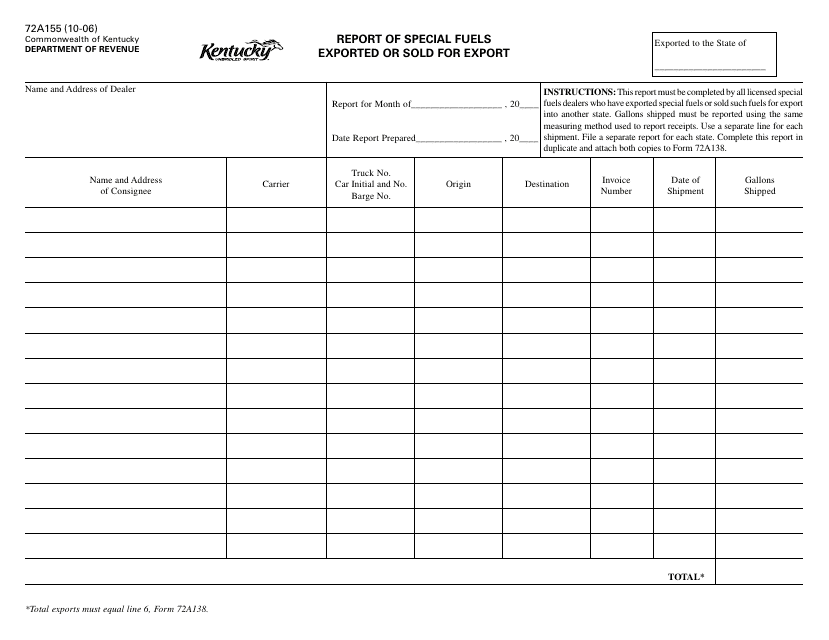

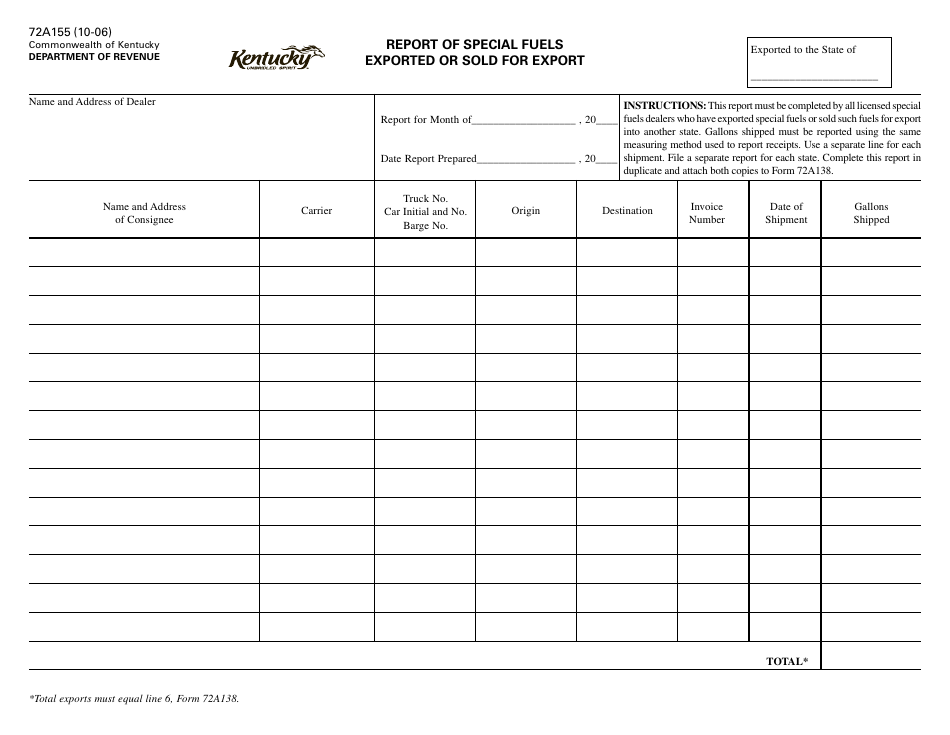

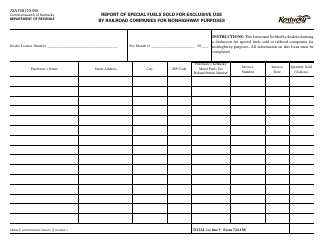

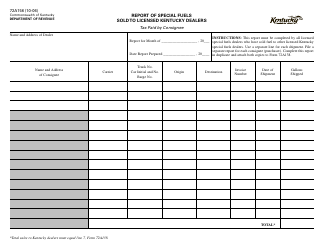

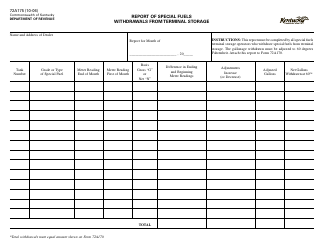

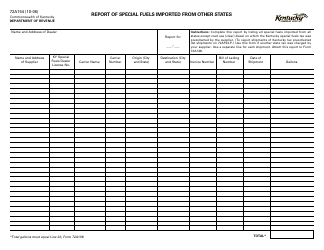

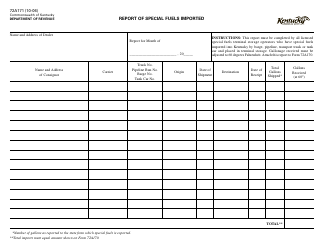

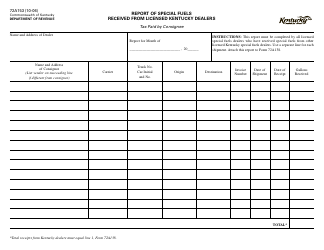

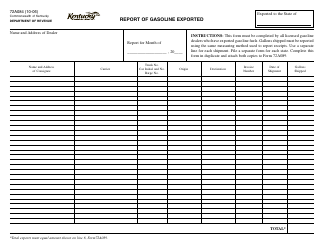

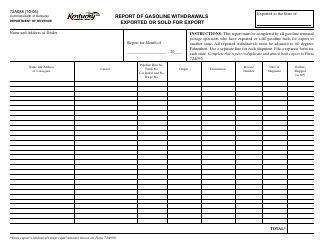

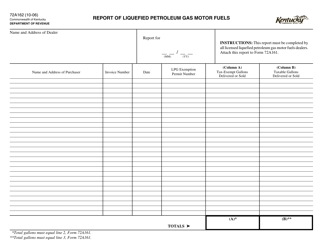

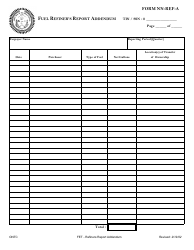

Form 72A155 Report of Special Fuels Exported or Sold for Export - Kentucky

What Is Form 72A155?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A155?

A: Form 72A155 is the Report of Special Fuels Exported or Sold for Export specifically for the state of Kentucky.

Q: Who needs to file Form 72A155?

A: Anyone who exports or sells special fuels for export in Kentucky needs to file Form 72A155.

Q: What are special fuels?

A: Special fuels include gasoline, diesel fuel, kerosene, and any other combustible liquid specifically used to power an internal combustion engine.

Q: What is the purpose of Form 72A155?

A: The purpose of Form 72A155 is to report the export or sale for export of special fuels in Kentucky.

Q: When is Form 72A155 due?

A: Form 72A155 is due on or before the 15th day of the month following the end of each quarter.

Q: Are there any penalties for not filing Form 72A155?

A: Yes, there may be penalties for not filing Form 72A155 or for filing it late, including monetary fines.

Q: Are there any exemptions from filing Form 72A155?

A: Yes, certain exemptions may apply. It's best to consult the Kentucky Department of Revenue or the form instructions for more information.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A155 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.