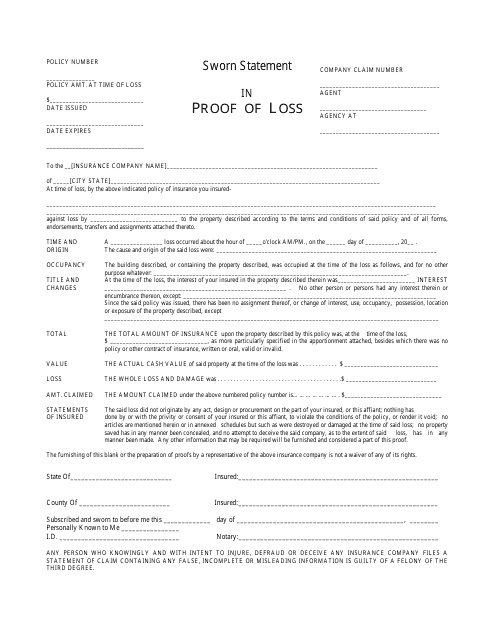

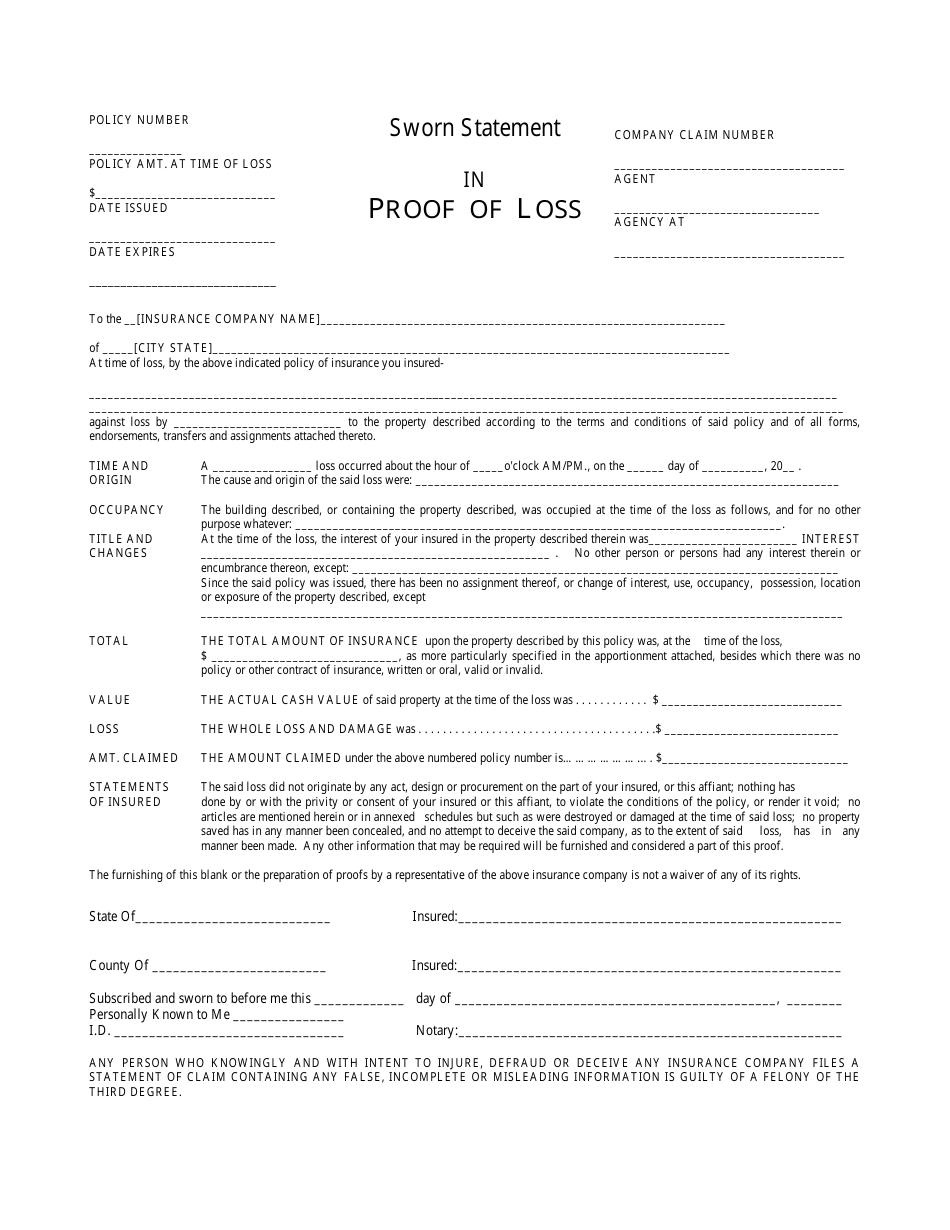

Sworn Statement in Proof of Loss

A Sworn Statement in Proof of Loss is a document used when making an insurance claim. It is a formal statement made by the insured person, under oath, providing detailed information about the loss or damage being claimed. The purpose of this document is to provide evidence and support the insurance claim.

The insured individual or policyholder typically files the sworn statement in proof of loss.

FAQ

Q: What is a Sworn Statement in Proof of Loss?

A: A Sworn Statement in Proof of Loss is a document that is used in insurance claims to provide a detailed account of the property damage or loss and the estimated value of the claim.

Q: Why is a Sworn Statement in Proof of Loss required?

A: A Sworn Statement in Proof of Loss is required by insurance companies to ensure that the claim is valid and that the amount being claimed is accurate.

Q: Who needs to complete a Sworn Statement in Proof of Loss?

A: The policyholder or the insured person is typically required to complete a Sworn Statement in Proof of Loss when filing an insurance claim.

Q: What information is included in a Sworn Statement in Proof of Loss?

A: A Sworn Statement in Proof of Loss generally includes details about the insured property, the cause of loss, the date of loss, and a detailed list of damaged or lost items.

Q: How should I fill out a Sworn Statement in Proof of Loss?

A: You should carefully review the instructions provided by your insurance company and provide accurate and detailed information about the loss or damage. It is important to be as thorough as possible when filling out the form.

Q: When should I submit a Sworn Statement in Proof of Loss?

A: You should submit a Sworn Statement in Proof of Loss as soon as possible after the loss or damage occurs. It is important to check with your insurance company to determine the deadline for submitting the form.

Q: What happens after I submit a Sworn Statement in Proof of Loss?

A: After you submit a Sworn Statement in Proof of Loss, your insurance company will review the claim and may request additional documentation or information. They will then evaluate the claim and make a decision regarding the coverage and settlement amount.