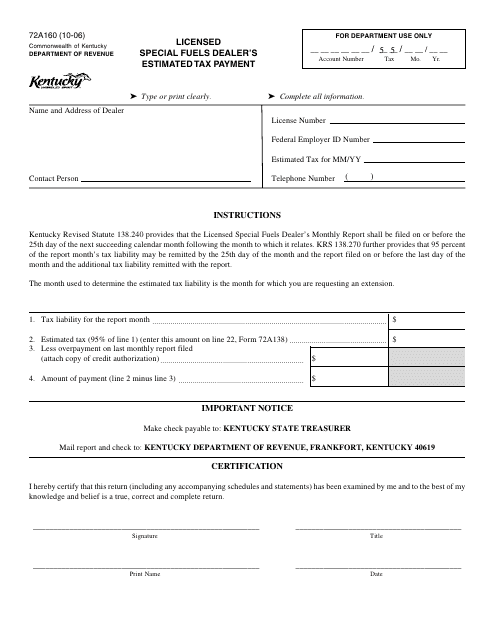

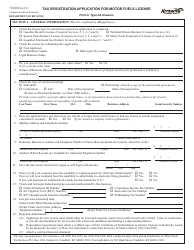

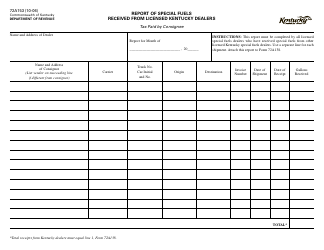

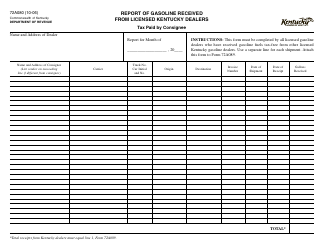

Form 72A160 Licensed Special Fuels Dealer's Estimated Tax Payment - Kentucky

What Is Form 72A160?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A160?

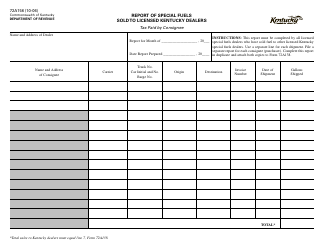

A: Form 72A160 is a tax form used by licensed special fuels dealers in Kentucky.

Q: Who needs to file Form 72A160?

A: Licensed special fuels dealers in Kentucky need to file Form 72A160.

Q: What is the purpose of Form 72A160?

A: Form 72A160 is used to make estimated tax payments by licensed special fuels dealers in Kentucky.

Q: What are special fuels?

A: Special fuels typically include diesel, biodiesel, and other non-highway fuels used for industrial or commercial purposes.

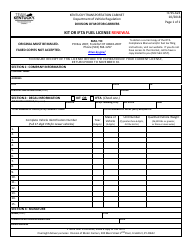

Q: How often should Form 72A160 be filed?

A: Form 72A160 should be filed on a quarterly basis.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A160 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.