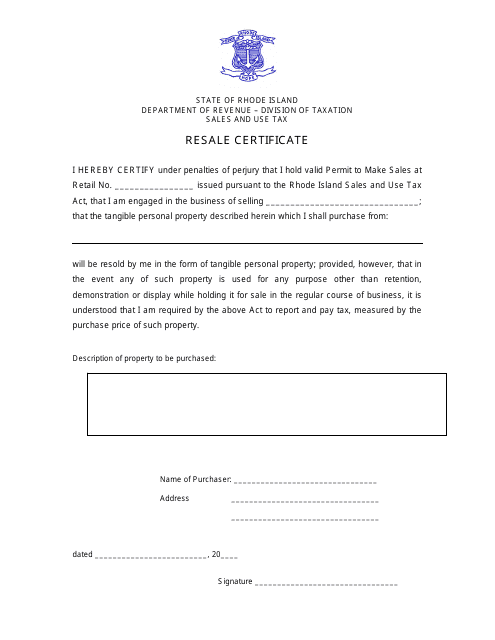

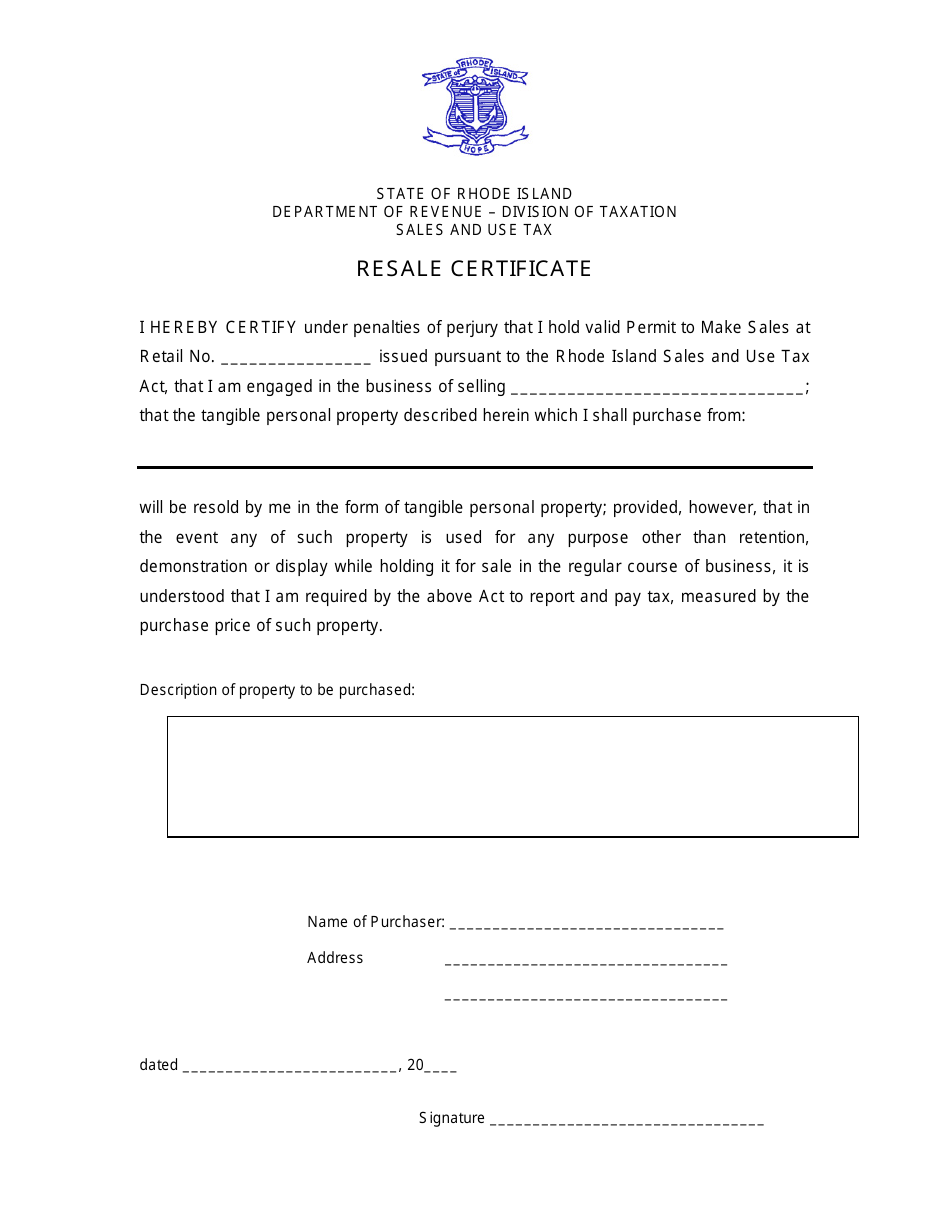

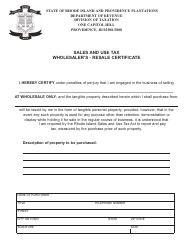

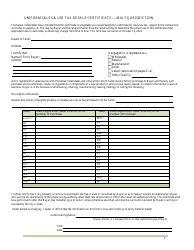

Resale Certificate - Rhode Island

Resale Certificate is a legal document that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.

FAQ

Q: What is a resale certificate?

A: A resale certificate is a document that allows businesses to purchase goods for resale without paying sales tax.

Q: Why do I need a resale certificate in Rhode Island?

A: You need a resale certificate in Rhode Island to prove that you are a legitimate retail business and are eligible to buy products for resale without paying sales tax.

Q: How do I get a resale certificate in Rhode Island?

A: To get a resale certificate in Rhode Island, you need to complete an Application for Sales Tax Resale Certificate and submit it to the Rhode Island Division of Taxation.

Q: Is there a fee for a resale certificate in Rhode Island?

A: No, there is no fee for a resale certificate in Rhode Island.

Q: How long is a resale certificate valid in Rhode Island?

A: A resale certificate is valid until it is revoked or cancelled. However, you should renew it every three years to ensure validity.

Form Details:

- The latest edition currently provided by the Rhode Island Department of Revenue - Division of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.