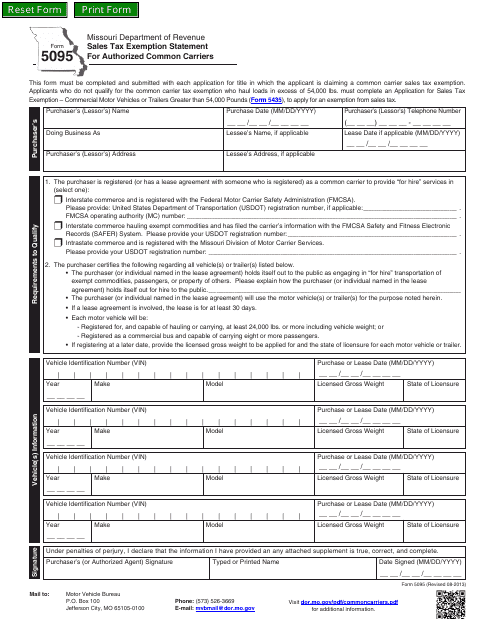

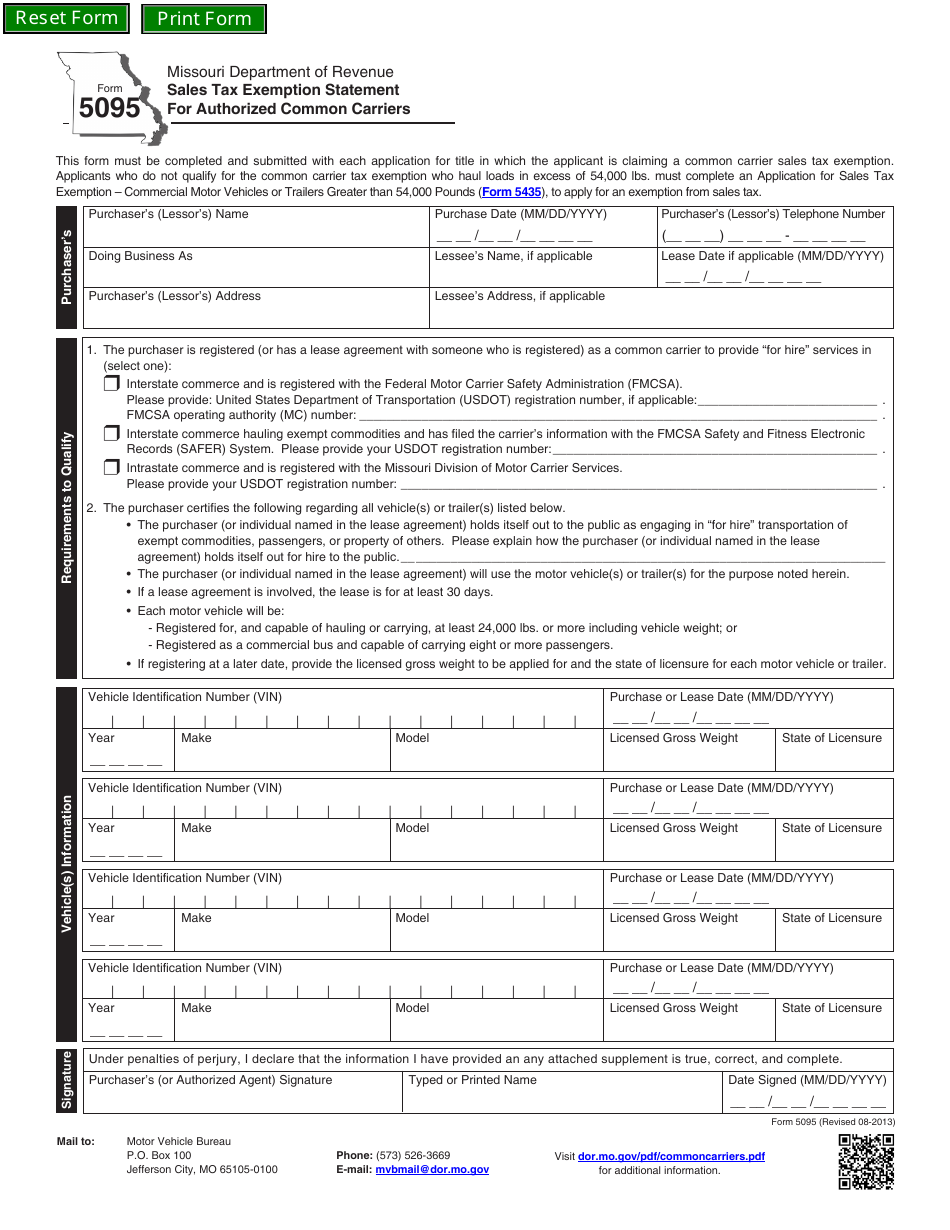

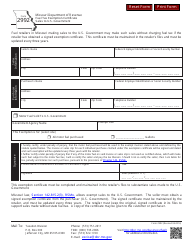

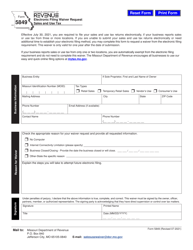

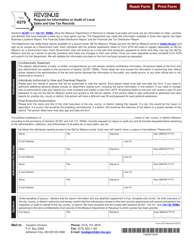

Form 5095 Sales Tax Exemption Statement for Authorized Common Carriers - Missouri

What Is Form 5095?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5095?

A: Form 5095 is the Sales Tax Exemption Statement for Authorized Common Carriers.

Q: Who is eligible to use Form 5095?

A: Authorized Common Carriers are eligible to use Form 5095.

Q: What is the purpose of Form 5095?

A: The purpose of Form 5095 is to claim a sales tax exemption for authorized common carriers.

Q: Do I need to file Form 5095 every year?

A: No, Form 5095 is a one-time filing unless there are changes to your authorized common carrier status.

Q: Is there a deadline for filing Form 5095?

A: There is no specific deadline for filing Form 5095, but it is recommended to file it as soon as possible.

Q: Can I use Form 5095 for other types of businesses?

A: No, Form 5095 is specifically for authorized common carriers.

Q: What information do I need to provide on Form 5095?

A: You need to provide your company name, address, federal employer identification number, and other relevant details.

Q: What should I do if there are changes to my authorized common carrier status?

A: If there are changes to your authorized common carrier status, you must notify the Missouri Department of Revenue.

Q: Are there any fees associated with filing Form 5095?

A: No, there are no fees associated with filing Form 5095.

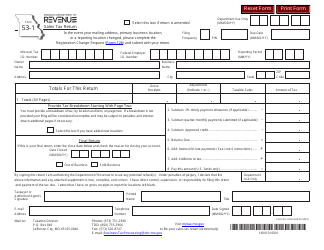

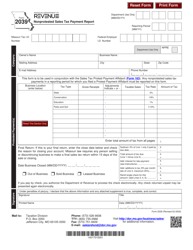

Form Details:

- Released on August 1, 2013;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5095 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.