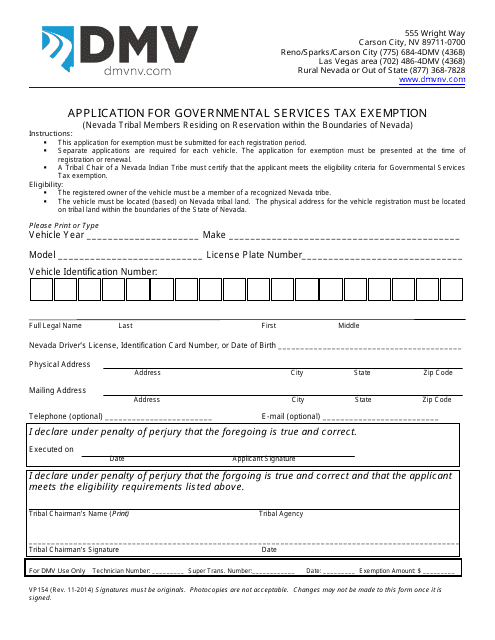

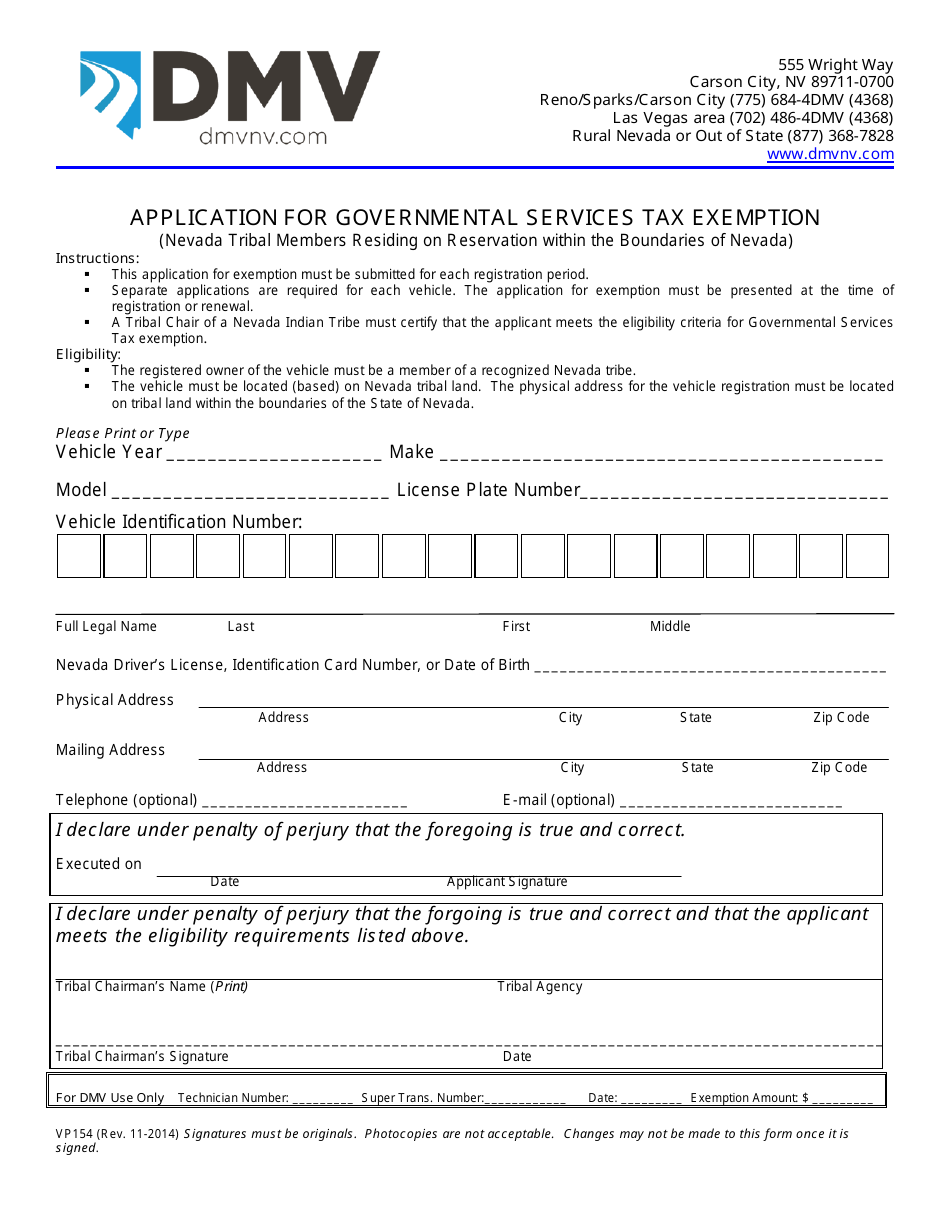

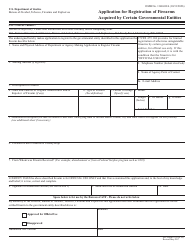

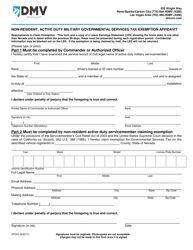

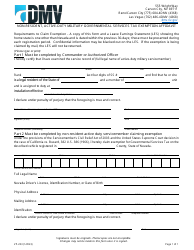

Form VP154 Application for Governmental Services Tax Exemption - Nevada

What Is Form VP154?

This is a legal form that was released by the Nevada Department of Motor Vehicles - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VP154?

A: VP154 is an application form for Governmental Services Tax Exemption in Nevada.

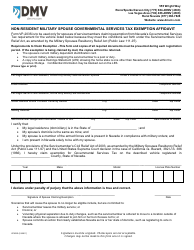

Q: Who can use VP154?

A: Any individual or organization seeking tax exemption for government services in Nevada can use VP154.

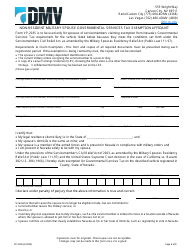

Q: What is the purpose of VP154?

A: The purpose of VP154 is to apply for exemption from certain taxes related to government services in Nevada.

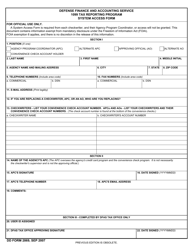

Q: What information is required in VP154?

A: VP154 requires information about the applicant's identity, organization details (if applicable), and reasons for seeking the tax exemption.

Q: How do I submit VP154?

A: You can submit VP154 by mail or in person at the designated government office in Nevada.

Q: What happens after submitting VP154?

A: After submitting VP154, your application will be reviewed by the relevant authorities. If approved, you will receive the tax exemption for government services in Nevada.

Q: Are there any restrictions or limitations to the tax exemption?

A: There may be restrictions or limitations on the tax exemption for government services in Nevada. You should refer to the official guidelines or consult with the Nevada government for detailed information.

Form Details:

- Released on November 1, 2014;

- The latest edition provided by the Nevada Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VP154 by clicking the link below or browse more documents and templates provided by the Nevada Department of Motor Vehicles.