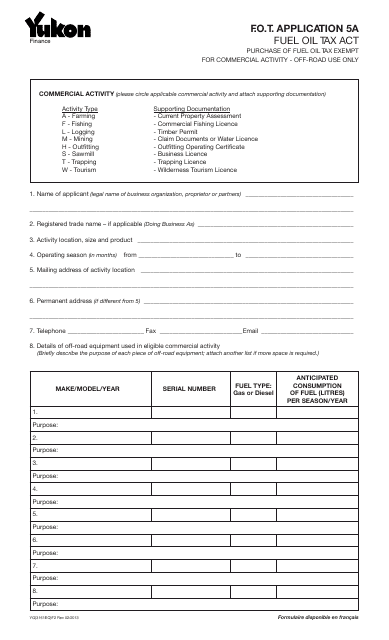

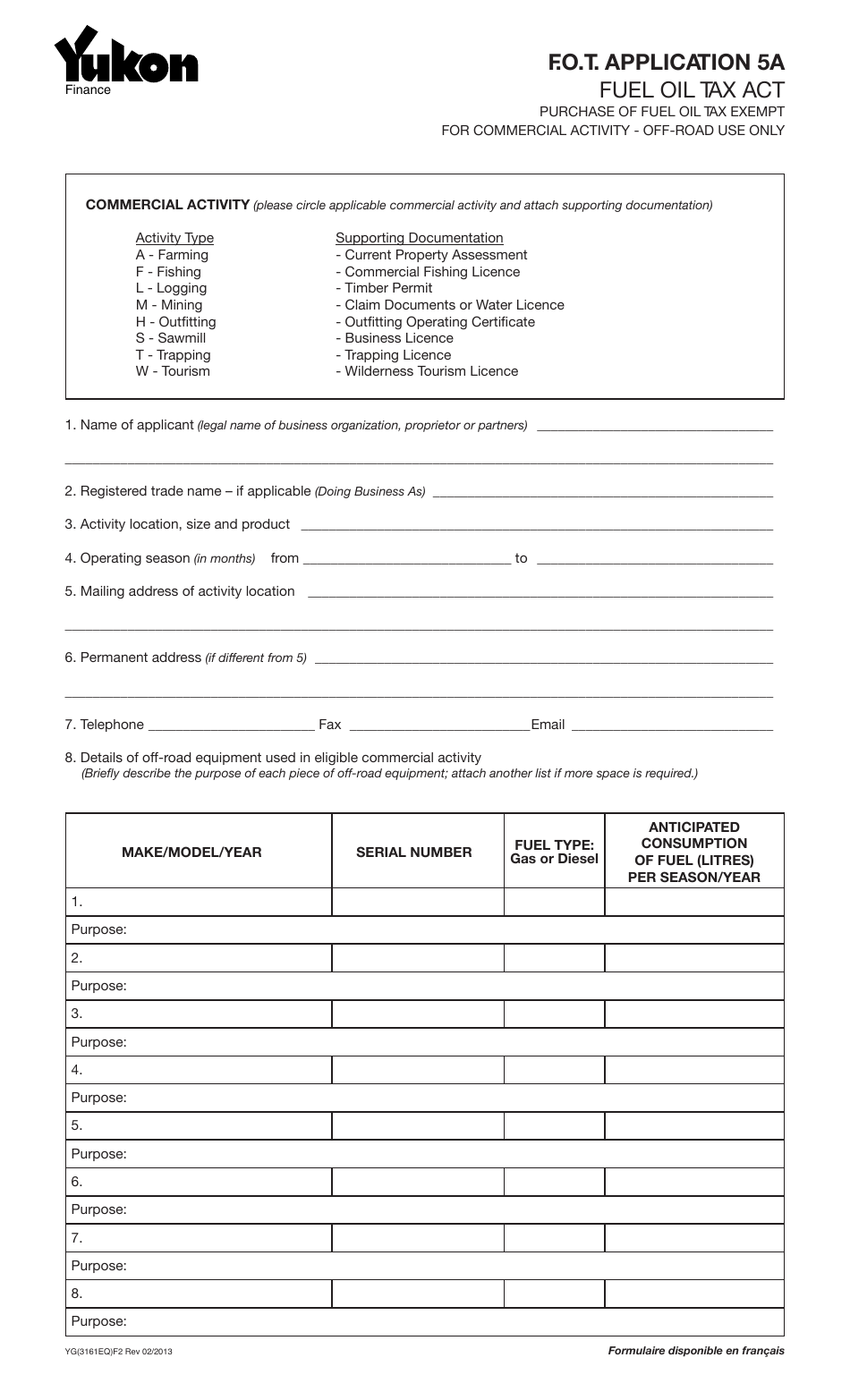

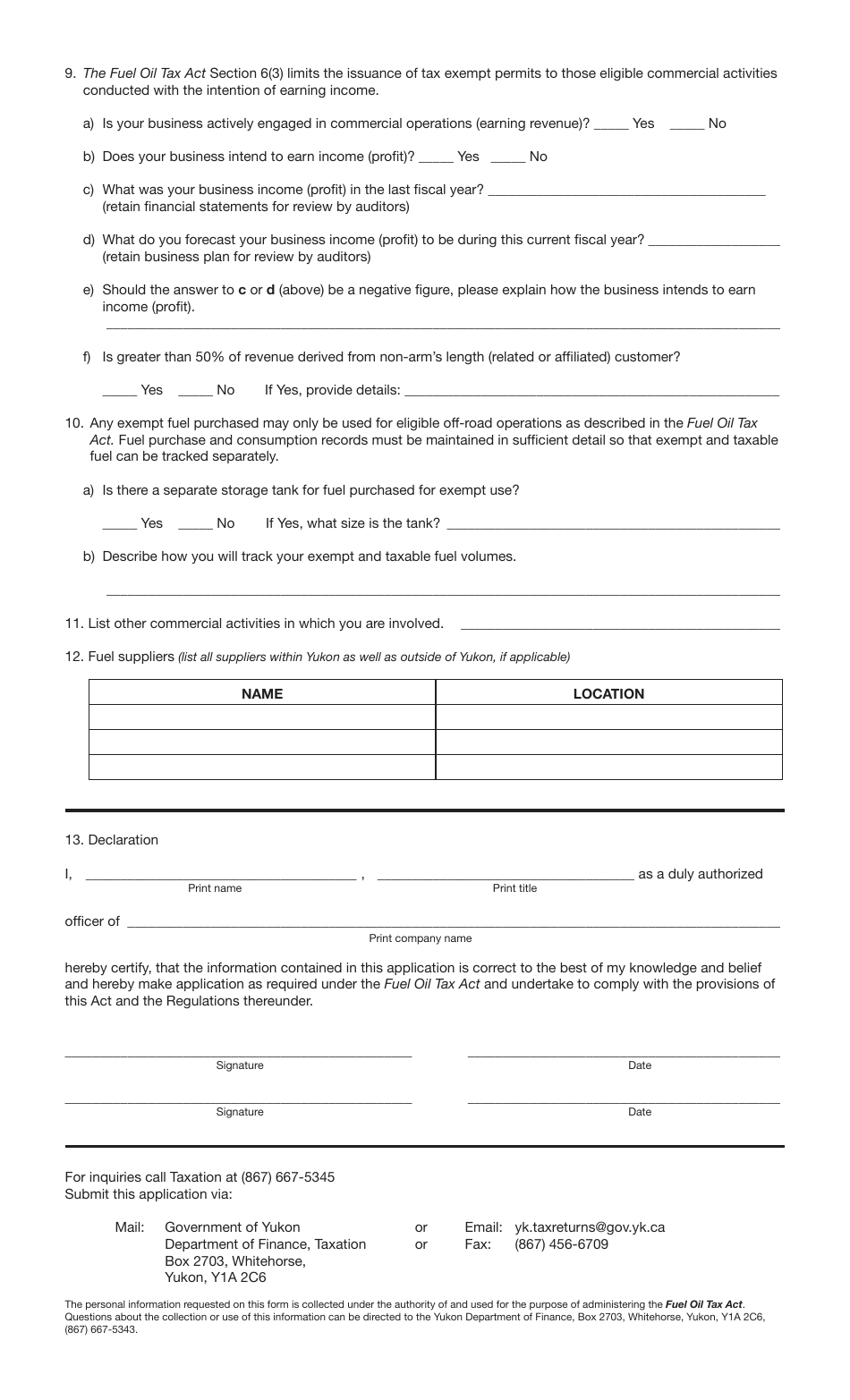

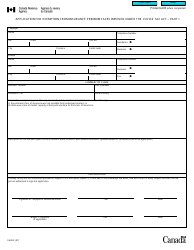

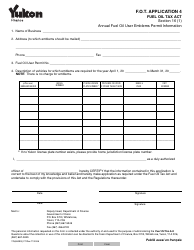

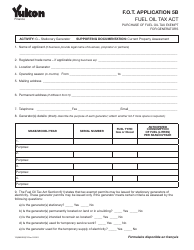

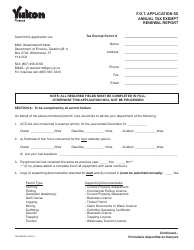

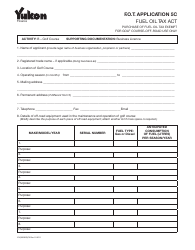

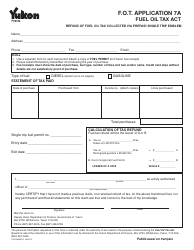

Form YG3161 Fuel Oil Tax - Application 5a - Yukon, Canada

Form YG3161 Fuel Oil Tax - Application 5a is used in Yukon, Canada for applying for a fuel oil tax refund.

The Form YG3161 Fuel Oil Tax - Application 5a in Yukon, Canada is typically filed by individuals or businesses who are eligible for the fuel oil tax rebate.

FAQ

Q: What is the Form YG3161 Fuel Oil Tax?

A: Form YG3161 Fuel Oil Tax is an application form used in Yukon, Canada to apply for fuel oil tax.

Q: What is Application 5a for?

A: Application 5a is specifically for fuel oil tax in Yukon, Canada.

Q: Who needs to fill out this form?

A: Any individual or business in Yukon, Canada that wishes to apply for fuel oil tax needs to fill out this form.

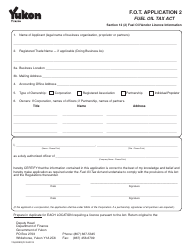

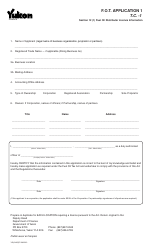

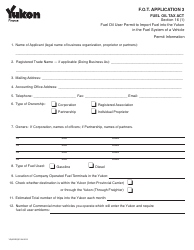

Q: What information is required in the application?

A: The application requires details such as the applicant's name, address, business information (if applicable), fuel type and quantity, and supporting documents.

Q: How long does it take to process the application?

A: The processing time for the Form YG3161 Fuel Oil Tax - Application 5a may vary. It is recommended to contact the Yukon Department of Finance for information on processing times.

Q: What should I do if I have more questions or need assistance with the application?

A: If you have more questions or need assistance with the Form YG3161 Fuel Oil Tax - Application 5a, you can contact the Yukon Department of Finance for further guidance.