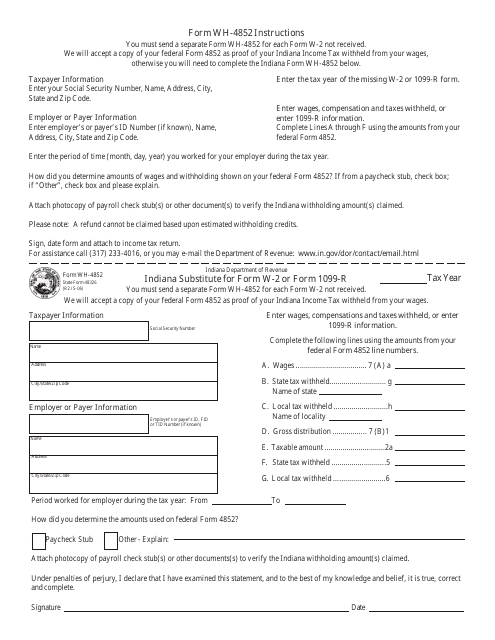

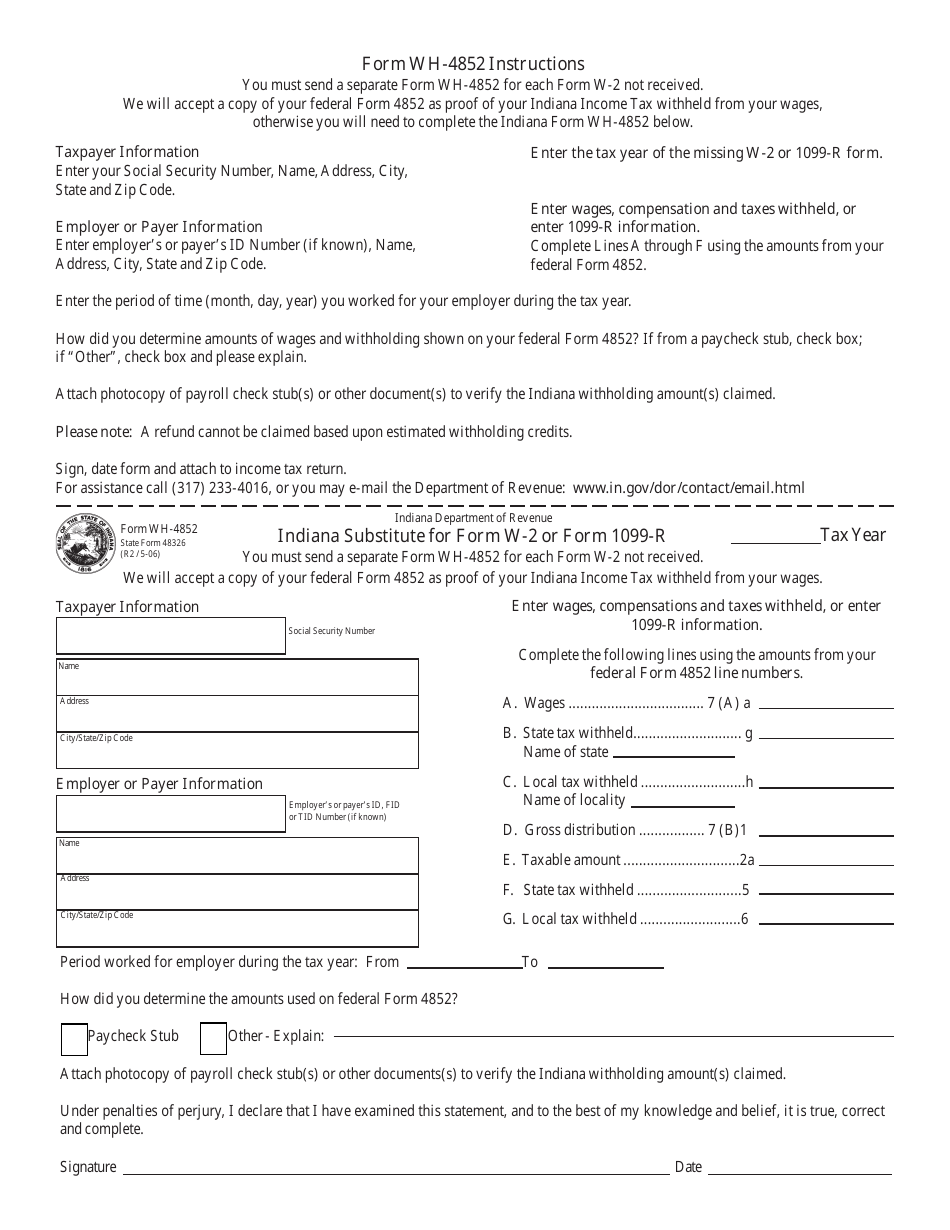

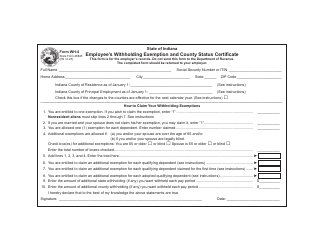

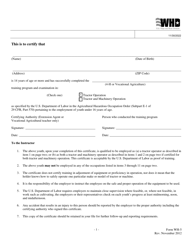

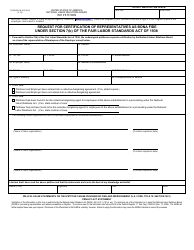

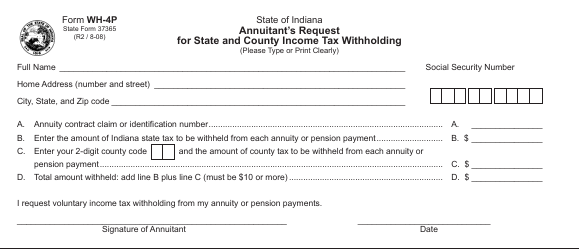

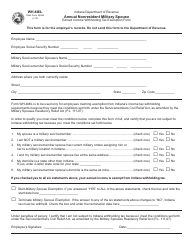

Form WH-4852 Indiana Substitute for Form W-2 or Form 1099-r - Indiana

What Is Form WH-4852?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WH-4852?

A: Form WH-4852 is an Indiana substitute for Form W-2 or Form 1099-R.

Q: What is the purpose of Form WH-4852?

A: The purpose of Form WH-4852 is to provide income information to the IRS when the original Form W-2 or Form 1099-R is not available.

Q: When should I use Form WH-4852?

A: You should use Form WH-4852 when you have not received a Form W-2 or Form 1099-R from your employer or payer.

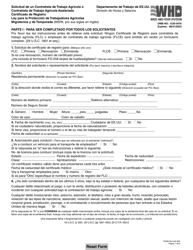

Q: How do I fill out Form WH-4852?

A: You need to provide your personal information, employer or payer information, and income details in the appropriate sections of the form.

Q: Can I e-file Form WH-4852?

A: No, Form WH-4852 cannot be e-filed. It must be filed by mail.

Q: What should I do if I receive the original Form W-2 or Form 1099-R after filing Form WH-4852?

A: If you receive the original form after filing Form WH-4852, you should file an amended tax return to correct any discrepancies.

Q: Is Form WH-4852 specific to Indiana?

A: Yes, Form WH-4852 is specific to Indiana and is used as a substitute for federal forms in Indiana.

Form Details:

- Released on May 1, 2006;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WH-4852 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.