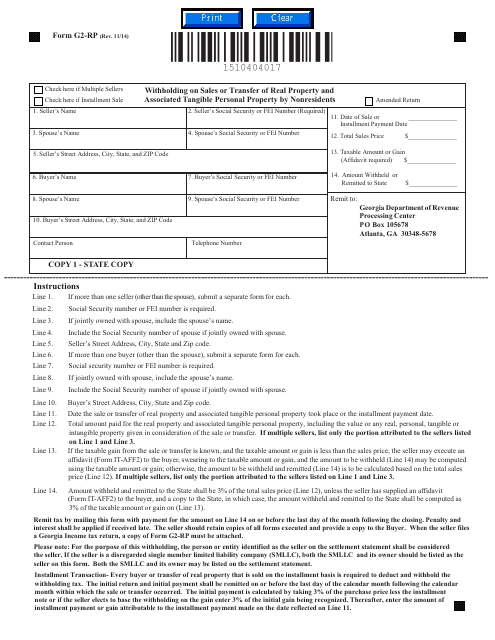

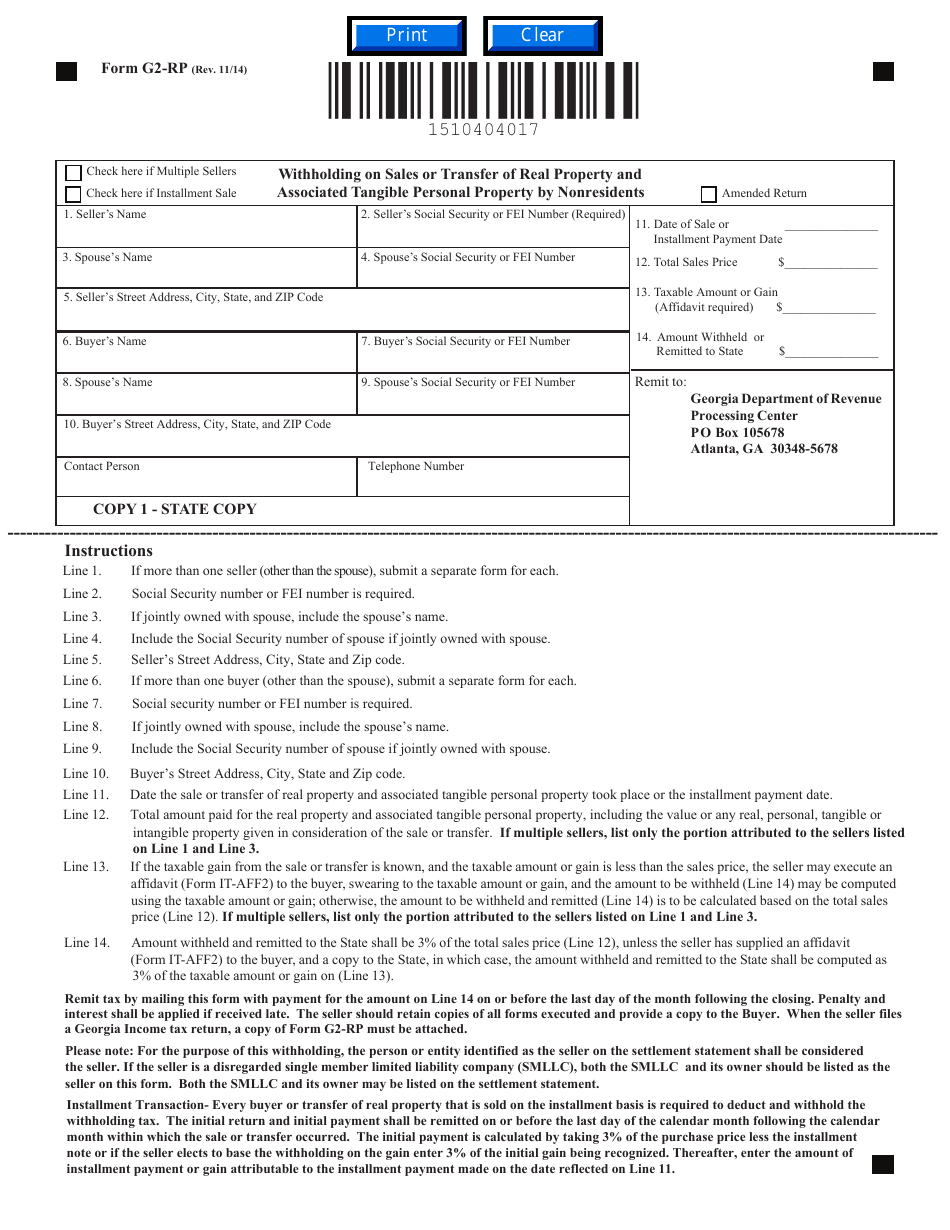

Form G2-RP Withholding on Sales or Transfer of Real Property and Associated Tangible Personal Property by Nonresidents - Georgia (United States)

What Is Form G2-RP?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G2-RP?

A: Form G2-RP is a form used to report and pay withholding on sales or transfers of real property and associated tangible personal property made by nonresidents in Georgia.

Q: Who needs to file Form G2-RP?

A: Nonresidents who are selling or transferring real property and associated tangible personal property in Georgia need to file Form G2-RP.

Q: What is the purpose of Form G2-RP?

A: The purpose of Form G2-RP is to ensure that nonresidents pay the appropriate withholding tax on the sale or transfer of real property and associated tangible personal property in Georgia.

Q: What information is required on Form G2-RP?

A: Form G2-RP requires information such as the buyer and seller's identification, the property details, and the amount of withholding tax.

Q: When is Form G2-RP due?

A: Form G2-RP is due on or before the date of the transfer of the property.

Q: Is there a penalty for late filing of Form G2-RP?

A: Yes, there is a penalty for late filing of Form G2-RP. The penalty is 5% per month, up to a maximum of 25% of the amount of tax due.

Q: How do I pay the withholding tax?

A: The withholding tax can be paid by check or money order, using the payment voucher included with Form G2-RP.

Q: Are there any exemptions from withholding on Form G2-RP?

A: Yes, there are certain exemptions from withholding on Form G2-RP. These exemptions include transfers to certain exempt organizations and transfers involving a bankruptcy proceeding.

Form Details:

- Released on November 1, 2014;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G2-RP by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.