This version of the form is not currently in use and is provided for reference only. Download this version of

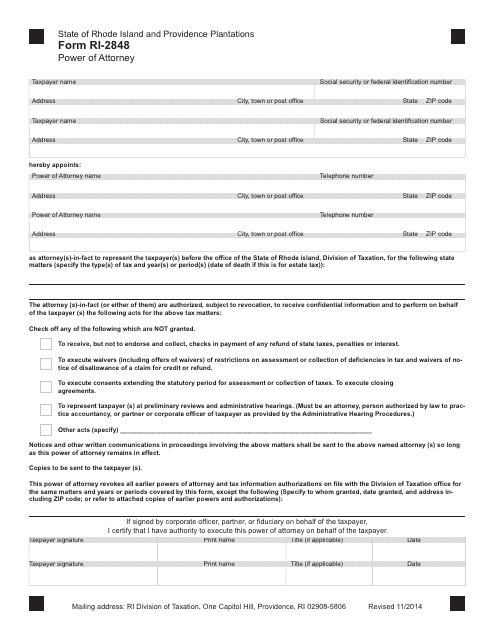

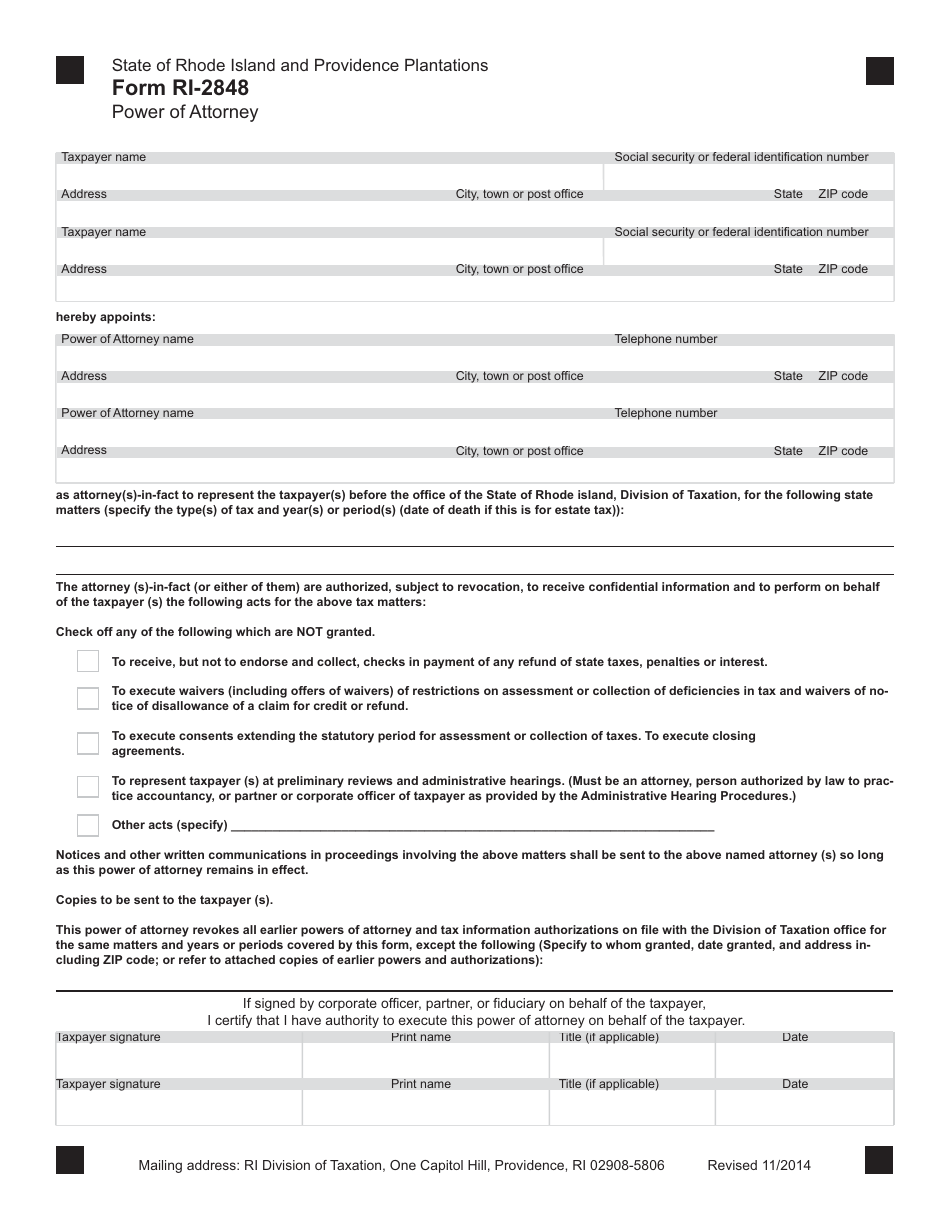

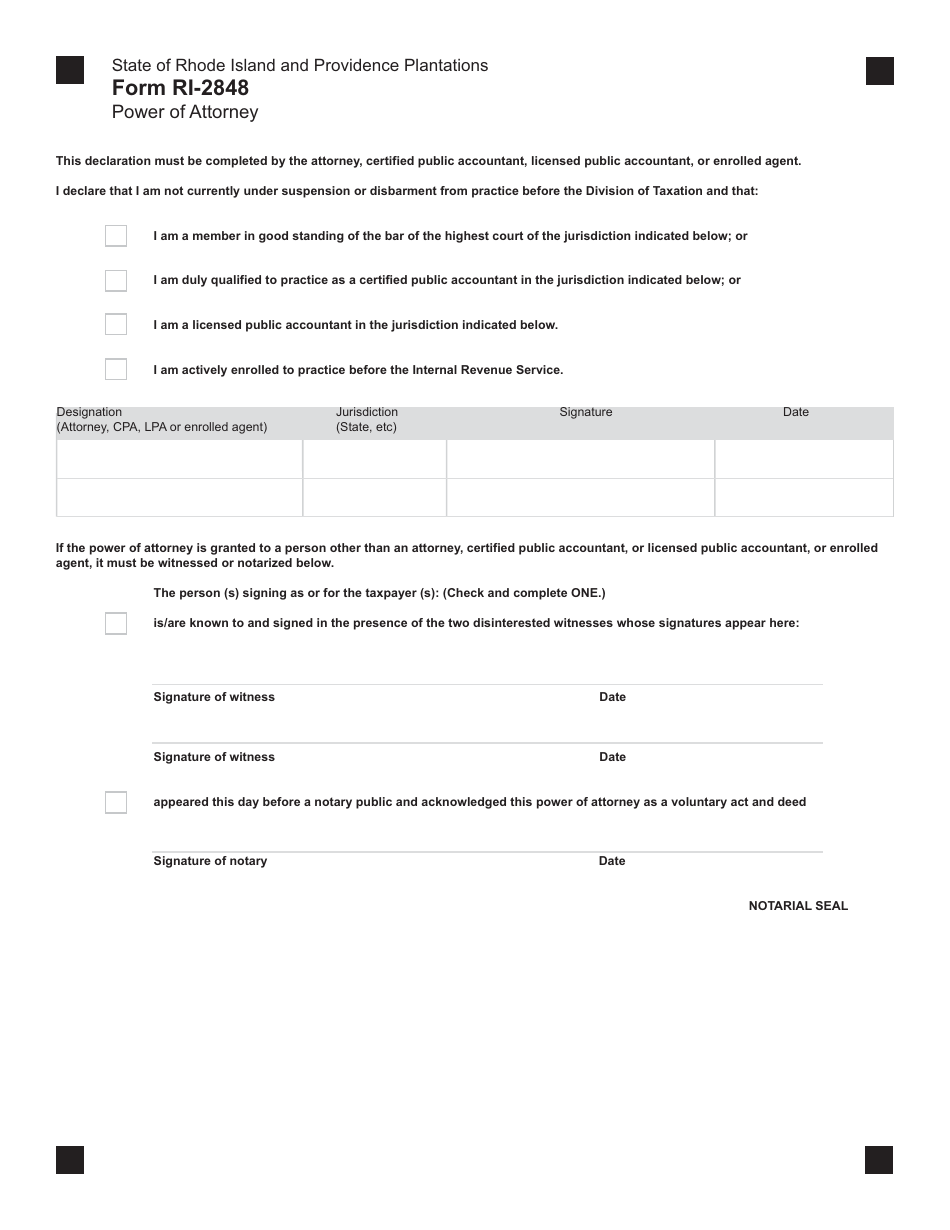

Form RI-2848

for the current year.

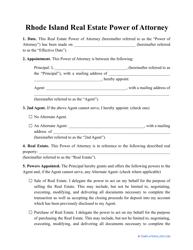

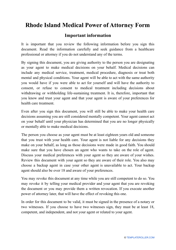

Form RI-2848 Power of Attorney - Rhode Island

What Is Form RI-2848?

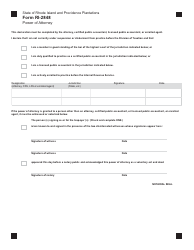

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-2848?

A: Form RI-2848 is a Power of Attorney form specific to the state of Rhode Island.

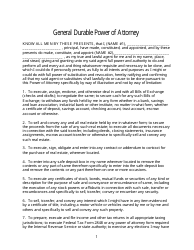

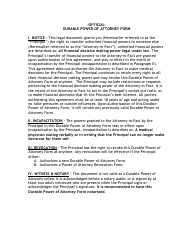

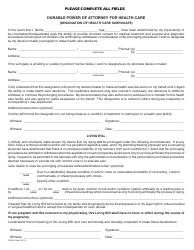

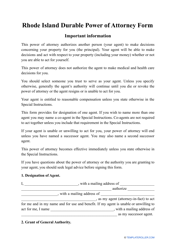

Q: What is the purpose of Form RI-2848?

A: The purpose of Form RI-2848 is to authorize someone to act as your representative for tax matters with the Rhode Island Division of Taxation.

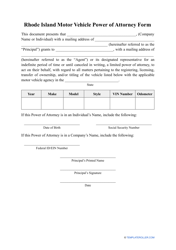

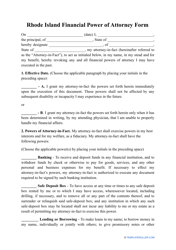

Q: Who should use Form RI-2848?

A: Form RI-2848 should be used by individuals or businesses who need to appoint someone to handle their tax matters with the Rhode Island Division of Taxation.

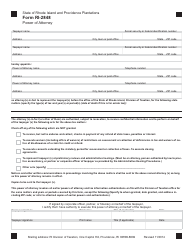

Q: What information is required on Form RI-2848?

A: Form RI-2848 requires information about the taxpayer, the representative, and specific tax matters being delegated.

Q: Are there any fees associated with filing Form RI-2848?

A: No, there are no fees associated with filing Form RI-2848. It is a free form.

Q: How should I submit Form RI-2848?

A: Form RI-2848 should be submitted to the Rhode Island Division of Taxation by mail or fax.

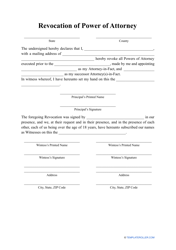

Q: Can I revoke or terminate a Power of Attorney granted through Form RI-2848?

A: Yes, you can revoke or terminate a Power of Attorney granted through Form RI-2848 by submitting a written statement to the Rhode Island Division of Taxation.

Q: Is Form RI-2848 specific to Rhode Island only?

A: Yes, Form RI-2848 is specific to the state of Rhode Island.

Form Details:

- Released on November 1, 2014;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RI-2848 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.