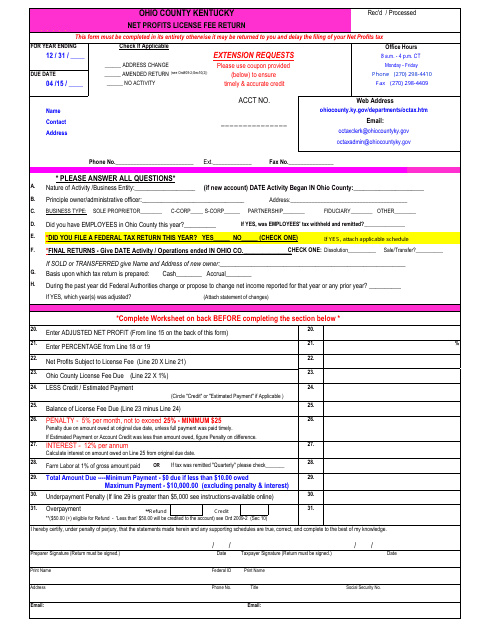

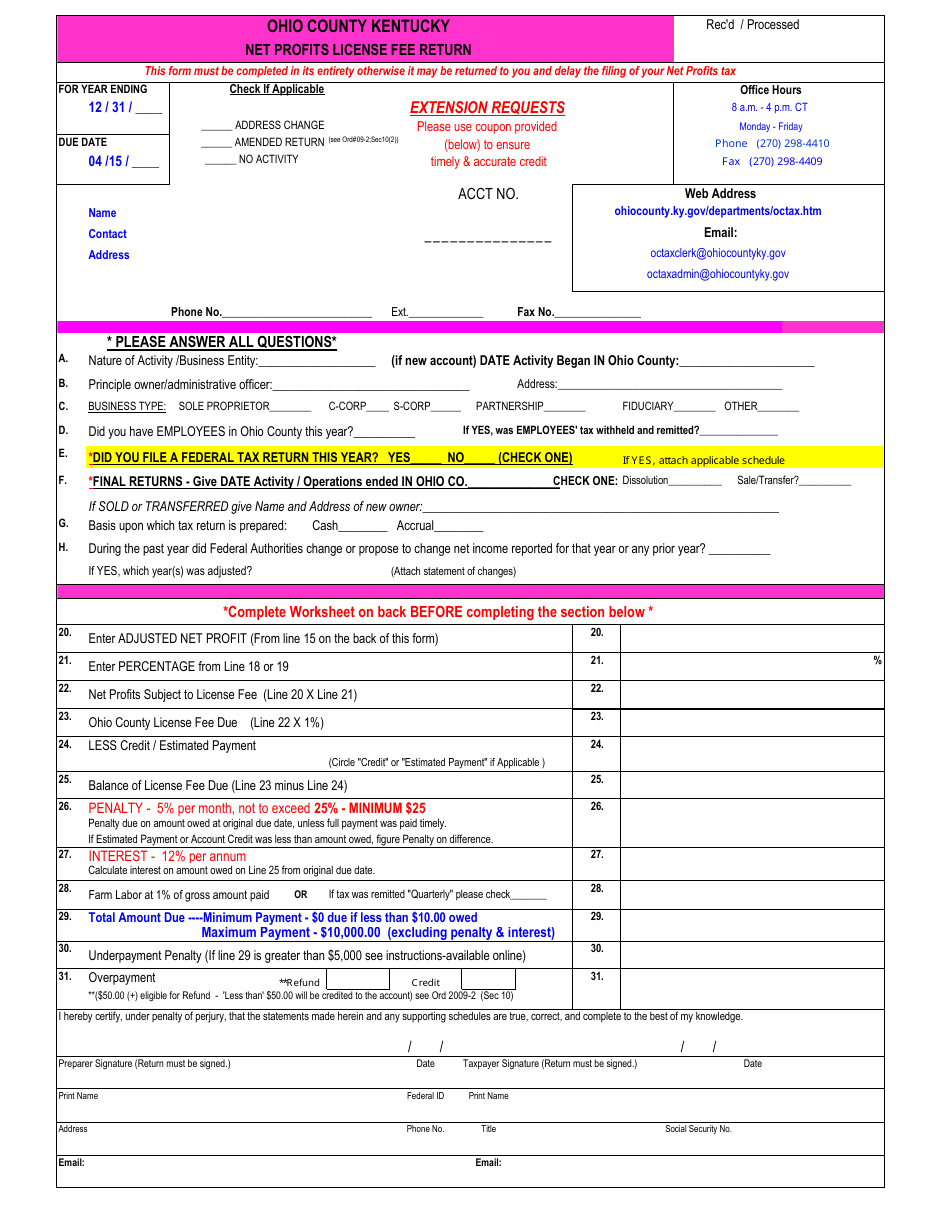

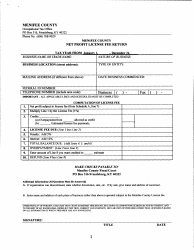

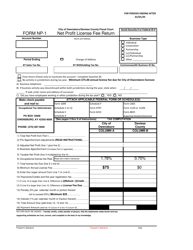

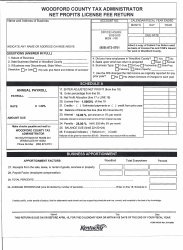

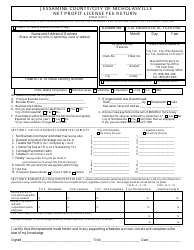

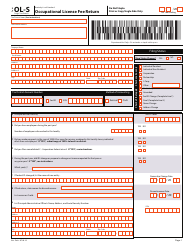

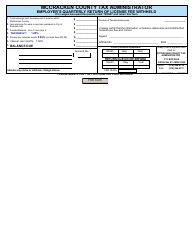

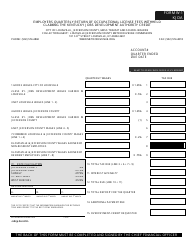

Net Profits License Fee Return - Ohio County, Kentucky

Net Profits License Fee Return is a legal document that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. The form may be used strictly within Ohio County.

FAQ

Q: What is a Net Profits License Fee Return?

A: A Net Profits License Fee Return is a form that businesses in Ohio County, Kentucky are required to file to report their net profits and pay the applicable license fee.

Q: Who needs to file a Net Profits License Fee Return in Ohio County, Kentucky?

A: All businesses operating in Ohio County, Kentucky are required to file a Net Profits License Fee Return, regardless of their size or type.

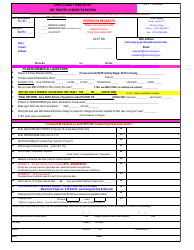

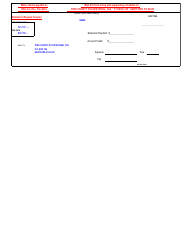

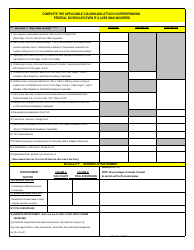

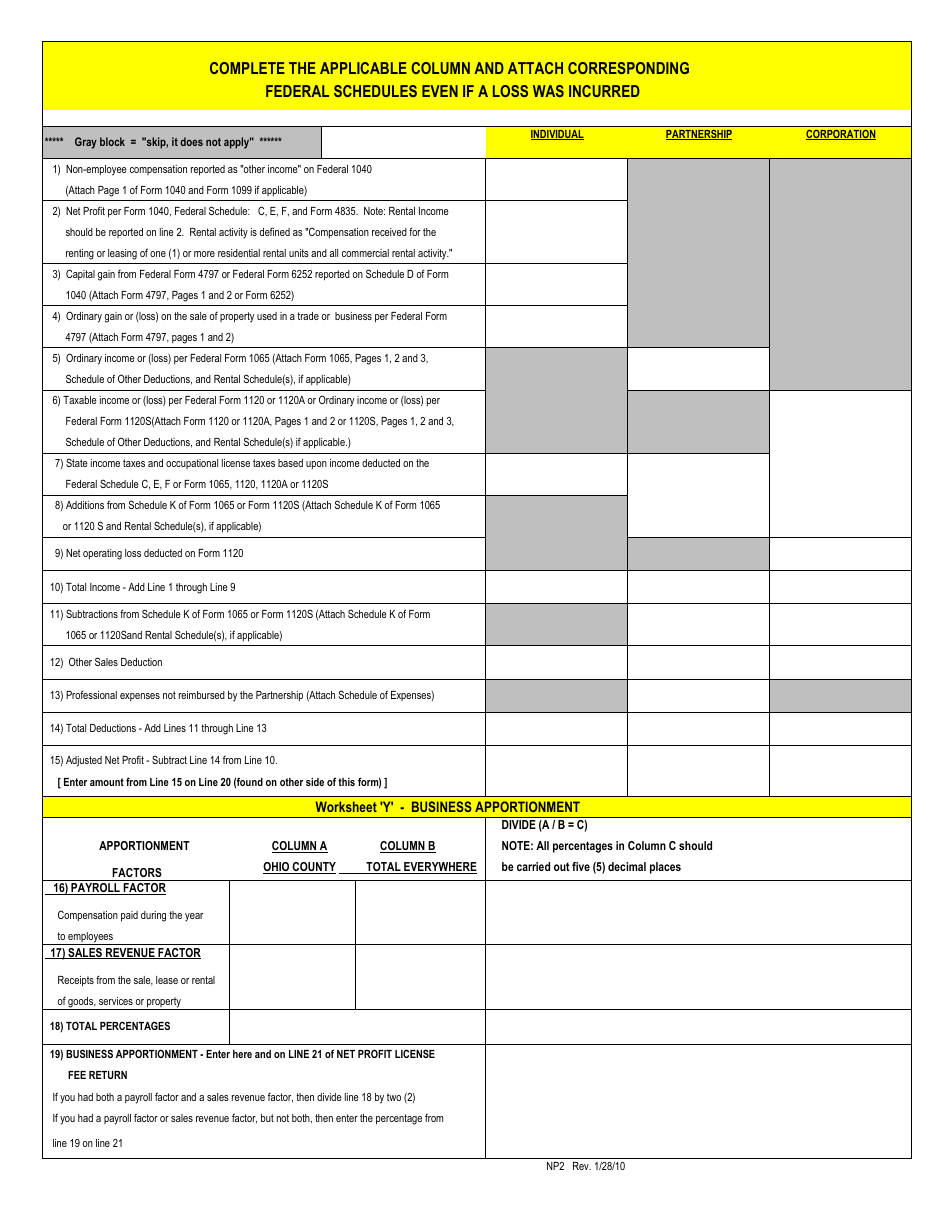

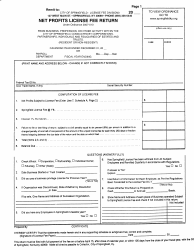

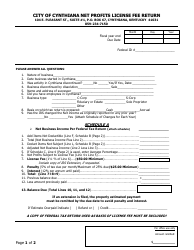

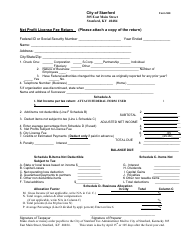

Q: What information needs to be reported on the Net Profits License Fee Return?

A: The Net Profits License Fee Return typically requires businesses to report their net profits for the relevant period, as well as other required information such as gross receipts and deductions.

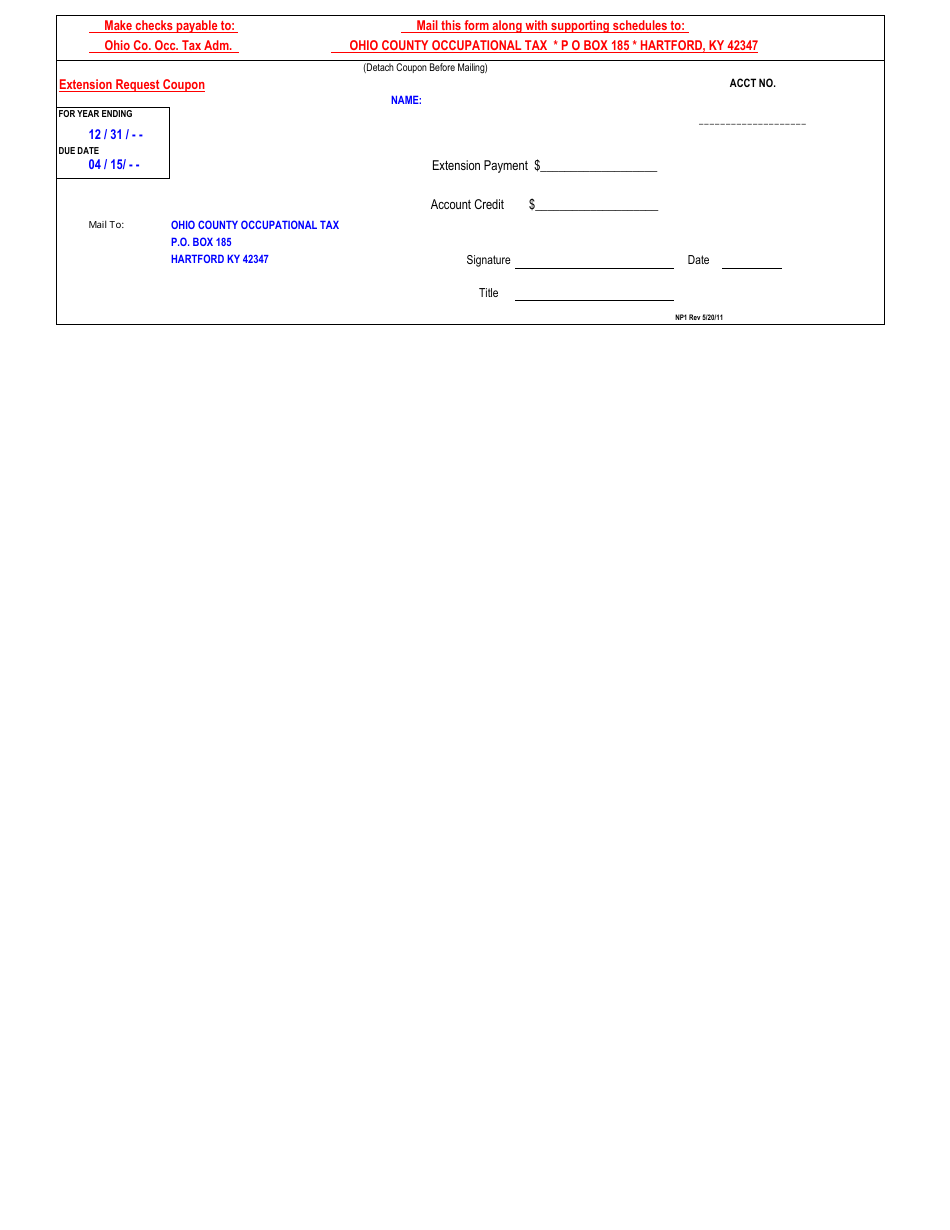

Q: How often does the Net Profits License Fee Return need to be filed?

A: The frequency of filing the Net Profits License Fee Return may vary depending on the specific requirements of Ohio County, Kentucky. It is important to consult the local government or tax agency for the correct filing schedule.

Q: What are the consequences of not filing or paying the Net Profits License Fee Return?

A: Failure to file or pay the Net Profits License Fee Return may result in penalties, fines, or other legal consequences as determined by Ohio County, Kentucky.

Form Details:

- The latest edition currently provided by the Kentucky Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.