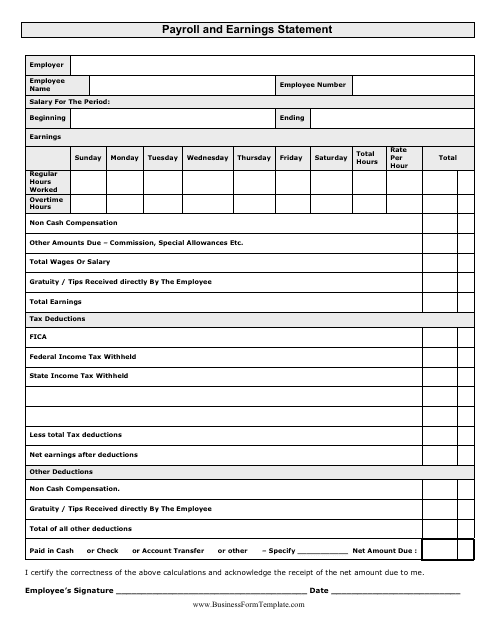

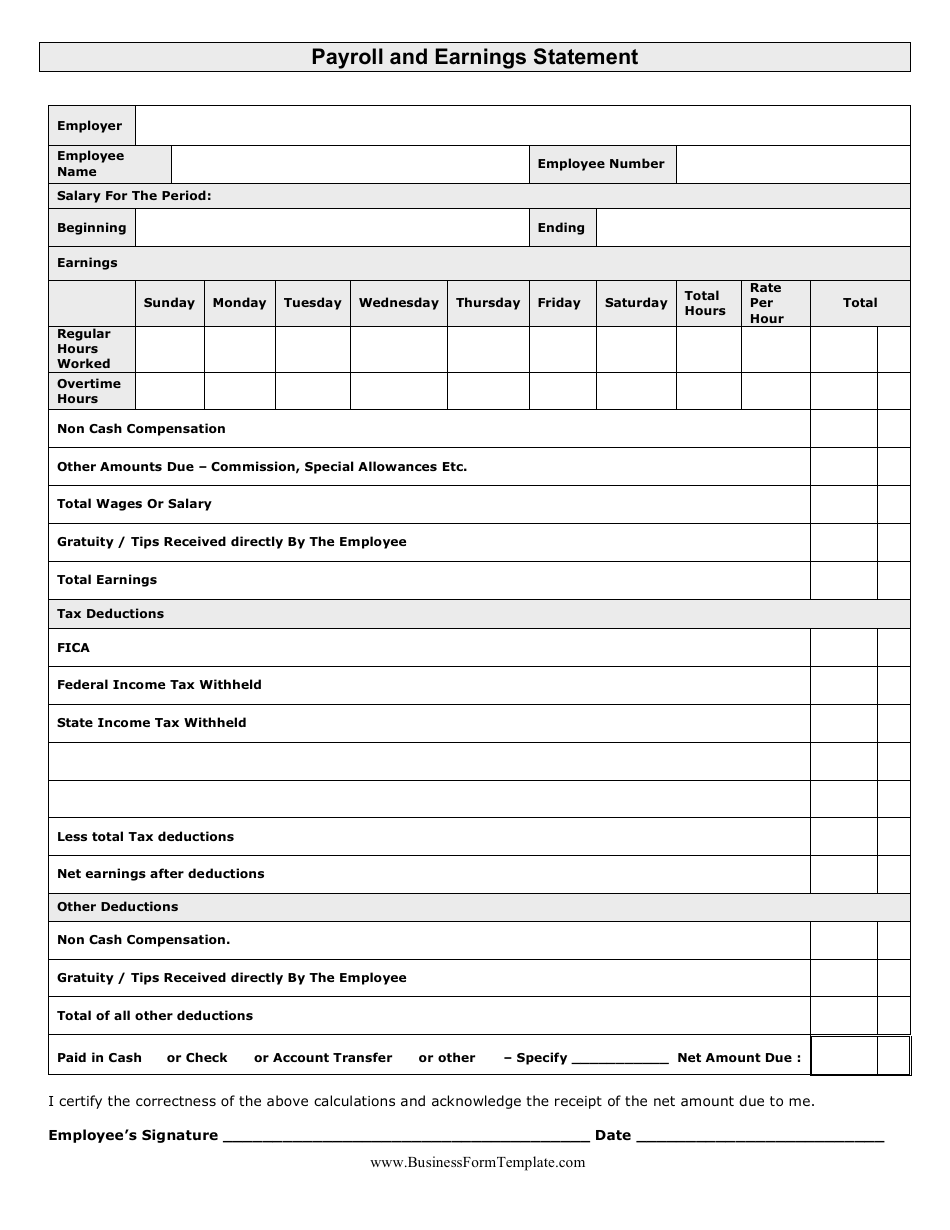

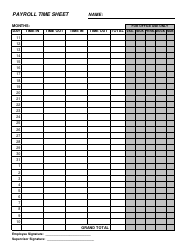

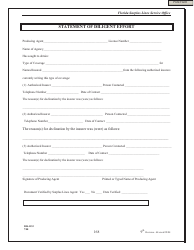

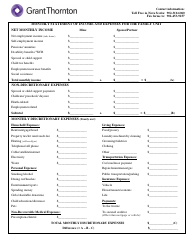

Payroll and Earnings Statement Template

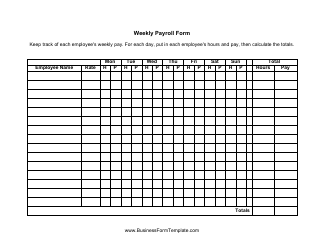

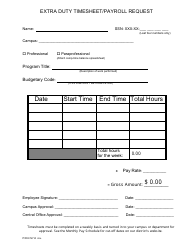

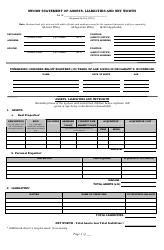

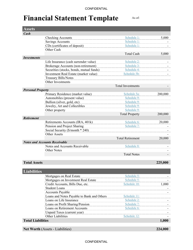

A Payroll and Earnings Statement Template is used to document an employee's salary, wages, deductions, and other details related to their earnings. It provides a detailed breakdown of the employee's salary and helps them understand how their pay is calculated.

The payroll and earnings statement template is typically filed by the human resources department or payroll department of an organization.

FAQ

Q: What is a payroll and earnings statement?

A: A payroll and earnings statement is a document that shows information about an individual's wages, deductions, and net pay for a specific pay period.

Q: What information is included in a payroll and earnings statement?

A: A payroll and earnings statement typically includes the employee's name, pay period dates, gross earnings, deductions, and net pay.

Q: Why is a payroll and earnings statement important?

A: A payroll and earnings statement is important because it provides transparency and accountability, showing how an employee's wages are calculated, and detailing any deductions.

Q: How often are payroll and earnings statements issued?

A: Payroll and earnings statements are usually issued on a regular basis, such as bi-weekly or monthly, depending on the employer's payroll schedule.

Q: Are payroll and earnings statements required by law?

A: Yes, employers are generally required by law to provide employees with a payroll and earnings statement for each pay period.