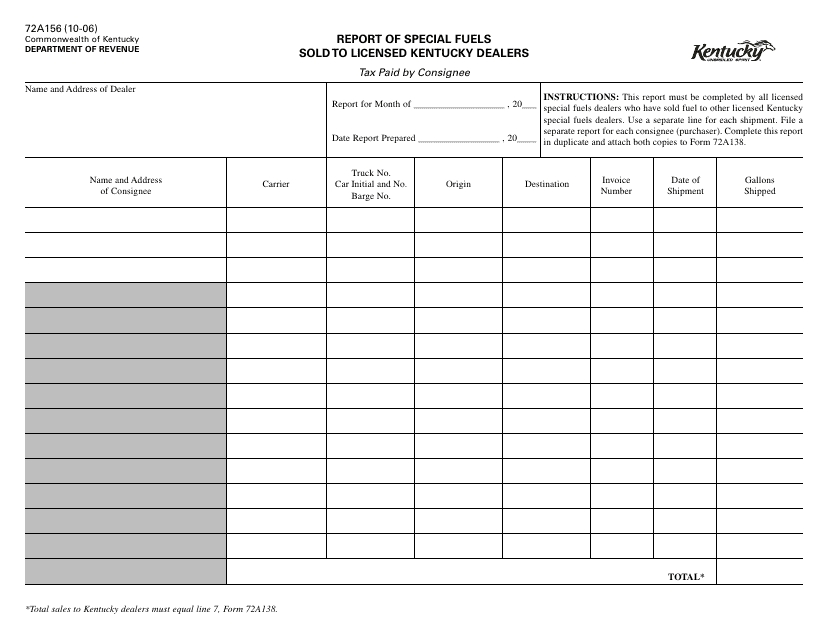

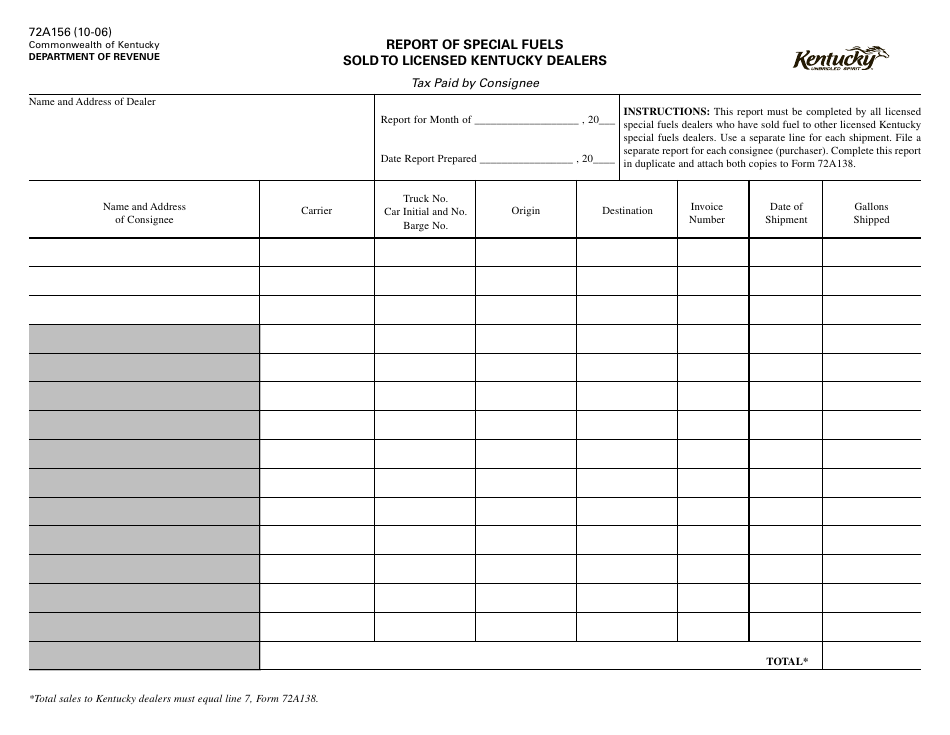

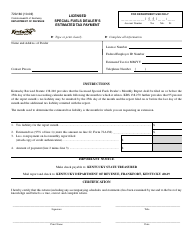

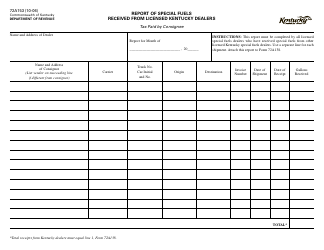

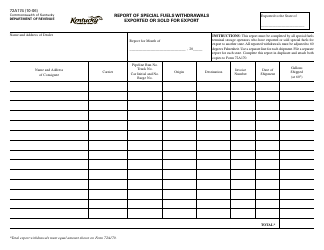

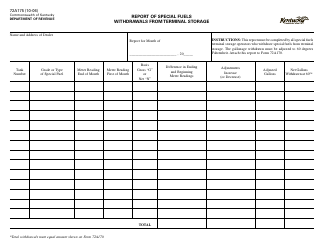

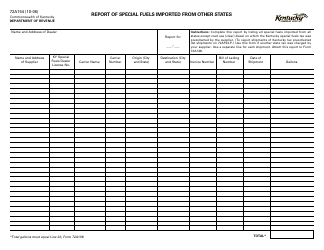

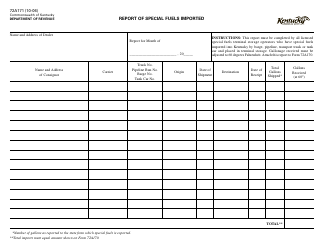

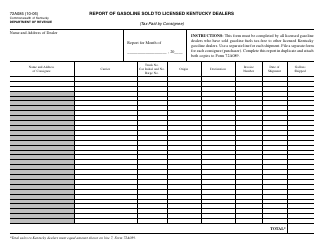

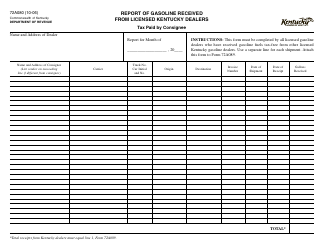

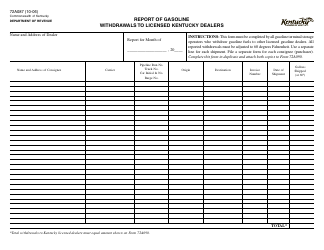

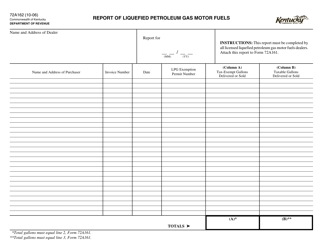

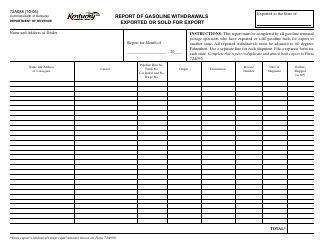

Form 72A156 Report of Special Fuels Sold to Licensed Kentucky Dealers - Kentucky

What Is Form 72A156?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form 72A156?

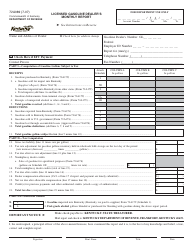

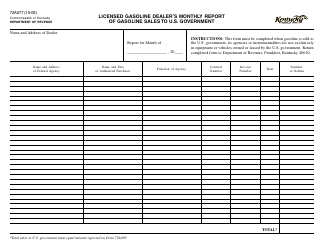

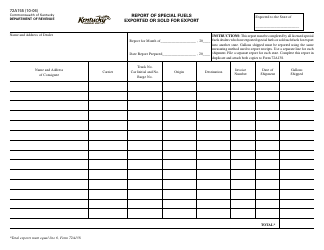

A: Form 72A156 is used to report special fuels sold to licensed Kentucky dealers.

Q: Who needs to file Form 72A156?

A: Any person or entity who sells special fuels to licensed Kentucky dealers needs to file Form 72A156.

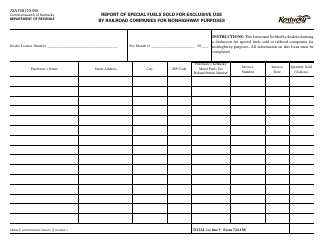

Q: What are special fuels?

A: Special fuels include motor fuels, aviation fuel, railroad diesel fuel, and certain other fuels as defined by Kentucky law.

Q: Who are licensed Kentucky dealers?

A: Licensed Kentucky dealers are individuals or businesses licensed to sell special fuels in Kentucky.

Q: When is Form 72A156 due?

A: Form 72A156 is due on a monthly basis, and the due date is the 20th of the month following the reporting period.

Q: Do I need to keep a copy of Form 72A156 for my records?

A: Yes, you should keep a copy of Form 72A156 for your records in case of any future audits or inquiries.

Q: Are there any penalties for late or incorrect filing of Form 72A156?

A: Yes, there are penalties for late or incorrect filing of Form 72A156, including fines and interest on unpaid taxes.

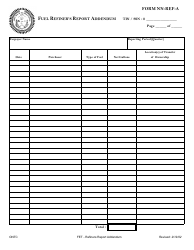

Q: Is there any additional documentation required with Form 72A156?

A: No, you do not need to submit any additional documentation with Form 72A156 unless specifically requested by the Kentucky Department of Revenue.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A156 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.