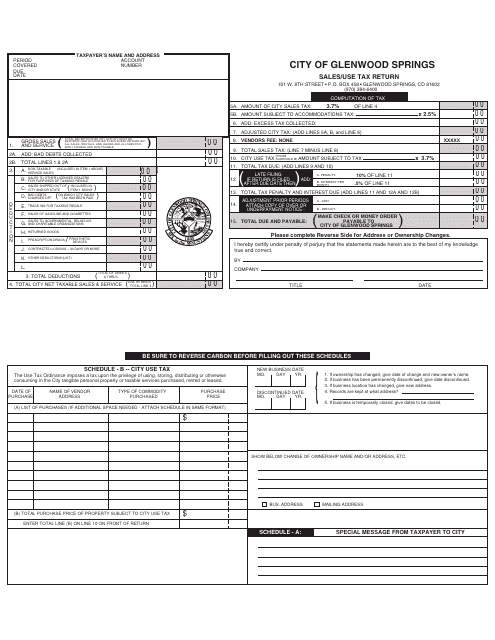

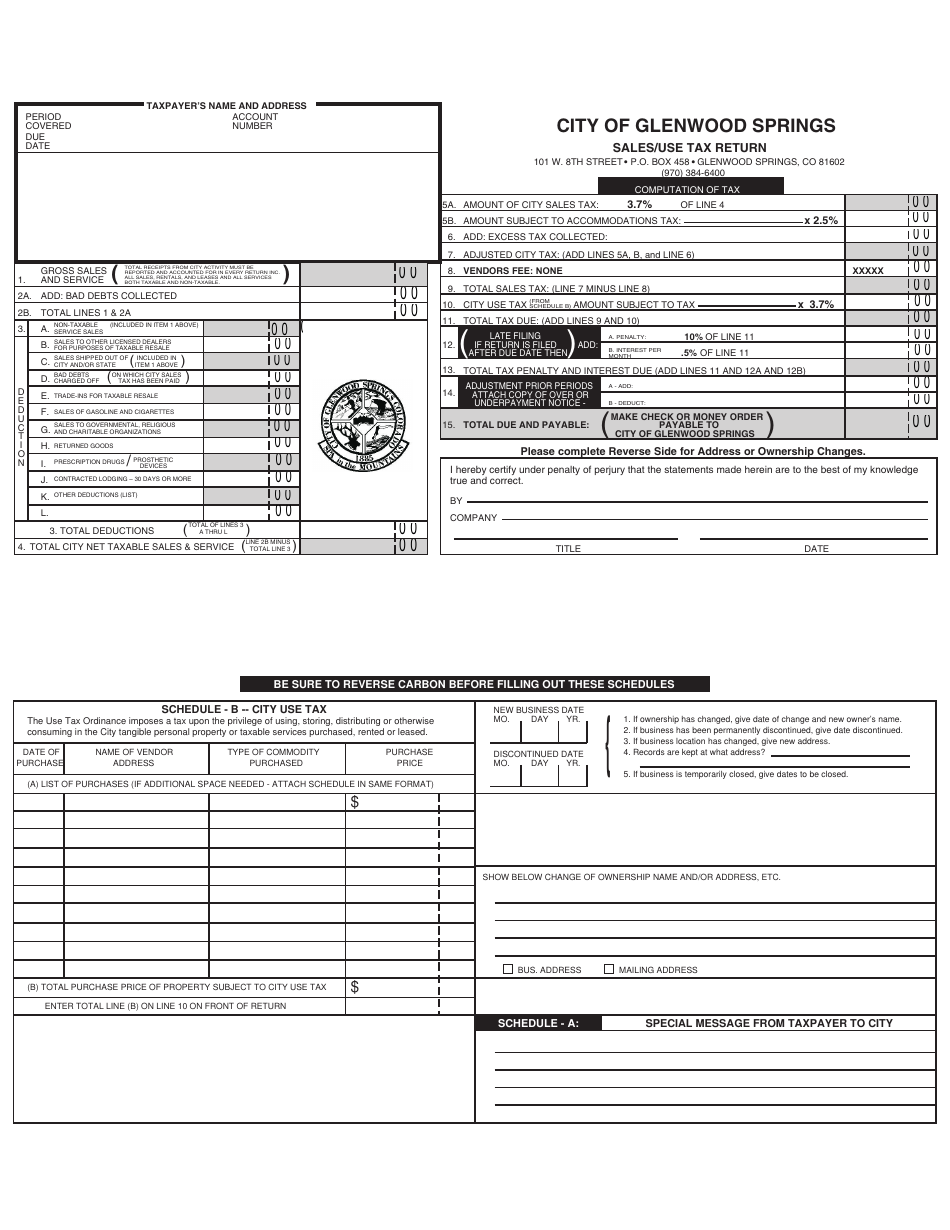

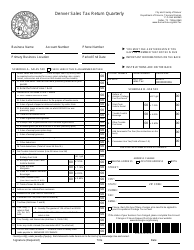

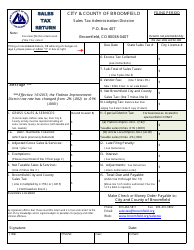

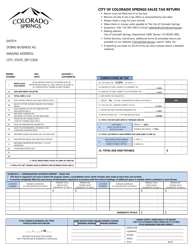

Sales / Use Tax Return Form - City of Glenwood Springs, Colorado

Sales/Use Tax Return Form is a legal document that was released by the Finance Department - City of Greenwood Village, Colorado - a government authority operating within Colorado. The form may be used strictly within City of Glenwood Springs.

FAQ

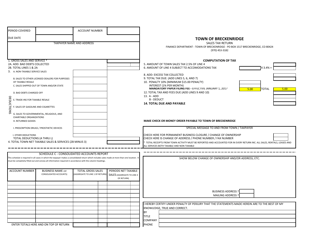

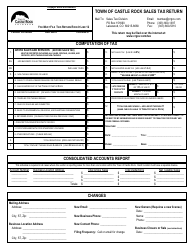

Q: What is the Sales/Use Tax Return Form?

A: The Sales/Use Tax Return Form is a form used to report and pay sales or use tax to the City of Glenwood Springs, Colorado.

Q: Who needs to file the Sales/Use Tax Return Form?

A: Anyone who conducts business in Glenwood Springs and is required to collect sales tax or anyone who makes taxable purchases that were not subject to sales tax must file the form.

Q: What is sales tax?

A: Sales tax is a tax on the sale of tangible personal property and some services.

Q: What is use tax?

A: Use tax is a tax on the use, storage, or consumption of tangible personal property.

Q: What is the purpose of the Sales/Use Tax Return Form?

A: The purpose of the form is to report and remit sales or use tax owed to the City of Glenwood Springs.

Q: When is the Sales/Use Tax Return Form due?

A: The form is due on a monthly or quarterly basis, depending on the taxpayer's sales tax liability.

Q: How do I calculate the amount of sales or use tax owed?

A: You can calculate the amount by multiplying the taxable sales or purchases by the applicable tax rate.

Q: Are there any penalties for late or non-filing of the Sales/Use Tax Return Form?

A: Yes, there may be penalties for late or non-filing, including interest and potential legal actions.

Form Details:

- The latest edition currently provided by the Finance Department - City of Greenwood Village, Colorado;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Finance Department - City of Greenwood Village, Colorado.