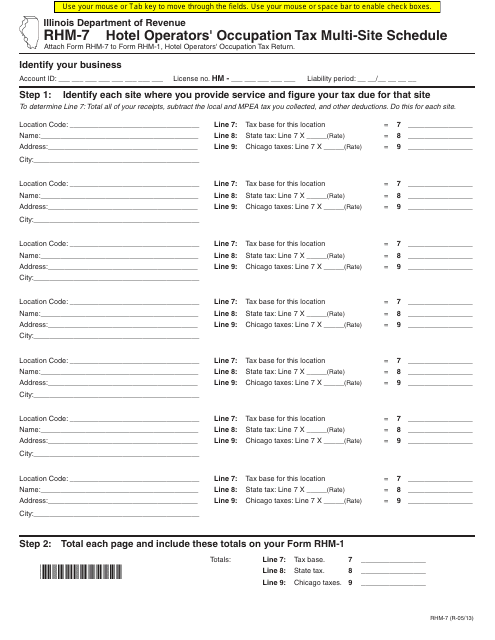

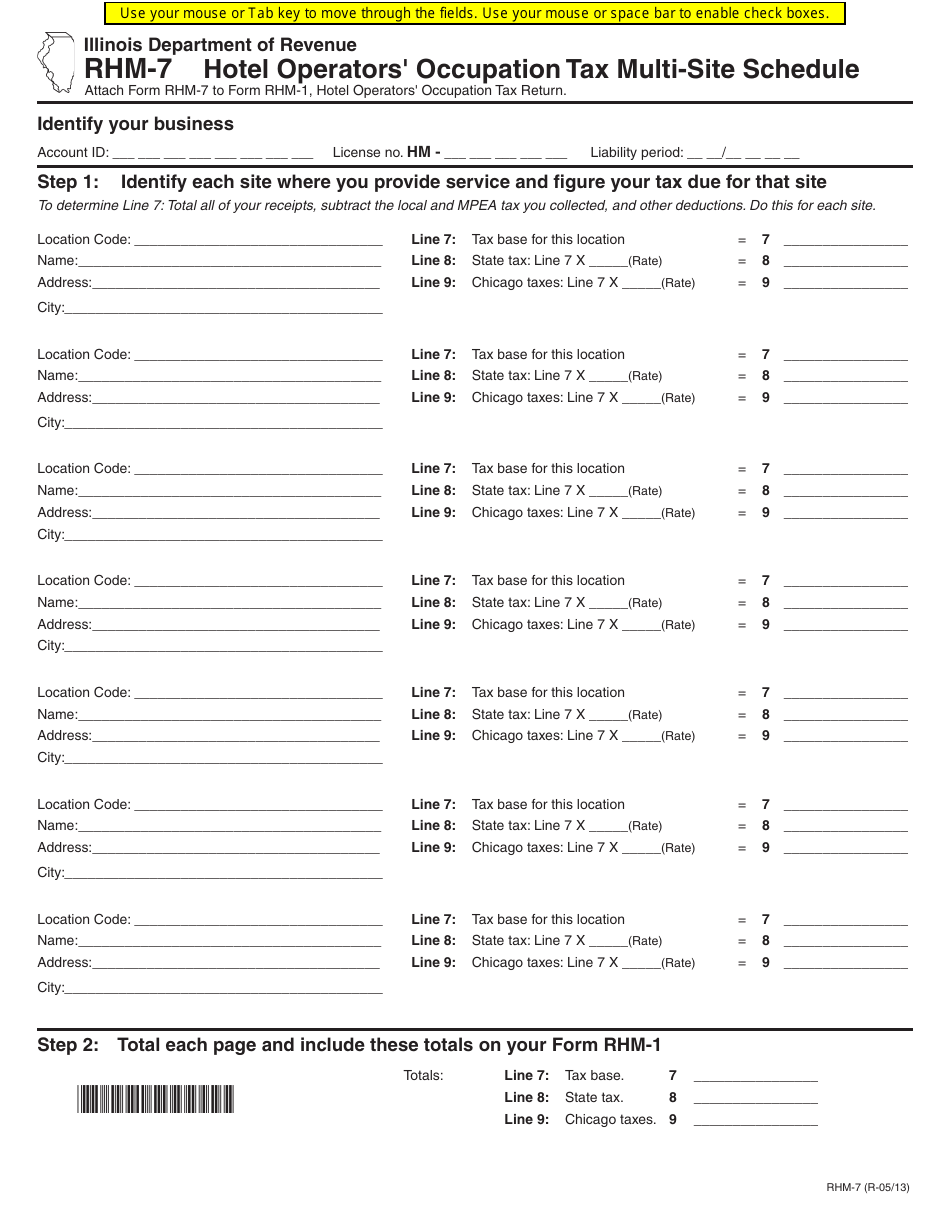

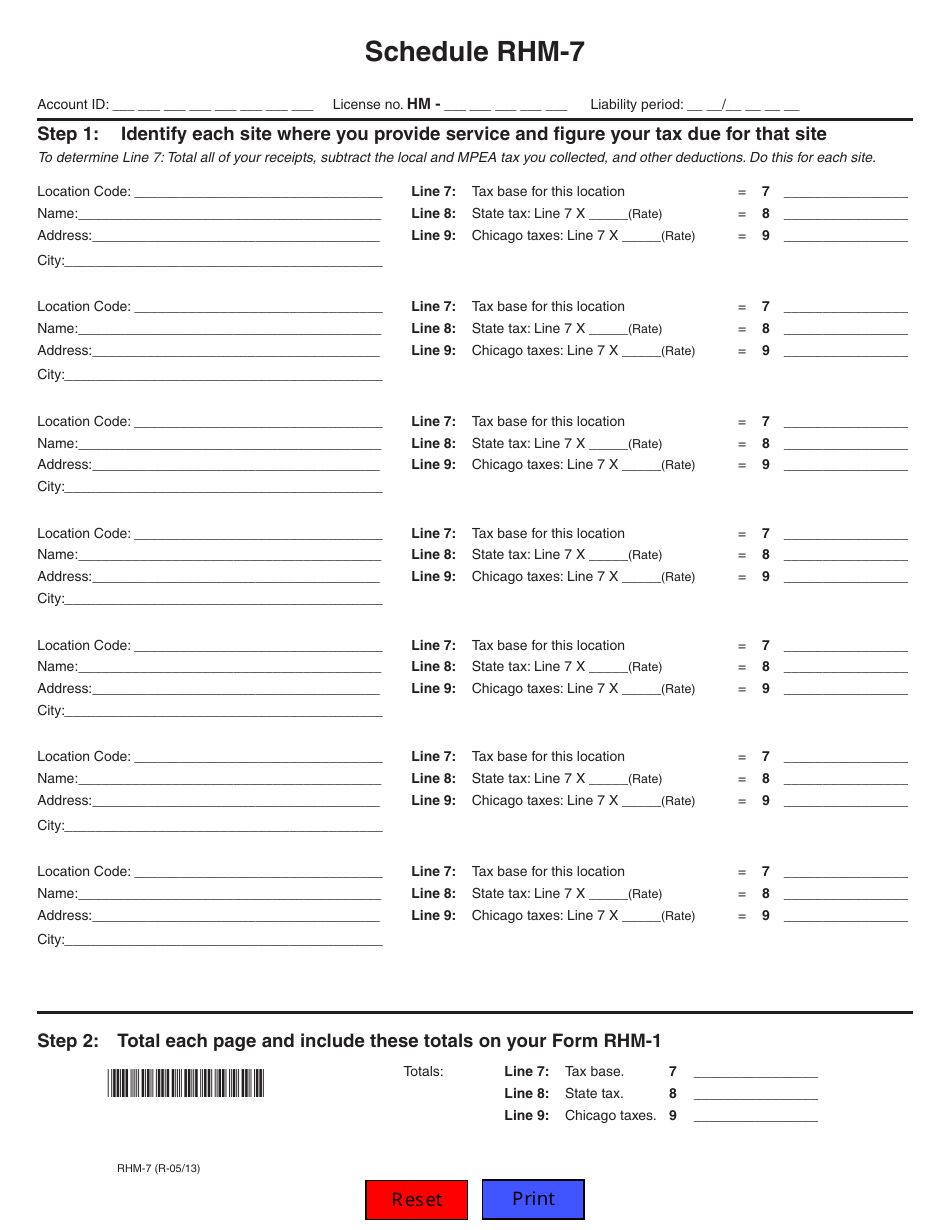

Form RHM-7 Hotel Operators' Occupation Tax Multi-Site Schedule - Illinois

What Is Form RHM-7?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RHM-7?

A: Form RHM-7 is a Hotel Operators' Occupation Tax Multi-Site Schedule specifically for Illinois.

Q: Who needs to use Form RHM-7?

A: Hotel operators in Illinois who have multiple sites need to use Form RHM-7.

Q: What is the purpose of Form RHM-7?

A: Form RHM-7 is used to report and remit hotel operators' occupation tax for multiple sites in Illinois.

Q: What is the hotel operators' occupation tax?

A: The hotel operators' occupation tax is a tax imposed on gross rental receipts for hotel accommodations in Illinois.

Q: Are there any penalties for not filing Form RHM-7?

A: Yes, there may be penalties for not filing or late filing of Form RHM-7, as prescribed by the Illinois Department of Revenue.

Q: When is Form RHM-7 due?

A: Form RHM-7 is generally due on a monthly basis, with the due date being the last day of the month following the end of the reporting period.

Form Details:

- Released on May 1, 2013;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RHM-7 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.