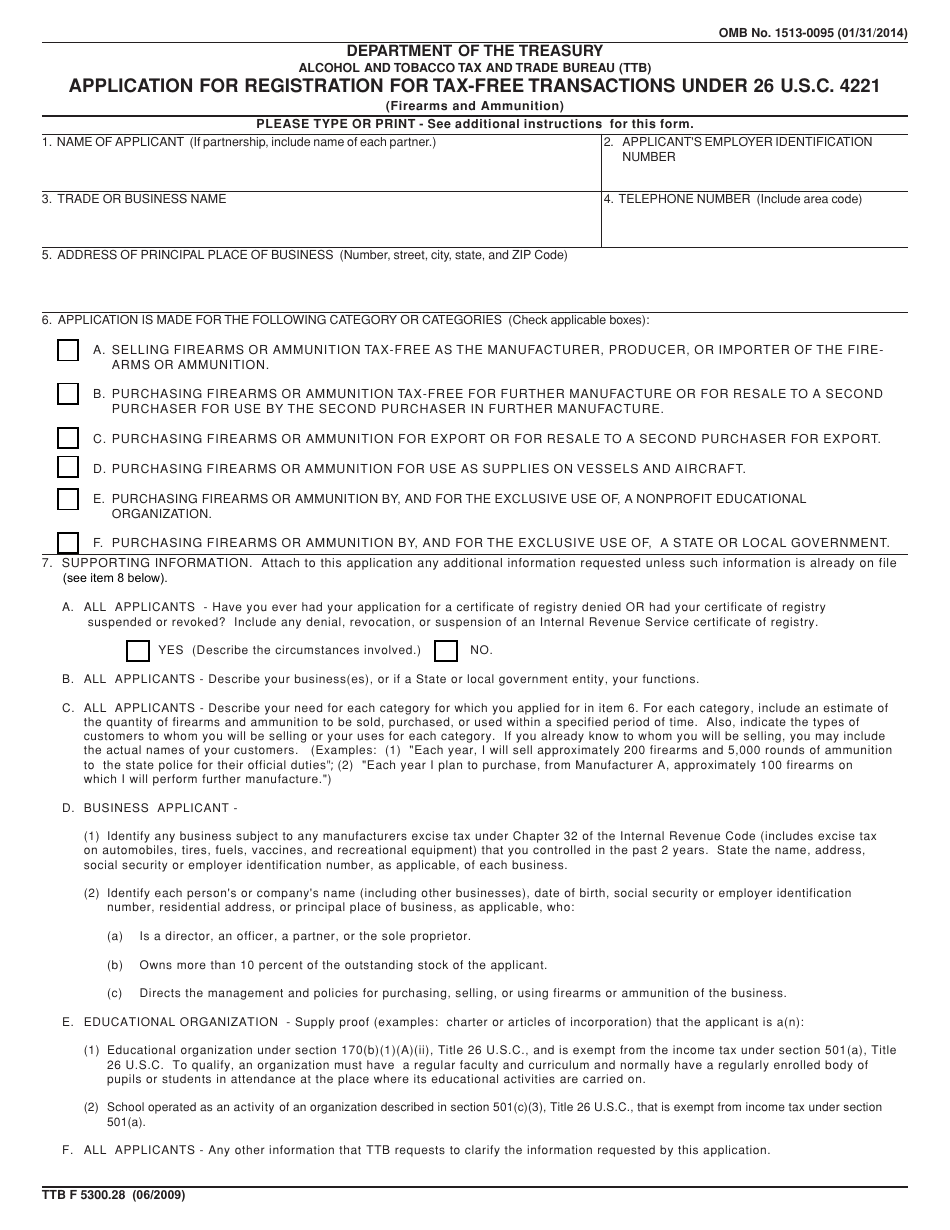

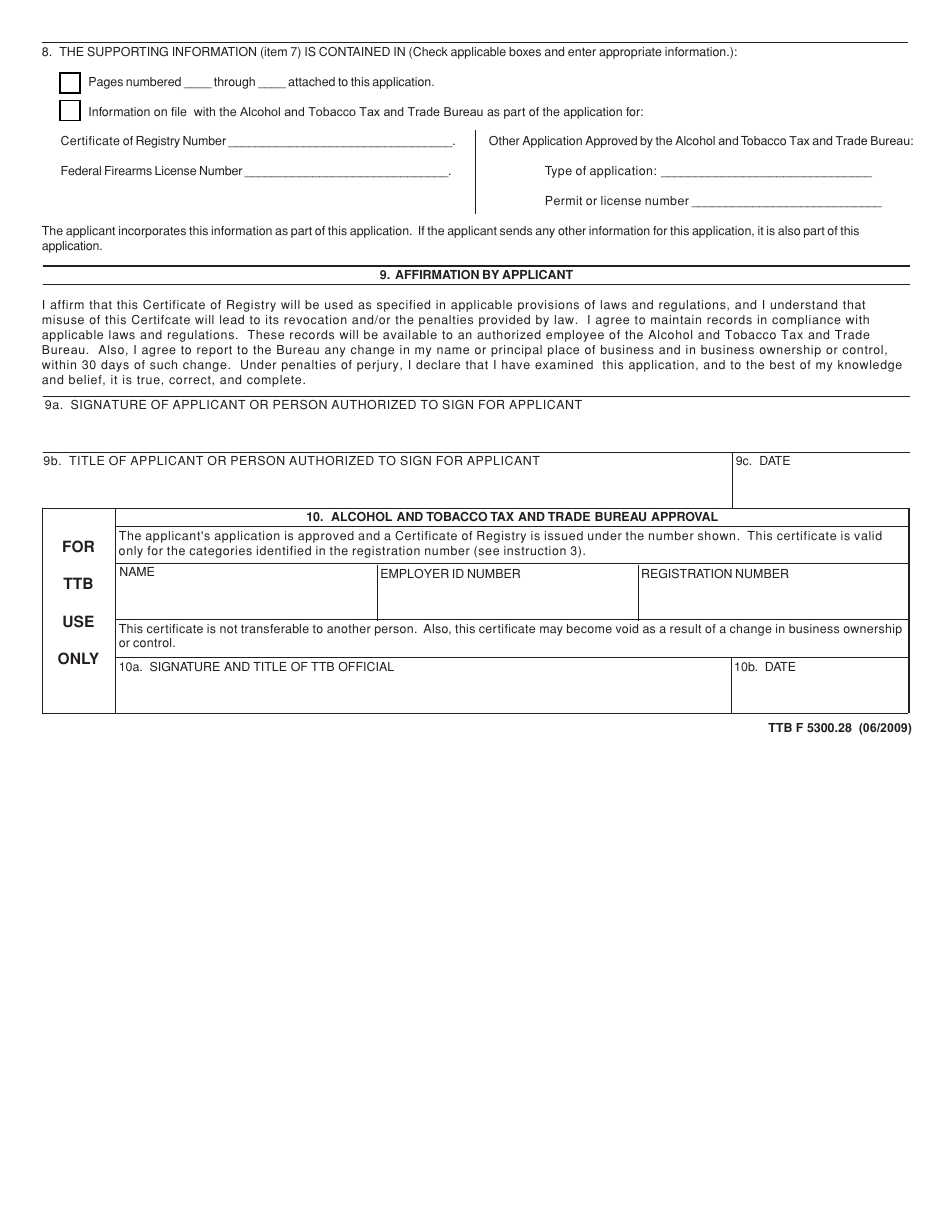

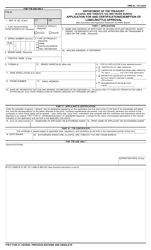

TTB Form 5300.28 Application for Registration for Tax-Free Transactions Under 26 U.s.c. 4221 (Firearms and Ammunition)

What Is TTB Form 5300.28?

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on June 1, 2009 and used country-wide. Check the official instructions before completing and submitting the form.

FAQ

Q: What is TTB Form 5300.28?

A: TTB Form 5300.28 is an Application for Registration for Tax-Free Transactions Under 26 U.S.C. 4221 (Firearms and Ammunition).

Q: What does TTB stand for?

A: TTB stands for Alcohol and Tobacco Tax and Trade Bureau.

Q: What is the purpose of Form 5300.28?

A: The purpose of Form 5300.28 is to register for tax-free transactions related to firearms and ammunition.

Q: Who needs to fill out this form?

A: Businesses involved in the manufacturing, importing, or sale of firearms and ammunition need to fill out this form.

Q: What is 26 U.S.C. 4221?

A: 26 U.S.C. 4221 is a section of the United States Code that deals with taxes on firearms and ammunition.

Q: What types of transactions are considered tax-free under this form?

A: This form applies to tax-free transactions related to firearms and ammunition.

Q: Are there any fees associated with filing this form?

A: There may be fees associated with filing this form. Please refer to the instructions provided with the form for more information.

Q: Can individuals fill out this form?

A: No, this form is specifically for businesses involved in the firearms and ammunition industry.

Q: What documents and information are required to complete this form?

A: The form requires basic business information, including the business name, address, and employer identification number. Additional information related to the firearms and ammunition transactions may also be required.

Form Details:

- Released on June 1, 2009;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5300.28 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.