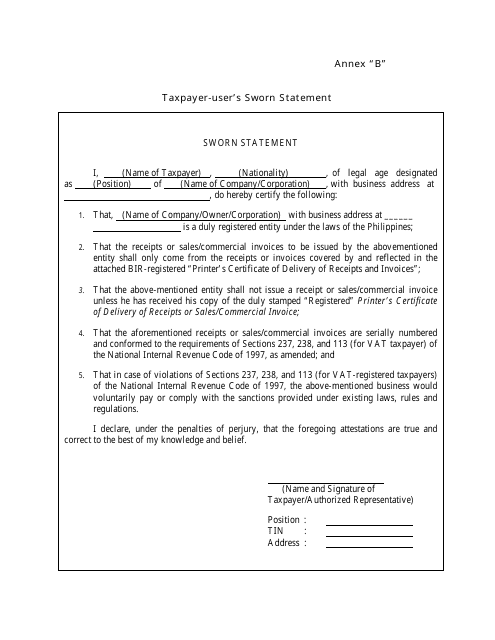

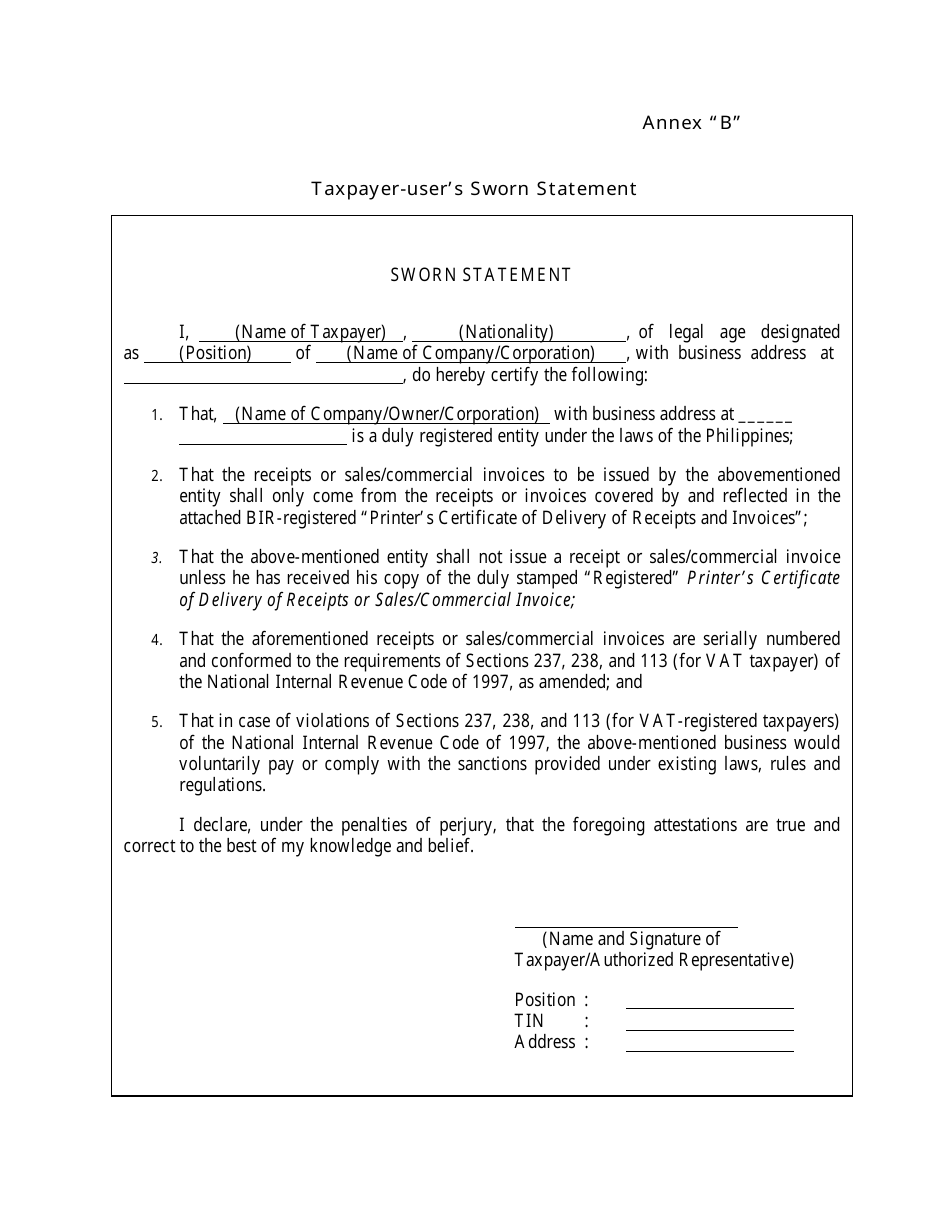

Taxpayer-User's Sworn Statement Template

The Taxpayer-User's Sworn Statement Template is used to provide a sworn statement regarding the accuracy and completeness of the information provided by the taxpayer for tax purposes.

The taxpayer files the Taxpayer-User's Sworn Statement template.

FAQ

Q: What is a taxpayer-user's sworn statement?

A: A taxpayer-user's sworn statement is a document used to declare and affirm the accuracy and truthfulness of information provided to the tax authorities.

Q: When is a taxpayer-user's sworn statement required?

A: A taxpayer-user's sworn statement is typically required when applying for certain tax-related benefits or exemptions.

Q: What information is typically included in a taxpayer-user's sworn statement?

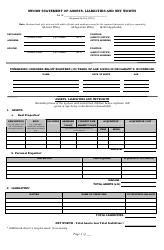

A: A taxpayer-user's sworn statement usually includes personal information, details about the taxpayer's income, expenses, and any relevant supporting documentation.

Q: Is a taxpayer-user's sworn statement legally binding?

A: Yes, a taxpayer-user's sworn statement is a legally binding document and providing false information can result in penalties or legal consequences.