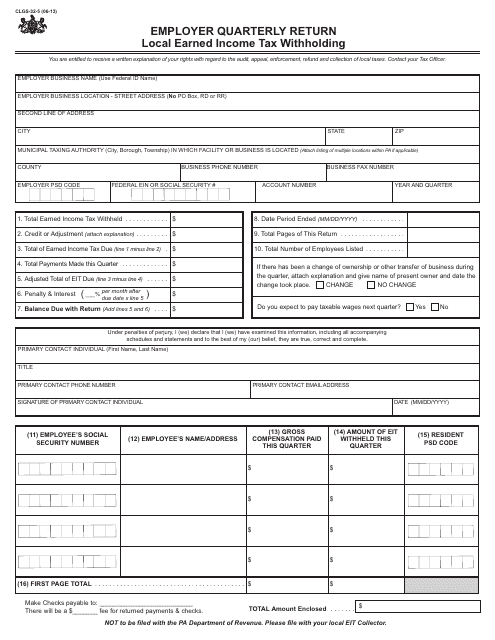

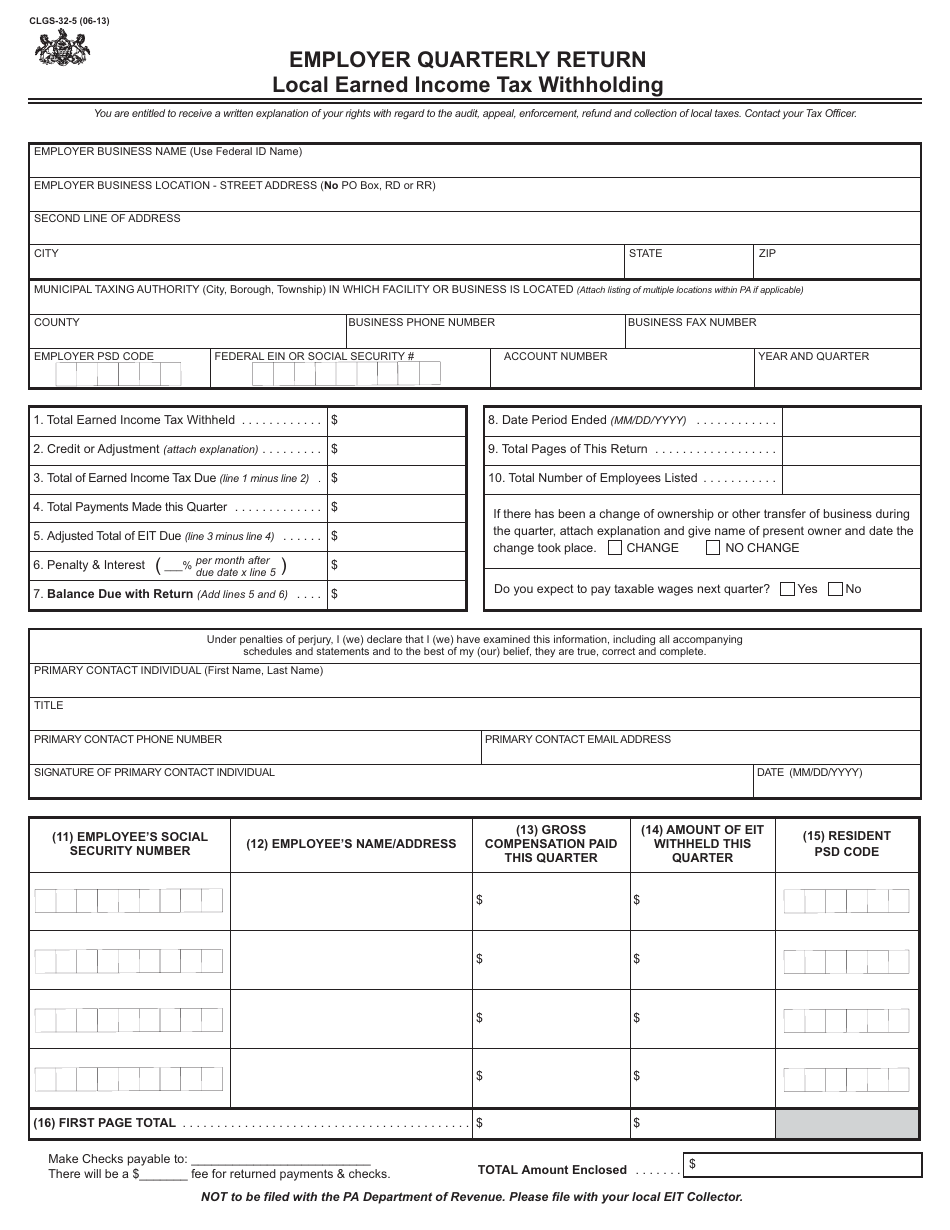

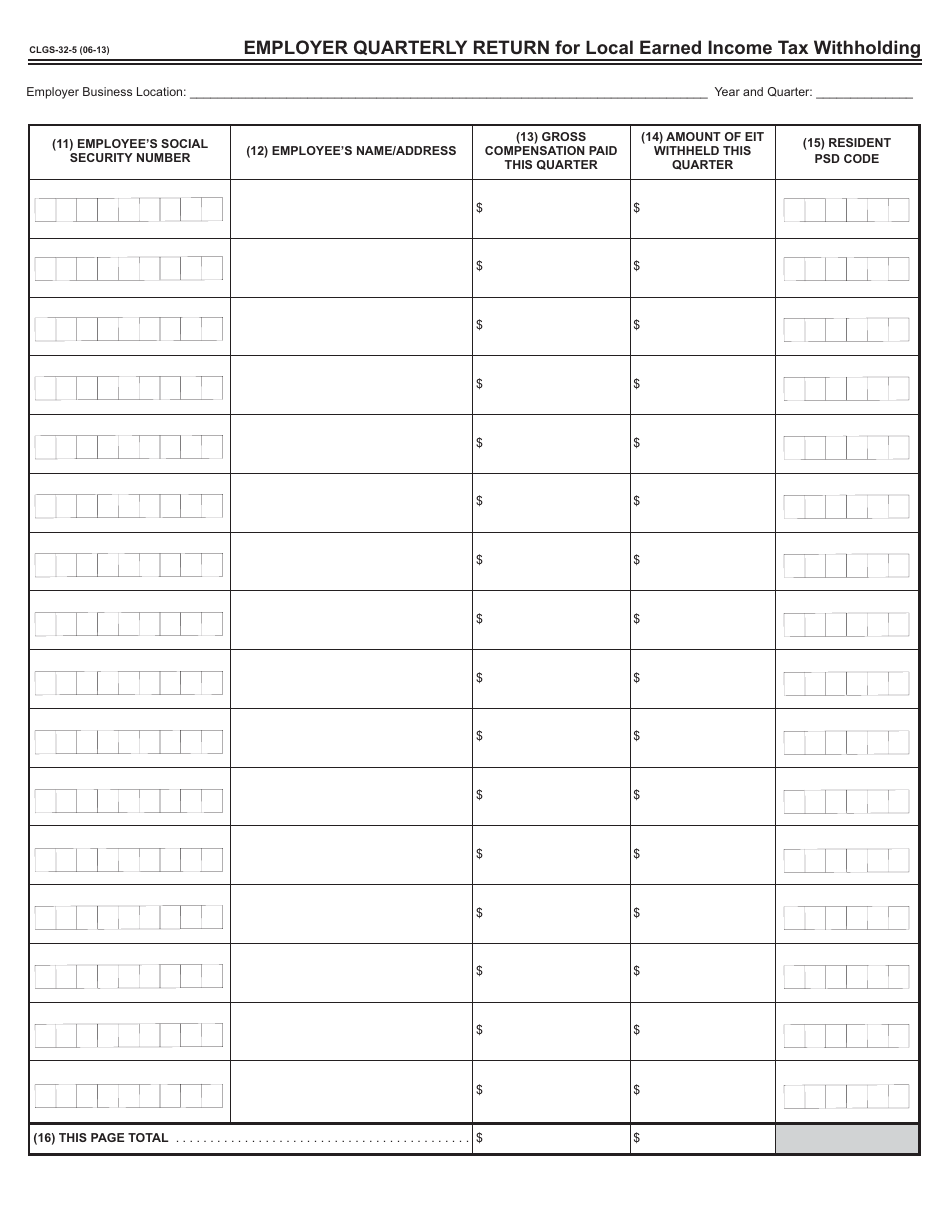

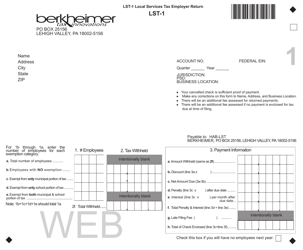

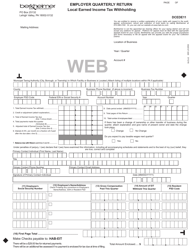

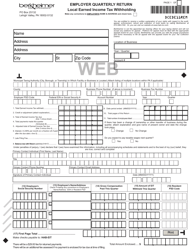

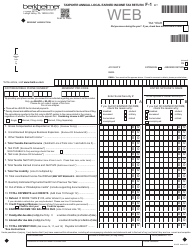

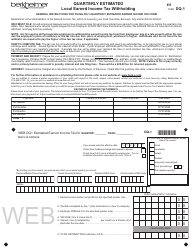

Form CLGS-32-5 Employer Quarterly Return - Local Earned Income Tax Withholding - Pennsylvania

What Is Form CLGS-32-5?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CLGS-32-5?

A: Form CLGS-32-5 is the Employer Quarterly Return for Local Earned IncomeTax Withholding in Pennsylvania.

Q: What is the purpose of Form CLGS-32-5?

A: The purpose of Form CLGS-32-5 is to report and remit local earned incometax withheld from employees' wages to the appropriate local tax collector in Pennsylvania.

Q: Who needs to file Form CLGS-32-5?

A: Employers in Pennsylvania who withhold local earned income tax from their employees' wages need to file Form CLGS-32-5.

Q: How often is Form CLGS-32-5 filed?

A: Form CLGS-32-5 is filed quarterly, meaning it needs to be filed four times a year.

Q: Is there a deadline for filing Form CLGS-32-5?

A: Yes, there are specific deadlines for filing Form CLGS-32-5. It must be filed by the last day of the month following the end of each calendar quarter.

Form Details:

- Released on June 1, 2013;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CLGS-32-5 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.