This version of the form is not currently in use and is provided for reference only. Download this version of

Form VP-201

for the current year.

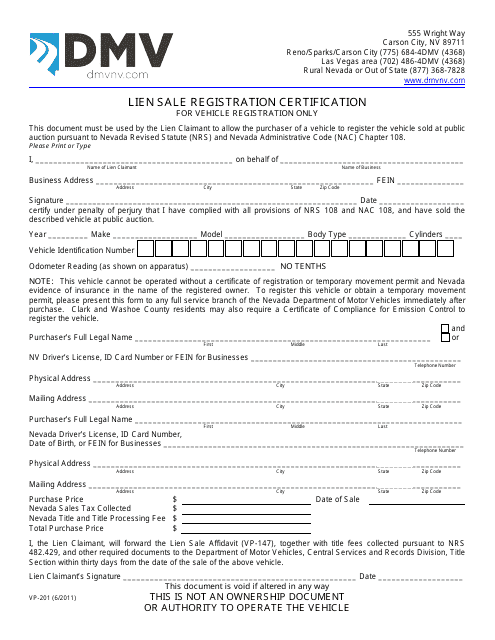

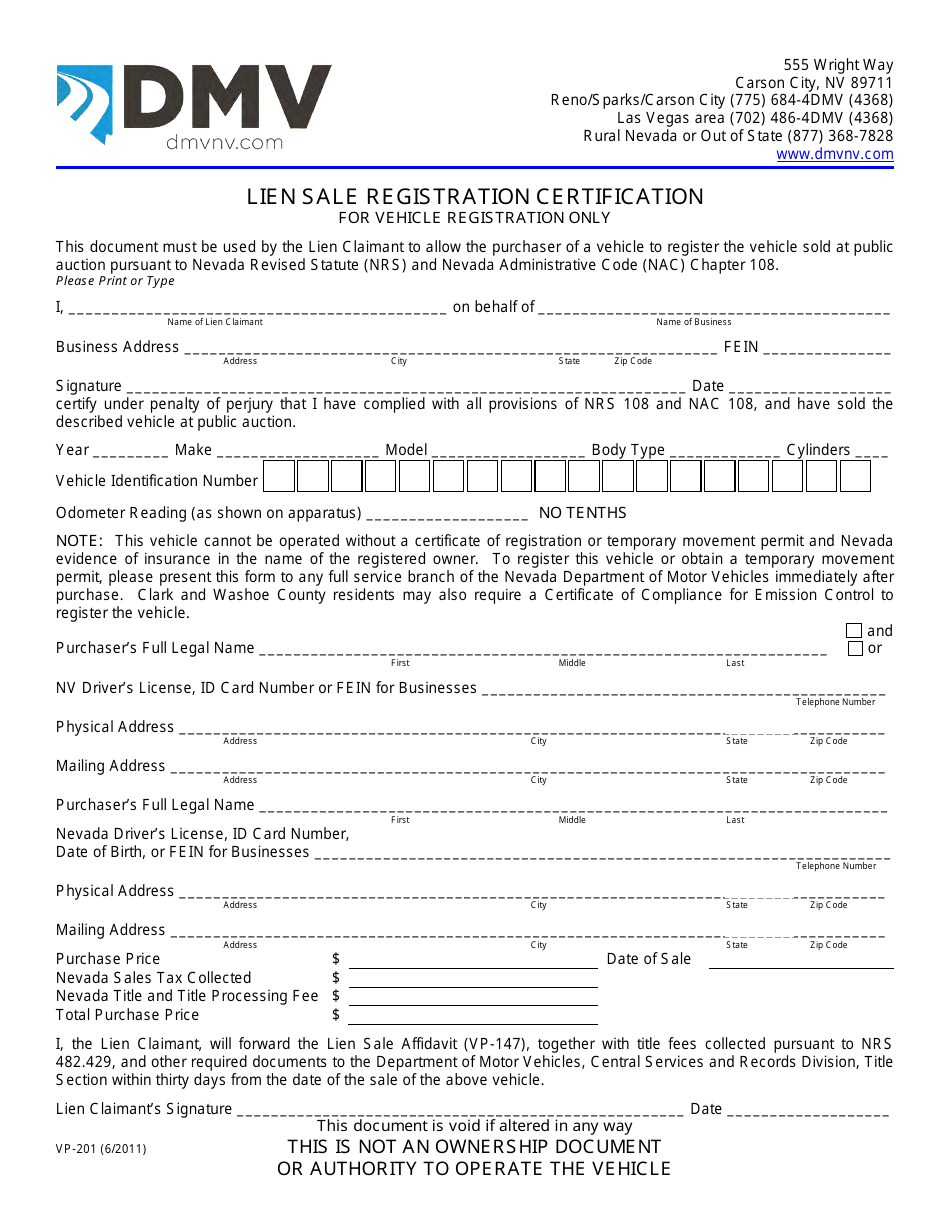

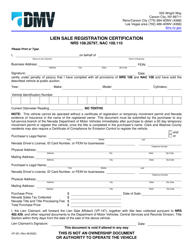

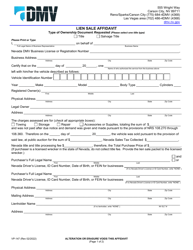

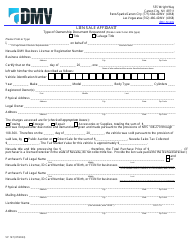

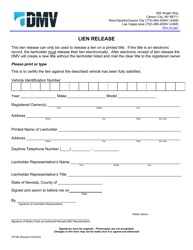

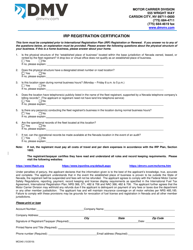

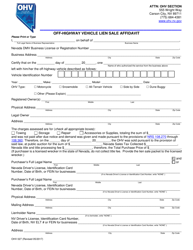

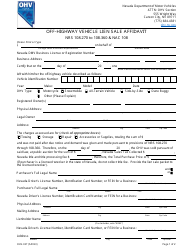

Form VP-201 Lien Sale Registration Certification - Nevada

What Is Form VP-201?

This is a legal form that was released by the Nevada Department of Motor Vehicles - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form VP-201?

A: Form VP-201 is a lien sale registration certification in Nevada.

Q: What is a lien sale?

A: A lien sale is a process where a vehicle that has an outstanding lien is sold to satisfy the debt.

Q: Who is required to file Form VP-201?

A: Any person or entity conducting a lien sale in Nevada is required to file this form.

Q: What information is required in Form VP-201?

A: Form VP-201 requires information about the lienholder, the vehicle, and the person filing the form.

Q: Are there any fees associated with Form VP-201?

A: Yes, there is a fee for filing Form VP-201.

Q: When should Form VP-201 be filed?

A: Form VP-201 should be filed at least 10 days before the planned sale date.

Q: What happens after filing Form VP-201?

A: After filing Form VP-201, you will receive a lien sale registration certification.

Q: Is Form VP-201 specific to Nevada?

A: Yes, Form VP-201 is specific to lien sales in Nevada.

Q: Who can I contact for more information about Form VP-201?

A: You can contact the Nevada Department of Motor Vehicles (DMV) for more information about Form VP-201.

Form Details:

- Released on June 1, 2011;

- The latest edition provided by the Nevada Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VP-201 by clicking the link below or browse more documents and templates provided by the Nevada Department of Motor Vehicles.