This version of the form is not currently in use and is provided for reference only. Download this version of

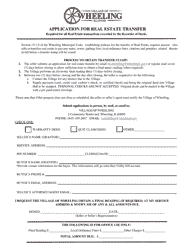

Form RLG-14

for the current year.

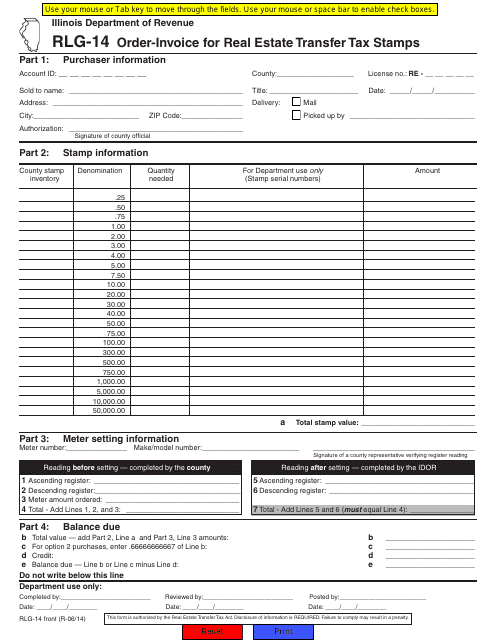

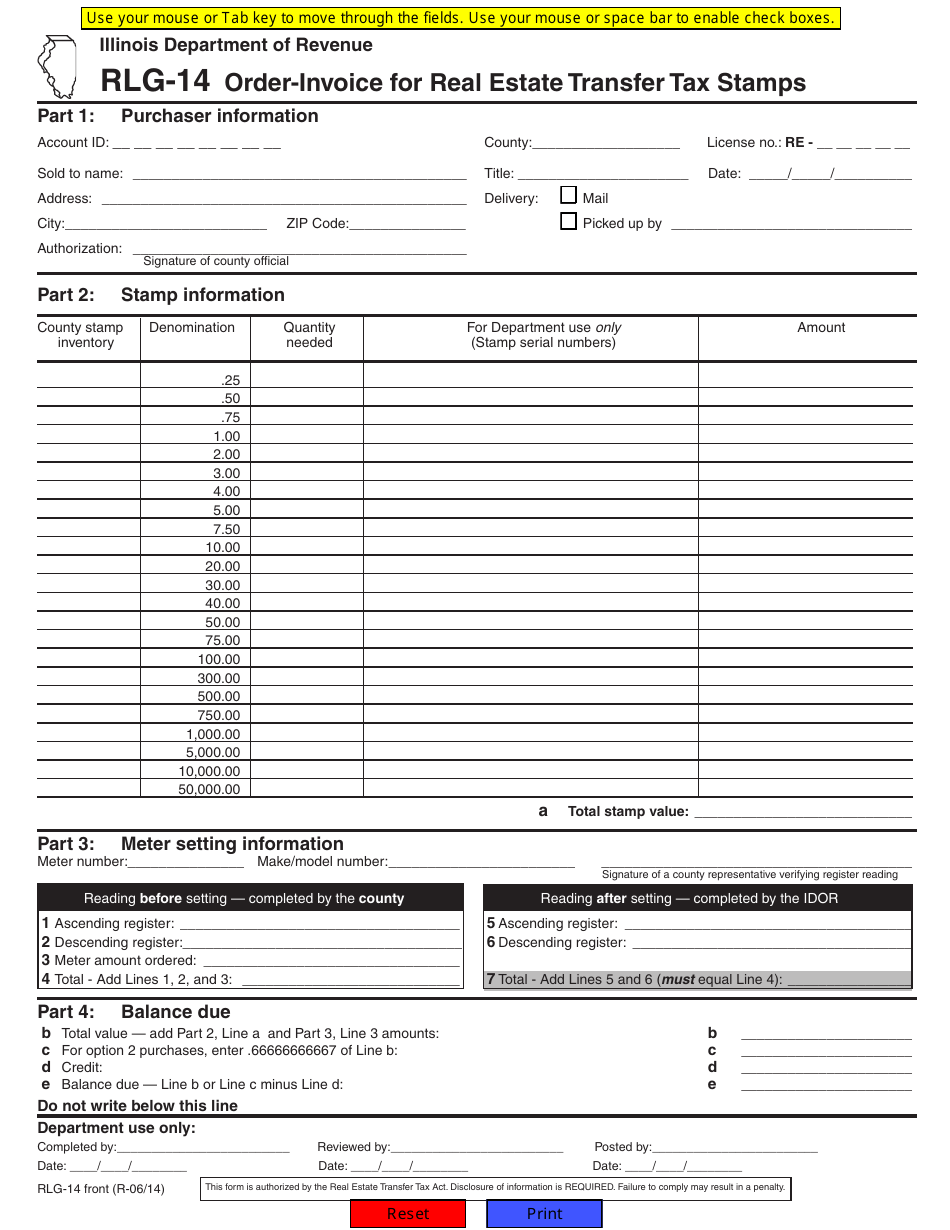

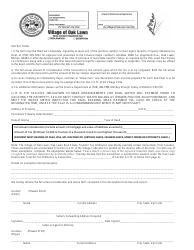

Form RLG-14 Order-Invoice for Real Estate Transfer Tax Stamps - Illinois

What Is Form RLG-14?

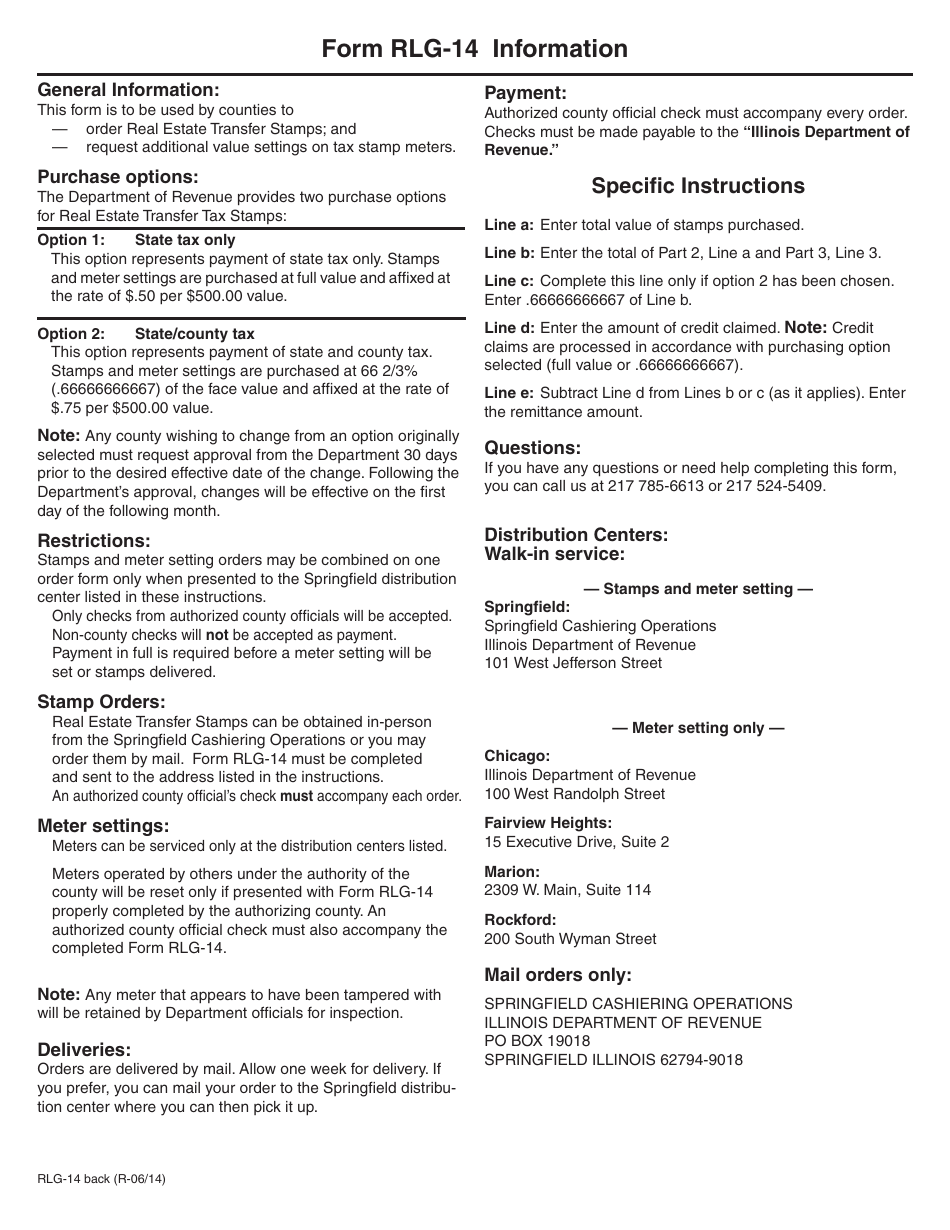

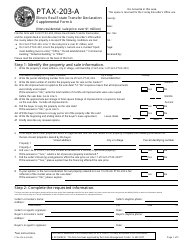

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RLG-14?

A: Form RLG-14 is the Order-Invoice for Real Estate Transfer Tax Stamps in Illinois.

Q: What is the purpose of Form RLG-14?

A: The purpose of Form RLG-14 is to place an order for real estate transfertax stamps in Illinois.

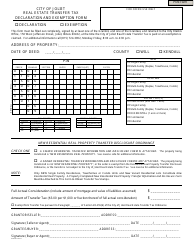

Q: Why do I need real estate transfer tax stamps in Illinois?

A: Real estate transfer tax stamps are required to document the payment of transfer taxes when a property is sold or transferred in Illinois.

Q: Can I use Form RLG-14 for other states?

A: No, Form RLG-14 is specific to Illinois and cannot be used for other states.

Q: What information is required on Form RLG-14?

A: Form RLG-14 requires information about the buyer and seller, property details, and the amount of transfer tax due.

Q: Are there any fees associated with Form RLG-14?

A: Yes, there are fees for the transfer tax stamps, which vary depending on the value of the property being transferred.

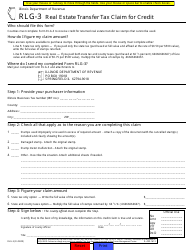

Q: Can I pay for transfer tax stamps using a credit card?

A: Yes, the Illinois Department of Revenue accepts credit card payments for transfer tax stamps.

Q: How long does it take to process Form RLG-14?

A: Processing times may vary, but it typically takes several business days to process Form RLG-14 and receive the transfer tax stamps.

Form Details:

- Released on June 1, 2014;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RLG-14 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.