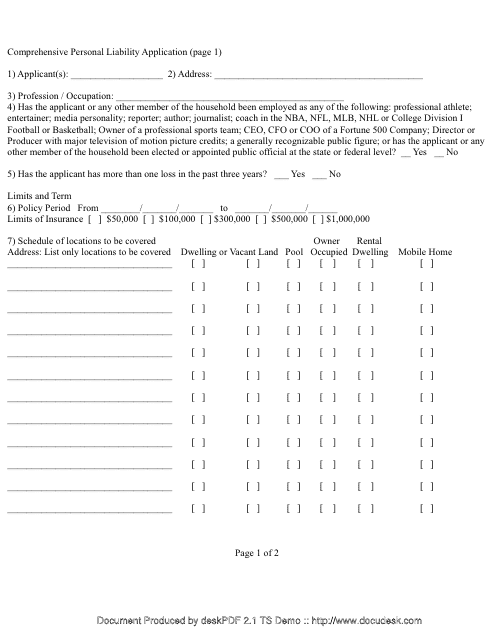

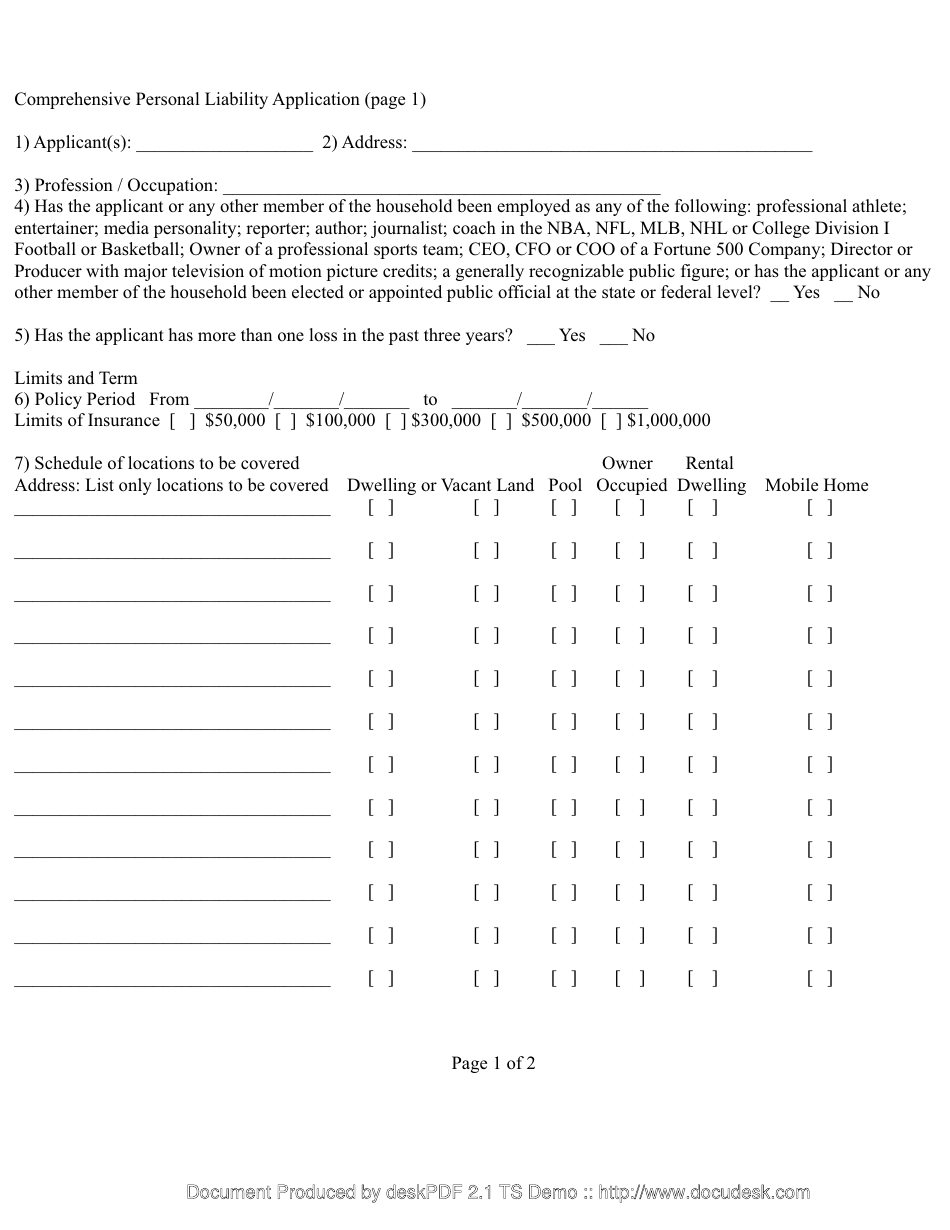

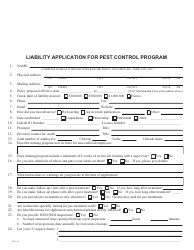

Comprehensive Personal Liability Application Form

The Comprehensive Personal Liability Application Form is used to apply for personal liabilityinsurance coverage. It helps to protect individuals from potential financial loss if they are held legally responsible for causing injury or damage to someone else's property.

The Comprehensive Personal Liability Application Form is usually filed by individuals who are seeking coverage for personal liability insurance.

FAQ

Q: What is a Comprehensive Personal Liability Application Form?

A: A Comprehensive Personal Liability Application Form is a document used to apply for personal liability insurance coverage.

Q: What is personal liability insurance?

A: Personal liability insurance is a type of insurance that provides coverage for damages or injuries caused by an individual to others, for which the individual is legally responsible.

Q: Why do I need personal liability insurance?

A: Personal liability insurance provides financial protection in case you are sued for damages or injuries you allegedly caused to another person or their property.

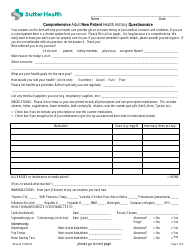

Q: What does a Comprehensive Personal Liability Application Form typically ask for?

A: A Comprehensive Personal Liability Application Form typically asks for personal information, details about the property you own or rent, information about any previous claims, and the desired coverage amount.

Q: What happens after submitting a Comprehensive Personal Liability Application Form?

A: After submitting a Comprehensive Personal Liability Application Form, the insurance provider will review the information provided and determine the premium and coverage options available to you.

Q: Can I be denied personal liability insurance?

A: Yes, an insurance provider can deny personal liability insurance coverage based on various factors, such as the applicant's previous claims history or the property's location.

Q: Is personal liability insurance required by law?

A: No, personal liability insurance is not legally required in most states, but it is highly recommended to have this type of coverage to protect yourself financially.

Q: How much does personal liability insurance cost?

A: The cost of personal liability insurance can vary depending on factors such as coverage limits, location, claims history, and the insurance provider. It is best to obtain quotes from different providers to compare prices.

Q: Can I increase my personal liability coverage?

A: Yes, you can usually increase your personal liability coverage by contacting your insurance provider and requesting a higher limit. This may result in a higher premium.

Q: What is not typically covered by personal liability insurance?

A: Personal liability insurance typically does not cover intentional acts, damage to one's own property, business-related liability, or liability related to motor vehicles.